What Is an Exchange-Traded Fund (ETF)?

An exchange-traded fund (ETF) is a pooled investment asset that functions similarly to a mutual fund. ETFs often follow a specific index, sector, commodity, or other asset, but unlike mutual funds, ETFs may be bought and sold on a stock marketin the same way that a conventional stock can. An ETF can be designed to track anything from a single commodity's price to a huge and diversified group of commodities. ETFs can even be designed to follow certain investing strategies.

Charting on Different Time Frames

The technical analysis time frames shown on charts range from one-minute to monthly, or even yearly, time spans. Popular time frames that technical analysts most frequently examine include:

KEY POINTS

Knowledge of Exchange-Traded Fund

An ETF is an exchange-traded fund because it is exchanged on a stock exchange, much like stocks. The value of an ETF's shares fluctuates during the trading day as they are purchased and sold on the market. In contrast, mutual funds are not

traded on an exchange and trade just once each day after the markets shut. Furthermore, as compared to mutual funds, ETFs are less expensive and more liquid.

An ETF is a form of vehicle that owns numerous underlying assets as opposed to just one, like a stock does. Because an ETF contains several assets, it can be a popular choice for diversification. ETFs can thus hold a variety of investments,

such as equities, commodities, bonds, or a mix of investment kinds.

An ETF might own hundreds or thousands of equities across many industries, or it can be limited to a single industry or sector. Some funds solely sell products in the United States, whilst others have a global vision. Banking-focused ETFs, for example, would own equities from various banks throughout the industry.

An ETF is a marketable investment, which means that its share price permits it to be purchased and sold on exchanges throughout the day, and it may be sold short. Most ETFs in the United States are structured as open-ended funds and are governed by the

Investment Company Act of 1940, unless later laws modify their regulatory requirements.

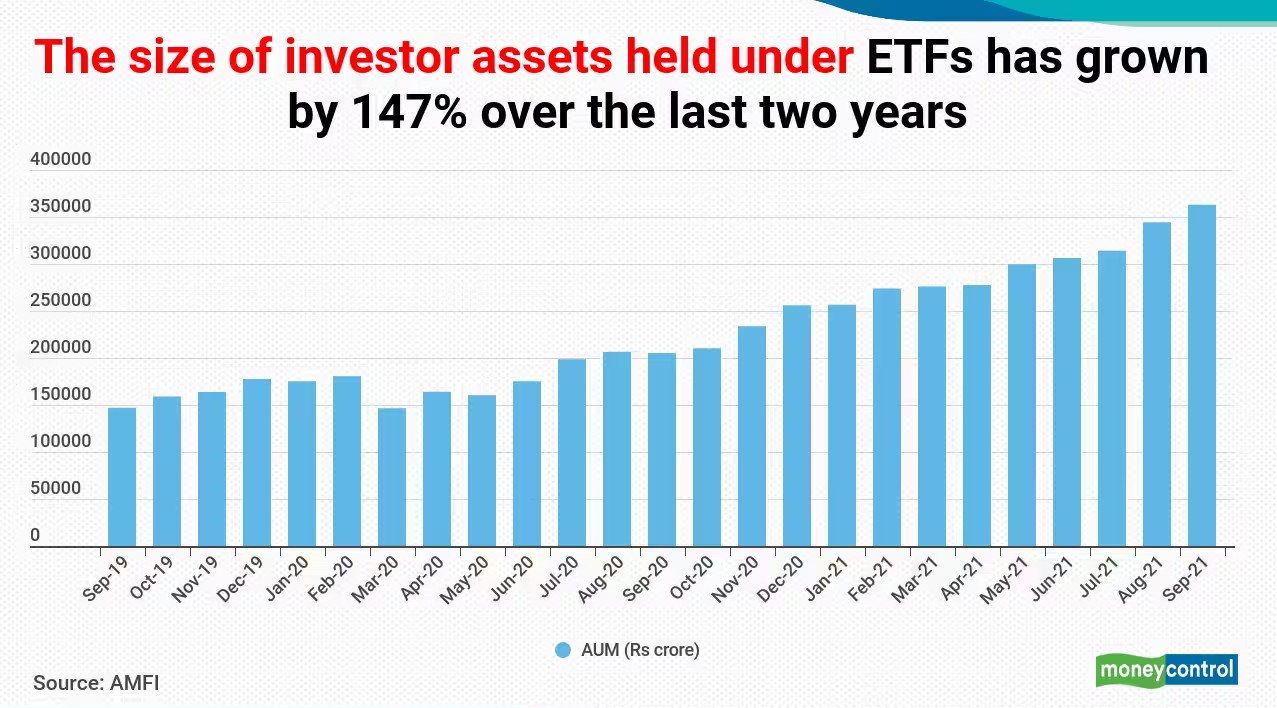

Cash Invested in ETFs

Types of ETF's

Investors can choose from a variety of ETFs that can be utilised for income generation, speculation, and price gains, as well as to hedge or partially offset risk in an investor's portfolio. Here is a quick summary of some of the ETFs that

are currently available on the market.

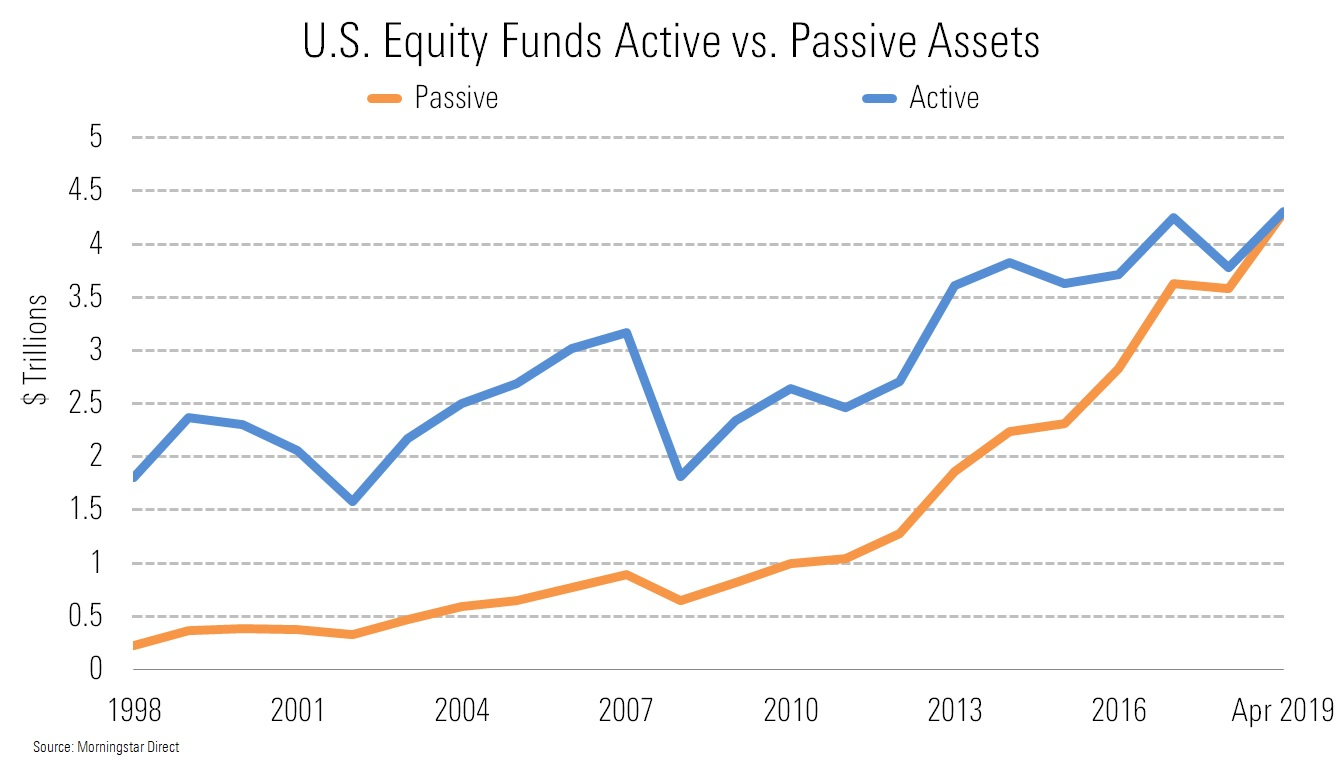

Passive and Active ETFs

ETFs are classified as either passive or actively managed. Passive ETFs seek to imitate the performance of a wider index, such as the S&P 500, or a more specialised focused sector or trend. Gold mining equities are an example of the latter

category: as of February 18, 2022, there are around eight ETFs that focus on firms engaged in gold mining, omitting inverse, leveraged, and funds with minimal assets under management (AUM).

Actively managed ETFs typically do not target an index of securities, but rather have portfolio managers making decisions about which securities to include in the portfolio. These funds have benefits over passive ETFs but tend to be more expensive

to investors. We explore actively managed ETFs below.

Bond ETFs

Bond ETFs are utilised to give investors with consistent income. Their income distribution is influenced by the performance of the underlying bonds. Government bonds, corporate bonds, and state and local bonds, known as municipal bonds, may

all be included. Bond ETFs, unlike their underlying products, do not have a maturity date. They often trade at a premium or discount to the underlying bond price.

Stock ETFs

Stock (equity) ETFs are a collection of equities that track a certain industry or sector. A stock ETF, for example, may follow automotive or international equities. The goal is to give diverse exposure to a particular industry that includes

both excellent performers and new entrants with development potential. Stock ETFs, unlike stock mutual funds, feature cheaper costs and do not need real ownership of stocks.

Industry/Sector ETFs

sector or industry ETFs are funds that specialise in a certain area or business. An energy sector ETF, for example, will contain firms in that industry. The objective behind industry ETFs is to acquire exposure to the upside of a certain industry

by following the performance of firms in that field.

One example is the IT industry, which has seen a recent flood of cash. At the same hand, because ETFs do not entail direct ownership of shares, the downside of erratic stock performance is also limited. During economic cycles, industry ETFs

are also utilised to rotate in and out of sectors.

Commodity ETFs

Commodity ETFs, as the name suggests, invest in commodities such as crude oil or gold. Commodity ETFs provide various advantages. To begin with, they diversify a portfolio, making it easier to hedge against downturns.

Commodity ETFs, for example, can provide as a buffer during a stock market downturn. Second, owning shares in a commodities ETF is less expensive than owning the commodity itself. This is because the former does not require insurance or storage.

Currency ETFs

Currency exchange-traded funds (ETFs) are pooled investment vehicles that follow the performance of currency pairings, which include both local and foreign currencies. Currency ETFs fulfil several functions. They may be used to speculate on

currency values depending on a country's political and economic trends. Importers and exporters use them to diversify their portfolios or as a hedge against volatility in FX markets. Some are also employed to protect against the possibility

of inflation. Bitcoin is even available as an ETF.

Inverse ETFs

Shorting stocks allows inverse ETFs to profit from stock falls. Shorting a stock is selling it with the expectation of repurchasing it at a cheaper price. In order to short a stock, an inverse ETF employs derivatives. They are essentially

wagers on the market falling.

When the market falls, an inverse ETF gains in proportion. Many inverse ETFs are exchange-traded notes (ETNs) rather than real ETFs, which investors should be aware of. An ETN is a bond that trades like a stock and is backed by a bank or other

issuer. Check with your broker to see if an ETN is appropriate for your portfolio.

How to Buy ETFs

Most online investment platforms, retirement account provider websites, and investing applications such as Robinhood provide ETFs. Most of these platforms offer commission-free trading, which means you don't have to pay platform costs to purchase or sell ETFs.

However, a commission-free purchase or sale does not imply that the ETF provider would also give free access to their product. Convenience, services, and product diversity are some areas where platform services might differentiate themselves from competitors.

Research ETFs

The second and most critical stage in ETF investing is to conduct research. There are several ETFs available on the market today. One thing to keep in mind during the research process is that ETFs are not the same as individual products like

stocks or bonds.

When investing in an ETF, you must analyse the big picture—in terms of sector or industry. Here are some questions to think about when you conduct your research:

Consider a Trading Strategy

Dollar-cost averaging, or spreading out your investment fees over time, is a smart trading approach for new ETF investors. This is due to the fact that it smoothes out returns over time and guarantees a disciplined (rather than haphazard or

erratic) approach to investment.

It also assists new investors in learning more about the subtleties of ETF investment. Investors can progress to more complicated tactics such as swing trading and sector rotation as they gain trading experience.

Traditional Brokers vs. Online Brokers

ETFs are traded through both online and traditional brokers. List of the best brokers for ETFs includes some of the industry's top brokers for ETFs. ETFs can also be purchased in your retirement account. A robo-advisor, such as Betterment

or Wealthfront, provides an alternative to traditional brokers since their investing products make considerable use of ETFs.

A brokerage account enables investors to trade ETF shares in the same way they would trade equities. Traditional brokerage accounts are suitable for hands-on investors, whilst robo-advisors are suitable for more passive investors. Robo-advisers

frequently use ETFs in their portfolios, albeit the client may not have the option of focusing on ETFs or individual equities.

Examples of Popular ETFs

Advantages and Disadvantages of ETFs

ETFs provide lower average cost because it would be expensive for an investor to buy all the stock held in an ETF portfolio individually. Investor only need to execute one transaction to buy and one transaction to sell, which leads to fewer

broker commissions because there are only a few trades being done by investor

Brokers typically charge a commission for each trade. Some brokers even offer no-commission trading on certain low-cost ETF's, reducing costs for investor even further.

An ETFs expense ratio is the cost to operate and manage the fund. ETFs are typically have low expenses because they track an index. For example, if an ETF tracks the S&P 500 Index, it might contain all 500 stocks from the S&P, making it a

track in a passive manner, and may therefore have a higher expenses ratio.

Pros

Cons

Actively Managed ETFs

There are also actively managed ETFs, wherein portfolio mangers are more involved in buying and selling shares of companies and changing the holding within the fund. Typically, more actively managed fund will have a higher expense ratio than

passively managed ETFs.

To make sure that an ETF is worth holding, it is important that investors determine how the fund is managed, whether it's actively or passively managed, the resulting expenses ratio, and the costs vs. the rate of return.

Special Considerations

I. Indexed-Stock ETFs

Because there are no minimum deposit restrictions, an indexed-stock ETF gives investors with the diversification of an index fund as well as the option to sell short, buy on leverage, and purchase as few as one share. Not all ETFs, however,

are similarly diversified. Some may have a high concentration in a single industry, or a limited number of equities or assets that are closely connected.

II. Dividends and ETFs

Though ETFs allow investors to profit when stock prices increase and fall, they also benefit from firms that pay dividends. Dividends are a share of earnings that firms distribute or pay to investors in exchange for keeping their stock. ETF

owners are entitled to a percentage of the fund's income, such as interest received or dividends paid, as well as a residual value if the fund is liquidated.

III. ETFs and Taxes

Because most buying and selling occurs through an exchange, an ETF is more tax-efficient than a mutual fund because the ETF sponsor does not need to redeem shares each time an investor chooses to sell or issue new shares each time an investor

desires to acquire.

Because redeeming fund shares might result in a tax burden, placing the shares on an exchange can help keep tax expenses low. In the case of a mutual fund, when an investor sells their shares, they sell them back to the fund, incurring a tax

burden that must be paid by the fund's shareholders.

IV. Market Impact

Because ETFs have grown in popularity among investors, numerous new funds have been established, resulting in low trading volumes for some of them. As a result, investors may find it difficult to acquire and sell shares of a low-volume ETF.

Concerns have been raised concerning the market impact of ETFs and if demand for these funds might inflate stock prices and produce fragile bubbles. Some ETFs rely on portfolio models that have not been tested in varied market situations,

which might result in severe inflows and outflows from the funds, negatively impacting market stability.

ETF Creation and Redemption

When an ETF wishes to issue more shares, the AP buys shares of the equities in the fund's index, such as the S&P 500, and sells or swaps them to the ETF for new ETF shares at an equal value. on turn, the AP profits by selling the ETF shares

on the market. When an AP sells equities to the ETF sponsor in exchange for ETF shares, the block of shares utilised in the transaction is referred to as a creation unit.

ETF Redemption

An AP, on the other hand, purchases ETF shares on the open market. The AP then sells these shares to the ETF sponsor in return for individual stock shares that may be sold on the open market. As a result, the number of ETF shares is lowered

during the redemption process.

Difference between ETf's vs Mutual Fund and Stocks

| ETFs' | Mutual Fund | Stocks |

|---|---|---|

| Exchange-traded funds (ETFs) are a type of index funds that track a basket of securities. | Mutual funds are pooled investments into bonds, securities, and other instruments that provide returns. | Stocks are securities that provide returns based on performance. |

| ETF prices can fluctuate at a premium or a discount to the fund's net asset value (NAV). | Mutual fund pricing are based on the total fund's net asset value. | Stock returns are determined by their market performance. |

| ETFs, like stocks, are traded on the markets during regular trading hours. | Mutual funds can only be redeemed at the conclusion of the trading day. | During regular market hours, stocks are exchanged. |

| Some ETFs are commission-free and less expensive than mutual funds since they do not impose marketing expenses. | Some mutual funds do not impose load fees, although the majority are more expensive than ETFs due to administrative and marketing costs. | Stocks can be acquired commission-free on several platforms and are normally free of costs after purchase. |

| ETFs are the most tax-efficient of the three forms of financial instruments since share transactions are recognised as in-kind payouts | When mutual funds return money or contain certain types of tax-exempt bonds in their portfolio, they provide tax benefits. | Stocks are taxed either as ordinary income or as capital gains. |

Diversification

Almost all ETFs offer more diversification than individual stock purchases. Nonetheless, some ETFs are very concentrated, either in terms of the number of stocks they own or the weighting of those shares. A fund that invests half of its assets

in two or three positions, for example, may provide less diversity than a fund with fewer overall portfolio constituents but a broader asset distribution.

Related Articles