Mid-Cap Fund What's that ?

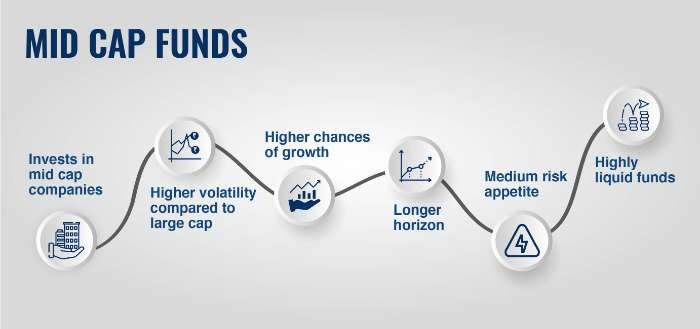

A mid-cap fund is a pooled investment vehicle (such as a mutual fund or ETF) that invests exclusively in the equities of mid-cap firms, or corporations with market capitalizations ranging from $2 billion to $10 billion.

What is Mid-Cap in India

Mid-cap companies are those with market caps above Rs 5,000 crore but less than Rs 20,000 crore. Investing in these companies can be riskier than investing in large-cap market companies, because mid-caps tend to be more volatile.

KEY KNOWLEDGE

1. A mid-cap fund is a pooled investment, such as a mutual fund, that focuses on firms with market capitalizations in the middle of the market capitalization range of listed equities.

2. Mid-cap stocks often provide investors with higher growth potential than large-cap stocks while posing less volatility and risk than small-cap stocks.

3. Mid-cap funds enable investors to maintain a diverse portfolio of these equities in a simple and cost-effective manner.

4.

Mid-cap funds can track numerous benchmark indexes, including the S&P 400 and Russell 1000.

Understanding Mid-Cap Funds

Mid-cap funds provide investors a diverse portfolio of mid-cap firms. Mid-cap stock funds invest in well-established companies. As a result, many firms have made equity capital markets a significant element of their capital structures. Overall,

mid-cap firms have more growth potential than large-cap stocks and lower volatility than small-cap stocks. Mid-cap funds aim to capitalise on this capital appreciation potential by establishing funds that are diverse across mid-cap firms.

Many fund managers and indexes concentrate on mid-cap equities with a growth or value component. Mid-cap funds can be managed actively or passively. The market's mid-cap group provides investors with a diverse set of investing alternatives. The

S&P MidCap 400, the Russell 1000 MidCap Index, and the Wilshire US MidCap Index are some of the most prominent mid-cap benchmarks. The lowest member of the Wilshire US Mid-Cap Index was worth $0.8 billion in December 2020. The most valuable

has a market valuation of $23.4 billion.

Defining Mid-Cap

"Mid-cap" is the term given to companies with a market capitalization (or value) between $2 billion and $10 billion. As the name implies, a mid-cap company falls in the middle between large-cap (or big-cap) and small-cap companies. Classifications such as large-cap, mid-cap, and small-cap are only approximations and may change over time.

A diverse portfolio, according to most financial consultants, is the key to minimising risk; investors should have a mix of small-cap, mid-cap, and large-cap companies. Some investors, though, regard mid-cap companies as a method to diversify

risk as well. Small-cap stocks have the most potential for development, but that growth comes with the greatest risk. Large-cap stocks provide the most stability, but they also have the lowest growth possibilities. Mid-cap stocks are a cross

between the two, offering both growth and stability.

Usage of MidCap Fund

Mid-cap funds offer several benefits over individual mid-cap equities as well as other forms of funds. While mid-cap equities are less volatile than small-cap companies, having only a few mid-cap funds is typically significantly riskier than holding

multiple large-cap stocks. Investors may access the growth potential of mid-cap funds without taking on company-specific risks by investing in a mid-cap fund.

Mid-cap funds can behave differently than either large or small companies. As a result, they are beneficial for portfolio diversification. Long periods in history have seen either huge or tiny stocks outperform. Choosing a mid-cap fund can help

investors avoid going too far down the wrong path.

Mid-Cap Funds are being chastised.

Investors who invest in a mid-cap fund rather than individual mid-cap stocks may miss out on significant returns. The CAN SLIM technique devised by William J. O'Neil, in particular, is frequently effectively used to mid-cap companies. The notion

is that winning stocks may be identified as they go through the small caps. Speculators are ready to benefit by the time equities reach mid-cap funds. In 2009, for example, O'Neil identified Netflix (NFLX) as a high selection. Most investors,

though, are less effective at predicting winners.

Best Mid-Cap Funds

ABOUT : The direct plan of Invesco India Mid Cap Fund has given 22.57% annualised returns while its regular plan has given 20.68% returns in 10 years.

Fund Size : 5734.93Cr

Minimum SIP Amount : ₹ 500

HOLDING ANALYSIS

Equity : 95.1%

Cash : 4.9%

EQUITY SECTOR ALLOCATION

Technology : 23.5%

Financial : 15.4%

Chemicals :11.9%

Service : 10.5%

Capital Goods : 9.6%

Construction : 8.5%

Other : 7.1%

Metals & Mining : 5.1%

ABOUT : SBI Magnum Mid Cap Direct Plan-Growth is a Mid Cap mutual fund scheme from Sbi Mutual Fund. This fund has been in existence for 10 yrs 8 m, having been launched on 01/01/2013.

Fund Size : 12555.20Cr

Minimum SIP Amount : ₹ 500

HOLDING ANALYSIS

Equity : 93.1%

Cash : 6.8%

EQUITY SECTOR ALLOCATION

Automobile : 15.6%

Financial : 12.0%

Chemicals : 8.7%

Service : 8.8%

Capital Goods : 12.3%

Construction : 8.9%

Other : 12.6%

Metals & Mining : 5.6%

Textiles : 8.5%

Healthcare : 6.9%

ABOUT : PGIM India Midcap Opportunities Fund has an ET Money Rank of # 5 of 22 and a consistency rating of 4. The Expense Ratio of the direct plan of PGIM India Midcap Opportunities Fund is 0.41%. . The AUM of PGIM India Midcap Opportunities

Fund is ₹9,393 Crs.

Fund Size : 9392.69Cr

Minimum SIP Amount : ₹ 1000

HOLDING ANALYSIS

Equity : 93.8%

Debt : 6.6%

Cash : -0.4%

EQUITY SECTOR ALLOCATION

Automobile : 14.7%

Financial : 19.4%

Chemicals : 11.7%

Service : 9.1%

Capital Goods : 9.8%

Construction : 8.2%

Other : 6.4%

Consumer Staples : 5.7%

Technology: 6.2%

Healthcare : 8.8%

ABOUT : The risk profile of Mirae Asset Midcap fund is 'Moderately High'. Investors should understand that their principal investment in this fund will be at moderately high risk.

Fund Size : 11919.24Cr

Minimum SIP Amount : ₹ 1000

HOLDING ANALYSIS

Equity : 95.8%

Cash : 4.2%

EQUITY SECTOR ALLOCATION

Automobile : 9.9%

Financial : 21.1%

Chemicals : 7.1%

Service : 8.7%

Capital Goods : 7.9%

Energy : 6.2%

Construction : 6.5%

Other : 10.5%

Consumer Staples : 5.5%

Technology: 5.4%

Healthcare : 11.3%

Related Articles