Mutual Fund What's that ?

A mutual fund is a financial entity that combines shareholder funds and invests them in securities such as stocks, bonds, money market instruments, and other assets. Mutual funds are managed by experienced money managers who deploy the

assets of the fund in order to generate capital gains or income for the fund's investors. The portfolio of a mutual fund is built and managed to meet the investment objectives indicated in the prospectus.

In simple words, Mutual Fund is kind of Long-Term investment and Passive Income for Retirement Benefits

Intelligent Investor - Warren Buffett

Mutual funds provide access to professionally managed portfolios of stocks, bonds, and other assets to small and individual investors. As a result, each stakeholder shares in the fund's profits or losses in proportion. Mutual funds invest

in a wide range of assets, and their success is often measured as the change in the fund's total market value, which is calculated by aggregating the performance of the underlying investments.

The majority of mutual funds are subsidiaries of bigger investing firms such as Fidelity Investments, Vanguard, T. Rowe Price, and Oppenheimer. A mutual fund employs a fund manager, often known as an investment adviser, who is legally

required to act in the best interests of mutual fund shareholders.

KEY KNOWLEDGE

A mutual fund is an investment instrument that consists of a portfolio of stocks, bonds, or other assets.

Mutual funds provide access to diverse, professionally managed portfolios for small and individual investors.

Mutual funds are classified into numerous types based on the securities they invest in, their investing objectives, and the sort of returns they seek.

Mutual funds levy yearly fees, cost ratios, or commissions, which can reduce total returns.

Mutual funds are frequently used in employer-sponsored retirement programmes.

How Do Mutual Funds Cost?

The mutual fund's value is determined by the performance of the securities in which it invests. When an investor purchases a unit or share of a mutual fund, he or she is purchasing the portfolio's performance or, more accurately, a portion

of the portfolio's worth. Investing in mutual fund shares is not the same as investing in stock. Mutual fund shares, unlike stock, do not provide holders with voting rights. A mutual fund share reflects an investment in a variety of

stocks or other securities.

The price of a mutual fund share is known as the net asset value (NAV) per share, which is commonly abbreviated as NAVPS. The NAV of a fund is calculated by dividing the entire value of the securities in the portfolio by the total number

of shares outstanding. All shareholders, institutional investors, and corporate executives or insiders own outstanding shares.

Mutual fund shares are normally acquired or redeemed at the fund's current net asset value (NAV), which does not vary during market hours but is settled at the conclusion of each trading day. When the NAVPS is resolved, the price of a

mutual fund is likewise adjusted.

The average mutual fund invests in a variety of securities, providing mutual fund owners with diversification. Consider an investor who exclusively buys Google shares and is reliant on the company's earnings. Because all of their money

is connected to one firm, their profits and losses are determined by the company's performance. A mutual fund, on the other hand, may contain Google in its portfolio, where the profits and losses of a single stock are offset by the

gains and losses of other firms within the fund.

How Are Returns Calculated for Mutual Funds?

When an investor purchases Apple shares, they are acquiring a portion of the firm. Similarly, a mutual fund investor purchases a portion of the mutual fund and its assets.

Types of Mutual Funds

There are various types of mutual funds available for investment, but the majority of mutual funds fall into one of four broad categories: stock funds, money market funds, bond funds, and target-date funds.

Stock Fund

A complete stock fund is a mutual fund or exchange traded fund that invests in every stock in a specific market. A total stock fund tries to imitate the broad market by owning the shares of every security that trades on a specific

exchange, invests in a specific nation, or meets basic size or trading volume standards. Total stock funds are appropriate for investors seeking low-cost exposure to the total equity market.

Related Funds

Franklin-Templeton Investment

The company was founded in 1947 in New York by Rupert H. (Harris) Johnson Sr. (1900-1989), who ran a successful retail brokerage firm from an office on Wall Street.

Minimum Investment : ₹ 2250 per fund.

Return : annualized returns for the past 3 years & 5 years has been around 37.96% & 18.94%

ICICI Prudential Mutual Fund

ICICI Prudential Mutual Fund is an Indian asset management company founded in 1993 as a joint venture between ICICI Bank and Prudential plc.

Minimum Investment : ₹ 5000

Return On Investment : 24.20

HDFC Mutual Fund

In early 2019, it moved past Aditya Birla and HDFC Mutual Funds to emerge as the 3rd largest Mutual Fund body in India based on Assets under Management or AUM.

Lumpsum Investment : ₹ 100

SIP Investment : ₹ 500

Return On Investment : 23.4%

Axis Mutual Fund

Axis Mutual Fund is an Indian asset management company. It was established in the year 2009 and has its headquarters in Mumbai.

Axis Mutual Fund offers various types of mutual fund schemes to invest in India, such as equity funds, hybrid funds, debt funds

Axis Money Market Fund : ₹ 5000

SIP : ₹ 10000

Return On Investment : 16.89%

Canara Robeco Mutual Fund

Previously as Head of Investments (Canara Robeco AMC), he was responsible for all Equity Business wherein he oversaw equity assets of Rs. 400 Bn

Canara Robeco Savings Fund : ₹ 5000

SIP : ₹ 1000

Return On Investment : 12.4%

Bond Funds

The fixed income category includes mutual funds that offer a minimum return. A fixed-income mutual fund invests in fixed-income investments such as government bonds, corporate bonds, or other debt instruments. The interest revenue generated

by the fund portfolio is distributed to the owners.

These funds, sometimes known as bond funds, are frequently actively managed and attempt to acquire relatively discounted bonds in order to sell them at a profit. These mutual funds are more likely to provide larger returns, although bond

funds are not without risk. A fund that specialises in high-yield trash bonds, for example, is far riskier than a fund that invests in government securities.

Bond funds can vary substantially depending on where they invest due to the many various types of bonds, and all bond funds are vulnerable to interest rate risk.

Related Articles

BlackRock

BlackRock, Inc. is an American multinational investment company based in New York City. Founded in 1988, initially as an enterprise risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with US$9.42 trillion in assets under management as of June 30, 2023

Axis Corporate Debt Fund

Fund Performance: The Axis Corporate Debt Fund has given 5.76% annualized returns in the past three years and 7.34% in the last 5 years. The Axis Corporate Deb

Corporate Bond Fund : The fund has 92.54% investment in Debt, of which 18.02% in Government securities, 74.52% is in Low Risk

UTI Bond Fund Direct Growth

UTI Bond Fund is an open ended medium to long duration fund investing in a well diversified portfolio of good credit quality corporate bonds and government securities. The fund is suitable for investors with medium to longer term investment horizon of 3 years and more.

Index Funds

Index funds invest in companies that track the performance of a major market index, such as the S&P 500 or the Dow Jones Industrial Average (DJIA). Because this method necessitates less research from analysts and advisers, less expenditures

are passed on to shareholders, and these funds are frequently constructed with cost-conscious investors in mind.

Related Articles

Minimum SIP Amount : ₹ 100

The Bandhan Nifty 50 Index Fund Growth has an AUM of 867.38 crores & has delivered CAGR of 12.96% in the last 5 years.

Current NAV: The Current Net Asset Value of the Bandhan Nifty 50 Index Fund - Regular Plan as of Sep 20, 2023 is Rs 42.44

UTI Mutual Fund was carved out of the erstwhile Unit Trust of India as a Securities and Exchange Board of India registered mutual fund from 1 February 2003.

P/E RATIO : 17.26

Dividend Yield : 2.08%

Primary Exchange : National Stock Exchange

Screen Description : Nifty Index Fund

CAGR : 13.28%

Net Asset Value : 195.0473%

AUM : 4976.77cr

Returns: Its trailing returns over different time periods are: 13.37% (1yr), 20.77% (3yr), 11.93% (5yr) and 9.86% (since launch).

Category : India Equity

YTD RETURN : 6.84%

Expense Ratio : 1.75%

ABOUT : The HDFC NIFTY Next 50 Index Fund Direct Growth is rated Very High risk. Minimum SIP Investment is set to 100. Minimum Lumpsum Investment is 100.

Current NAV : 183.8472%

Expense Ratio : 0.4%

Fund Size: 9446.34cr

ABOUT :SBI Nifty Index Direct Plan-Growth scheme's ability to deliver returns consistently is in-line with most funds of its category. Its ability to control losses in a falling market is average. The fund has the majority of

its money invested in Financial, Technology, Energy, Consumer Staples, Automobile sectors.

NAV : 171.6355

Fund Size : 4862.69cr

Expense Ratio : 0.5%

Exchange Traded Fund(ETF)

The exchange-traded fund (ETF) is a variation on the mutual fund. They are not mutual funds, but they use tactics that are similar to mutual funds. They are formed as investment trusts that trade on stock markets and have the advantages

of stocks.

Throughout the trading day, ETFs can be purchased and sold. ETFs can also be acquired on leverage or sold short. ETFs are generally often less expensive than mutual funds. Many ETFs benefit from active options markets, which allow investors to hedge or

leverage their positions.

Related ETF's

Return : 31.00%

Portfolio P/E Ratio : 30.53

Expense Ratio : 0.58

Portfolio P/B Ratio : 6.57

AUM : 9496cr

Portfolio P/E Ratio : 41.27

Portfolio P/B Ratio : 7.14

AUM : 49cr

Expense Ratio : 0.31

Fund Return : 5.3%

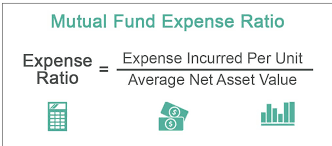

Mutual Fund Fees

Annual operational costs or shareholder fees are charged by mutual funds. Annual fund running fees are a proportion of the funds under administration, often ranging from 1-3%, and are referred to as the expense ratio. The expense ratio

of a fund is the sum of its advisory or management fee and administrative charges.

Shareholder fees are sales charges, commissions, and redemption fees that investors pay directly when they buy or sell funds. A mutual fund's "load" is its sales costs or commissions. Fees are levied when shares of a mutual fund with a front-end load

are acquired. Mutual fund fees are charged as a back-end burden when an investor sells their shares.

Pro Mutual Fund Investing

Mutual funds have been the retail investor's preferred vehicle for a variety of reasons, with the vast majority of money in employer-sponsored retirement plans put in mutual funds.

Diversification

One of the benefits of investing in mutual funds is diversification, or the mixing of investments and assets within a portfolio to decrease risk. A diverse portfolio includes securities with differing capitalizations and industries, as

well as bonds with varying maturities and issuers. Purchasing a mutual fund might provide diversification at a lower cost and sooner than purchasing individual shares.

Easy Access

Mutual funds may be purchased and sold with relative ease on the main stock markets, making them extremely liquid assets. Furthermore, when it comes to specific types of assets, such as foreign stocks or exotic commodities, mutual funds

are frequently the most practical—and, in some cases, the only—way for ordinary investors to engage.

Pros and Cons of Mutual Fund

| Pros |

Cons |

|

Liquidity

|

High fees, commissions, and other expenses

|

|

Diversification

|

Large cash presence in portfolios

|

|

Minimal investment requirements

|

No FDIC coverage

|

|

Professional management

|

Difficulty in comparing funds and Lack of transparency in holdings

|

What Exactly Is a Target-Date Mutual Fund?

Target-date funds, also known as life-cycle funds, are a popular alternative for investing in a 401(k) or other retirement savings plan. By selecting a fund with a goal date close to retirement, such as FUND X 2050, the fund pledges to rebalance and adjust

the risk profile of its assets, often to a more conservative approach, as the fund approaches the target date.

Related Articles