INVESTMENTS

MULTI ASSET ALLOCATION MUTUAL FUND

What is Multi Asset Allocation Mutual Fund?

Multi Asset Allocation Funds are hybrid funds that must invest a minimum of 10% in at least 3 asset classes. These funds typically have a combination of equity, debt, and one more asset class like gold, real estate, etc.

An investor can invest up to 80% of capital in either of the asset class. Mutual Funds units and stock lending up to 20% of assets can be a probable investment prospect for the said fund.

KEY KNOWLEDGE

How Multi Asset Class Works?

By spreading assets across many classes, multi-asset class investments improve portfolio diversification overall. When compared to holding a single class of assets, this lowers risk (volatility), but it may also impede possible rewards. A single-class investor might just own equities, whereas a multi-asset class investor might have bonds, stocks, cash, and real estate. Historically, no asset class has outperformed in every period of time, even though one may do so for a certain length of time.

Who Should Invest in Multi Asset Allocation Mutual Fund?

Major Advantages of Multi Asset Allocation Mutual Fund

Multi-asset allocation enables investors to expose their portfolio to different asset classes with various risk-reward factors. It facilitates investors to lower their risk and to derive steady earnings through different market cycles.

Maintaining a well-distributed investment portfolio in asset classes that are yielding higher returns than others requires regular rebalancing. The option of automated portfolio rebalancing is included with the multi-asset allocation mutual funds, which benefits investors in a variety of ways. Rebalancing your portfolio and reallocating your assets are essential to weathering the ups and downs of the market, which is known to be a tumultuous area.

Not everybody can afford to create a tailor-made their investment portfolio by a professional. However, when an investor invests in multi-asset allocation funds, they not just avail a well-balanced investment option of risk and reward but also avail a ready-made portfolio. Investors can avail the benefits of different types of asset classes by investing in just one type of fund.

Top Performing Multi Asset Allocation Mutual Fund

Quant Multi Asset Fund Direct-Growth is a Multi Asset Allocation mutual fund scheme from Quant Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. Quant Multi Asset Fund Direct-Growth has ₹1,051 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.6%, which is close to what most other Multi Asset Allocation funds charge. Currently, the fund has a 56.56% allocation to equity and 8.62% to Debt.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

ALLOCATION BY MARKET CAPITALIZATION

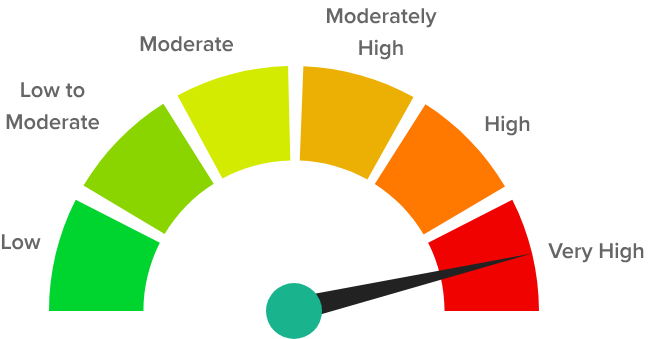

RISKOMETER

ICICI Prudential Multi Asset Fund Direct-Growth is a Multi Asset Allocation mutual fund scheme from Icici Prudential Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. ICICI Prudential Multi Asset Fund Direct-Growth has ₹24,931 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.0%, which is higher than what most other Multi Asset Allocation funds charge. Currently, the fund has a 58.62% allocation to equity and 12.55% to Debt.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

ALLOCATION BY MARKET CAPITALIZATION

RISKOMETER

HDFC Multi Asset Fund Direct-Growth is a Multi Asset Allocation mutual fund scheme from Hdfc Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. HDFC Multi Asset Fund Direct-Growth has ₹2,000 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.85%, which is higher than what most other Multi Asset Allocation funds charge. Currently, the fund has a 52.82% allocation to equity and 13.87% to Debt.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

ALLOCATION BY MARKET CAPITALIZATION

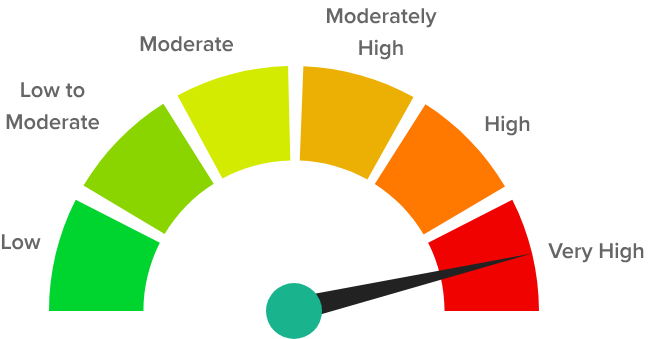

RISKOMETER

UTI Multi Asset Allocation Fund Direct-Growth is a Multi Asset Allocation mutual fund scheme from Uti Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. UTI Multi Asset Allocation Fund Direct-Growth has ₹891 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.08%, which is higher than what most other Multi Asset Allocation funds charge. Currently, the fund has a 60.90% allocation to equity and 13.53% to Debt.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

ALLOCATION BY MARKET CAPITALIZATION

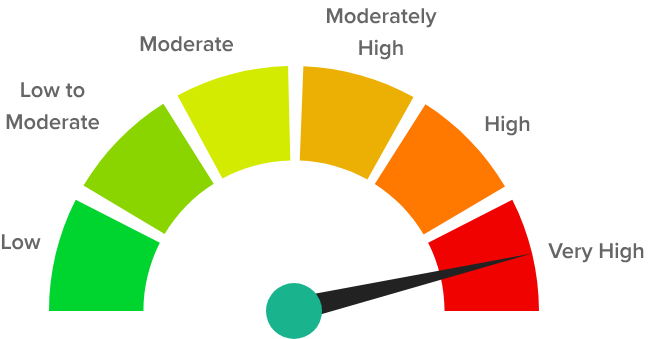

RISKOMETER

SBI Multi Asset Allocation Fund Direct-Growth is a Multi Asset Allocation mutual fund scheme from Sbi Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. SBI Multi Asset Allocation Fund Direct-Growth has ₹2,224 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.73%, which is higher than what most other Multi Asset Allocation funds charge. Currently, the fund has a 38.92% allocation to equity and 21.32% to Debt.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

ALLOCATION BY MARKET CAPITALIZATION

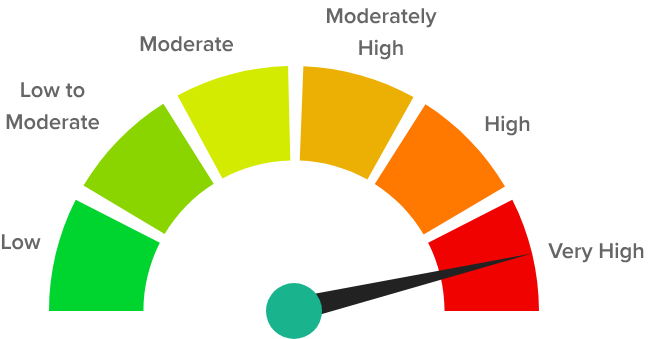

RISKOMETER

Axis Multi Asset Allocation Direct Plan -Growth is a Multi Asset Allocation mutual fund scheme from Axis Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. Axis Multi Asset Allocation Direct Plan -Growth has ₹1,260 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.82%, which is higher than what most other Multi Asset Allocation funds charge. Currently, the fund has a 73.07% allocation to equity and 13.18% to Debt.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

ALLOCATION BY MARKET CAPITALIZATION

RISKOMETER

Aditya Birla Sun Life Multi Asset Allocation Fund Direct - Growth is a Multi Asset Allocation mutual fund scheme from Aditya Birla Sun Life Mutual Fund. This fund has been in existence for 10 m, having been launched on 11/01/2023. Aditya Birla Sun Life Multi Asset Allocation Fund Direct - Growth has ₹2,637 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.32%, which is less than what most other Multi Asset Allocation funds charge. Currently, the fund has a 63.30% allocation to equity and 17.06% to Debt.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

ALLOCATION BY MARKET CAPITALIZATION

RISKOMETER

Related Articles: