INVESTMENTS

DEBT MUTUAL FUND

What is Debt Fund?

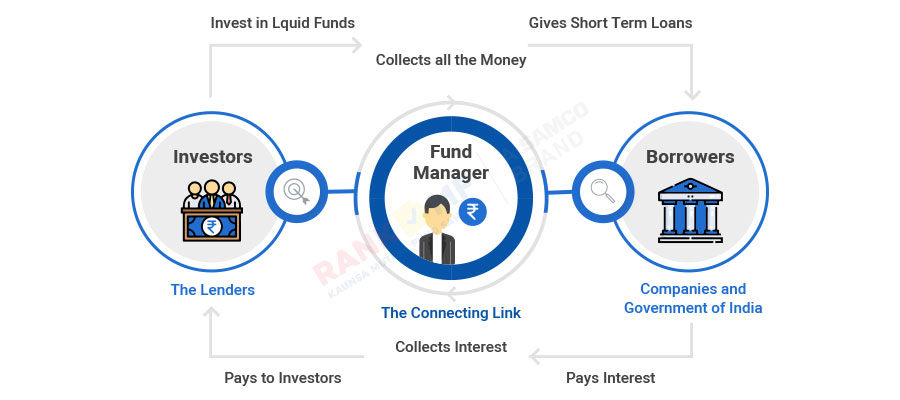

Companies or other organizations that issue debt instruments "borrow" money from investors in order to raise capital. They guarantee a consistent and regular interest in exchange. To put it simply, this is how debt instruments operate.

A debt fund is an investment pool that consists mostly of fixed income investments, similar to an exchange-traded fund or Mutual Fund. Bonds, money market instruments, securitized products, and adjustable rate debt are all possible investments for a debt fund. Because the total management expenses are lower for debt funds, the fee ratios are often lower than those for equity funds.

Often referred to as credit funds or fixed income funds, debt funds fall under the fixed income asset category. These low-risk vehicles are customarily sought by investors looking to preserve capital and/or achieve low-risk income distributions.

KEY KNOWLEDGE

How Do Debt Fund Works?

Debt funds make investments in a range of assets according to their credit scores. The credit rating of a security indicates the likelihood that the debt instrument issuer will fail to provide the promised returns. A debt fund's fund management makes care to only make investments in highly regarded credit securities. An organization with a higher credit rating is more likely to repay the principle amount at maturity as well as pay monthly interest on the debt security.

Compared to low-rated assets, debt funds that invest in higher-rated securities have lower volatility. Maturity is also influenced by the fund manager's investing approach and the general interest rate environment in the economy. The fund manager is encouraged to make long-term securities investments under a regime of declining interest rates. On the other hand, he is encouraged to invest in short-term assets by an increasing interest rate regime.

Who should Invest in Debt Funb?

Debt funds invest in a variety of asset classes in an effort to maximize returns. Debt funds are now able to provide respectable returns. The returns aren't assured, though. Returns on debt funds frequently fall into a known range. This renders them more secure options for cautious investors. Additionally, they are appropriate for investors with both medium- and short-term investment goals. The medium-term spans from three years to five years, while the short-term spans from three months to one year.

Short-Term Debt Funds:

Debt funds, such as liquid funds, could be a better option for a short-term investor than storing your money in a savings account. Higher yields, ranging from 7% to 9%, are provided by liquid funds, coupled with comparable levels of liquidity to cover unexpected expenses.

Medium-Term Debt Funds:

Debt funds, such as dynamic bond funds, are a great way for a medium-term investor to ride the interest rate volatility. Debt bond funds yield better returns than 5-year bank savings deposits. Monthly Income Plans might be a fantastic choice if you want to receive a consistent income from your assets. For risk-averse investors, debt funds are the best option since they invest in securities that provide interest at a set rate and fully repay the principle amount at maturity.

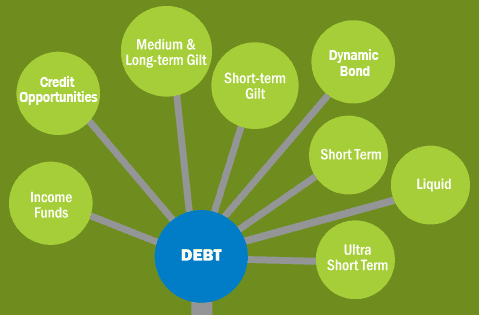

Types of Debt Funds:

These are "dynamic" funds, as the name implies. In other words, the fund management continuously modifies the composition of the portfolio to reflect changes in the interest rate environment. Because these funds take interest rate calls and invest in securities with both longer and shorter maturities, dynamic bond funds have varying average maturity lengths.

Income funds mostly invest in debt instruments with long maturities and make calls on interest rates. They therefore have greater stability than dynamic bond funds. Income funds have an average maturity of five to six years.

These debt funds make investments in securities with one- to three-year maturities, which are shorter than the average. For cautious investors, short-term funds are the best option since they are less impacted by changes in interest rates.

Debt securities with a maximum maturity of 91 days are invested in by liquid funds. They are almost risk-free as a result. Negative returns have hardly occurred with liquid funds. Because these funds offer greater rates along with comparable liquidity, they are preferable options to savings bank accounts. Through special debit cards, a number of mutual fund firms provide quick redemption on investments in liquid funds.

Gilt Funds invest in only government securities – high-rated securities with very low credit risk. Since the government seldom defaults on the loan it takes in the form of debt instruments; gilt funds are an ideal choice for risk-averse fixed-income investors

These debt funds are somewhat more recent. Credit Opportunities Funds do not make investments based on the maturities of debt instruments, in contrast to other debt funds. By taking on credit risks or owning lower-rated bonds with higher interest rates, these funds aim to increase their profits. Funds for credit possibilities are comparatively riskier debt instruments.

Things to be Considered as an Investor:

Debt funds are riskier than bank FDs since they are subject to interest rate and credit risk. The fund management may take on credit risk by purchasing assets with poor credit ratings that are more likely to default. Bond prices might decrease as a result of rising interest rates in an interest rate risk scenario.

Debt funds are safe havens for fixed-income investors, but they don't guarantee returns. An increase in the general interest rates in the economy typically results in a decrease in the Net Asset Value (NAV) of debt funds. They are therefore appropriate for a system of declining interest rates.

You could use liquid funds if your investing horizon is as short as three months to a year. On the other hand, short-term bond funds typically have tenures of two to three years. Dynamic bond funds would be suitable for an intermediate horizon of three to five years. In general, the rewards are better the longer the horizon.

An expense ratio is a cost that debt fund managers charge you to handle your money. The maximum allowable spending ratio has been set by SEBI at 2.25% of total assets. Given that debt funds yield lower returns than equity funds, a lengthy holding period would aid in making up the money lost to expense ratio.

Top 10 Debt Funds

| ICICI Prudential Short Term Fund |

|---|

| Tata Money Market Fund |

| Kotak Nifty SDL Apr 2032 Top 12 Equal Weight Index Fund |

| SBI Magnum Income Fund |

| HDFC Low Duration Fund |

| SBI Magnum Medium Duration Fund |

| Axis Strategic Bond Fund |

| ICICI Prudential Savings Fund |

| ICICI Prudential Corporate Bond Fund |

| Aditya Birla Sun Life Money Manager Fund |

ICICI Prudential Short Term Fund Direct Plan-Growth is a Short Duration mutual fund scheme from Icici Prudential Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. ICICI Prudential Short Term Fund Direct Plan-Growth has ₹18,709 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.45%, which is higher than what most other Short Duration funds charge.

Holding Analysis

Debt Sector Allocation

Tata Money Market Fund Direct-Growth is a Money Market mutual fund scheme from Tata Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Tata Money Market Fund Direct-Growth has ₹15,016 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.17%, which is close to what most other Money Market funds charge.

Holding Analysis

Debt Sector Allocation

HDFC Low Duration Fund Direct Plan-Growth is a Low Duration mutual fund scheme from HDFC Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. HDFC Low Duration Fund Direct Plan-Growth has ₹16,097 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.45%, which is higher than what most other Low Duration funds charge.

Holding Analysis

Debt Sector Allocation

Aditya Birla Sun Life Money Manager Fund Direct-Growth is a Money Market mutual fund scheme from Aditya Birla Sun Life Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Aditya Birla Sun Life Money Manager Fund Direct-Growth has ₹16,417 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.21%, which is close to what most other Money Market funds charge.

Holding Analysis

Debt Sector Allocation

Nippon India Ultra Short Duration Fund Direct-Growth is a Ultra Short Duration mutual fund scheme from Nippon India Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Nippon India Ultra Short Duration Fund Direct-Growth has ₹5,971 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.37%, which is close to what most other Ultra Short Duration funds charge.

Holding Analysis

Debt Sector Allocation

ICICI Prudential Corporate Bond Fund Direct Plan -Growth is a Corporate Bond mutual fund scheme from ICICI Prudential Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. ICICI Prudential Corporate Bond Fund Direct Plan -Growth has ₹24,508 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.32%, which is close to what most other Corporate Bond funds charge.

Holding Analysis

Debt Sector Allocation

SBI Magnum Medium Duration Fund Direct -Growth is a Medium Duration mutual fund scheme from SBI Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. SBI Magnum Medium Duration Fund Direct -Growth has ₹6,970 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.69%, which is close to what most other Medium Duration funds charge.

Holding Analysis

Debt Sector Allocation

Related Articles: