INVESTMENTS

OTHER EQUITY INDEX MUTUAL FUND

What is Other Equity Index Mutual Funds?

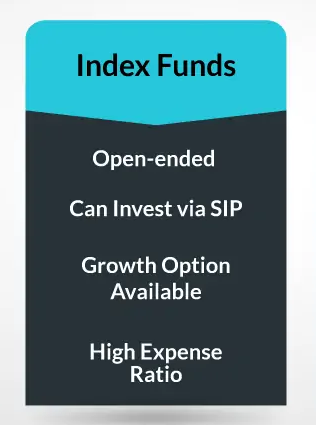

These funds track different large-cap indices such as NIFTY 50, SENSEX, NIFTY Next 50, NIFTY 100. These are low-cost index funds that track and mirror the underlying index.

Diversification is a key element of a good investment portfolio. Investors try to spread their funds across various asset classes like equity, debt, real estate, gold, etc. Even within each asset class, they try to further diversify to minimize risks. In equity investing, a known method of reducing risks is diversifying your equity portfolio by investing in shares of companies from different sectors and of market capitalizations.

KEY KNOWLEDGE

Top Schemes in Other Equity Index Mutual Funds

Axis Nifty IT Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Axis Mutual Fund. This fund has been in existence for 5 m, having been launched on 27/06/2023. Axis Nifty IT Index Fund Direct - Growth has ₹87 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.29%, which is close to what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Bandhan Nifty IT Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Bandhan Mutual Fund. This fund has been in existence for 3 m, having been launched on 18/08/2023. Bandhan Nifty IT Index Fund Direct - Growth has ₹20 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.35%, which is close to what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

DSP Nifty Midcap 150 Quality 50 Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Dsp Mutual Fund. This fund has been in existence for 1 yrs 4 m, having been launched on 18/07/2022. DSP Nifty Midcap 150 Quality 50 Index Fund Direct - Growth has ₹180 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.34%, which is close to what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Edelweiss Mutual Fund. This fund has been in existence for 3 yrs 2 m, having been launched on 06/10/2020. Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund Direct - Growth has ₹134 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.47%, which is higher than what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

HDFC S&P BSE 500 Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Hdfc Mutual Fund. This fund has been in existence for 8 m, having been launched on 06/04/2023. HDFC S&P BSE 500 Index Fund Direct - Growth has ₹22 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.3%, which is close to what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

ICICI Prudential Nifty IT Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Icici Prudential Mutual Fund. This fund has been in existence for 1 yrs 4 m, having been launched on 28/07/2022. ICICI Prudential Nifty IT Index Fund Direct - Growth has ₹291 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.35%, which is close to what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Kotak Nifty Financial Services Ex-Bank Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Kotak Mahindra Mutual Fund. This fund has been in existence for 4 m, having been launched on 24/07/2023. Kotak Nifty Financial Services Ex-Bank Index Fund Direct - Growth has ₹10 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.23%, which is close to what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Motilal Oswal Nifty 500 Index Fund Direct - Growth is a Other Equity Index mutual fund scheme from Motilal Oswal Mutual Fund. This fund has been in existence for 4 yrs 3 m, having been launched on 19/08/2019. Motilal Oswal Nifty 500 Index Fund Direct - Growth has ₹548 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.37%, which is close to what most other Other Equity Index funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION