Large-Cap Fund What does it mean ?

A large-cap (sometimes known as a "big cap") corporation has a market capitalisation of more than $10 billion. Large cap is an abbreviation for "large market capitalization." The market capitalisation of a corporation is derived by multiplying

the number of outstanding shares by the stock price per share. The stock of a firm is often categorised as large-cap, mid-cap, small-cap, or micro-cap.

KEY KNOWLEDGE

A large-cap (sometimes known as a "big cap") corporation has a market capitalisation of more than $10 billion.

A large-cap (sometimes known as a "big cap") corporation has a market capitalisation of more than $10 billion.

Large-cap is an abbreviation for "large market capitalization."

The market capitalisation of a corporation is derived by multiplying the number of outstanding shares by the stock price per share.

Large-cap companies account for a sizable share of the US equities market and are frequently employed as core portfolio assets.

Large Cap (Big Cap) Explained :

According to the Wilshire 5000 overall Market Index, which includes only businesses with a minimum float-adjusted market valuation of $25 million, large-cap stocks account for about 98.5% of the overall U.S. equities market. The Index comprises

nearly 3,500 equities reflecting the full U.S. equity market universe as of April 30, 2021.

Top U.S. Stocks

Large-cap firms are often included in the market's major benchmark indexes throughout the world. These indexes include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite in the United States.

Transparent: Because large-cap corporations are often transparent, investors may easily obtain and analyse public information about them.

Dividend payers: For dividend income distributions, investors frequently pick large-cap, stable, established corporations. Because of their established market position, they have been able to create and commit to substantial dividend payment

ratios.

Large-cap stocks are often blue-chip corporations in peak business cycle stages, with established and consistent revenue and profitability. Because of their scale, they tend to follow the market economy. They also dominate the market. They provide

unique solutions, frequently with worldwide market operations, and market news concerning these organizations is usually significant to the broader market.

Market Capitalization

A company's market capitalization defines its market size. Market capitalization is a type of stock market categorization that is widely utilised in the financial sector. The market capitalisation of a company is an essential factor that investment

firms and individual investors examine. Market capitalization is a firm attribute that is utilised in investing analysis. Market capitalization is often utilised in conjunction with other stock features such as price-to-earnings ratios and

earnings growth projections. It is also a measure of a company's market penetration.

Market capitalization is computed by multiplying the number of outstanding shares by the stock price of the firm. The number of shares outstanding is disclosed quarterly, although the stock price can fluctuate from minute to minute. As a result,

the market capitalization value changes in tandem with the market price. A business with 10 billion shares outstanding and trading at $10 per share, for example, has a market capitalization of $100 billion. Similarly, a business with 100 billion

outstanding shares selling at $1 has a market value of $100 billion.

Publicly traded stock issuance is a method for publicly listed corporations to raise cash. When a firm decides to issue its shares for trading on the open public market, share issuance is often used as its principal equity capital raising technique.

Thus, equity share management is a main function employed for capital by well-established organizations, and shares outstanding are a component of that management process.

Market Capitalization Categories

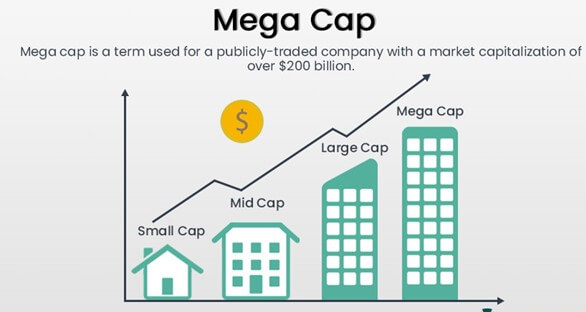

Stocks are often classified into three capitalization categories: large-cap, mid-cap, and small-cap. Mega-cap and micro-cap stock segregation, on the other hand, may be applied. Mega-cap stocks have a market capitalization of more than $200 billion.

Micro-cap is less than $300 million, while nano-cap is less than $50 million.

A large-cap firm is one with a market valuation of more than $10 billion. A mid-cap firm has a market valuation of between $2 billion and $10 billion, whereas a small-cap company has a market capitalisation of less than $2 billion. "Market Cap,

Explained." Financial Industry Regulatory Authority, Inc. Large-cap firms often have more market issuance experience and stronger capital market connections. Large-cap stocks often have the most trading liquidity.

Investing in Large-Cap Stocks

Investors seek to diversify their portfolios by investing in firms with varied market capitalizations, sales, and profits growth expectations. Large-cap stocks are thought to be safer because of their size. While they may not have the same prospects

for development as emerging mid-cap and small-cap firms, large-cap corporations are industry leaders in terms of innovation. As a result, their stock price might skyrocket as a result of unique market endeavours or ground-breaking market solutions.

Because of their stability and payouts, large-cap firms are commonly utilised as a fundamental long-term investment strategy within a portfolio. Financial advisors often advise including small-cap, mid-cap, and large-cap companies in an investing

portfolio. Risk tolerance and investment horizons are often used to guide asset allocation and investment decisions.

TOP LARGE-CAP FUNDS

About : The primary investment objective of the scheme is to seek to generate long term capital appreciation by investing predominantly into equity and equity related instruments of large cap companies.

Fundamental Analysis

Category : Equity

Risk : Very High

Return : 23.7%

Fund-Size : 15855Cr

Technical Analysis

Expense Ratio : 1.75%

More Information

About : Blue-chip stocks generate returns quarterly in the form of dividends. The fact that companies which are well-established also serve as a safe investment avenue for most investors. With this safety comes the assurance of earning

steady but guaranteed returns.

Fundamental Analysis

Category : Equity

Risk : Very High

Return : 18.6%

Fund-Size : 40079Cr

Technical Analysis

Expense Ratio : 1.02%

Minimum SIP Amount : 100

More Information

About : Over the years it has been seen that diversified plans have given an average return rate of 13% to 15% in 5 years and more. those who want to earn a higher return rate can choose to invest in aggressive SIP investment plans.

Fundamental Analysis

Category : Equity

Risk : Very High

Return : 16.2%

Fund-Size : 6369.87Cr

Technical Analysis

Expense Ratio : 0.59%

Holding Analysis

EQUITY : 97.7%

CASH : 0.2%

DEBT : 0.3%

More Information

About : The fund currently has an Asset Under Management(AUM) of ₹47,886 Cr and the Latest NAV as of 18 Sep 2023 is ₹53.68. The Canara Robeco Bluechip Equity Fund Direct Growth is rated Very High risk.

Fundamental Analysis

Category : Equity

Risk : Very High

Return : 15%

Fund-Size : 1090Cr

Technical Analysis

Expense Ratio : 0.45%

Holding Analysis

EQUITY : 95.1%

CASH : 4.9%

DEBT : 0.0%

More Information

About : It primarily invests in the blue chip stocks i.e companies with a huge market cap. These companies are very sound and one can expect an annual return of 14% (After LTCG) from this fund.

Fundamental Analysis

Category : Equity

Risk : Very High

Return : 16.8%

Fund-Size : 38881Cr

Technical Analysis

Expense Ratio : %

Holding Analysis

EQUITY : 94.4%

CASH : 5.5%

DEBT : 0.1%

More Information