INVESTMENTS

FLEXI-CAP MUTUAL FUND

What is Flexi-Cap Fund:

One kind of mutual fund that isn't limited to investing in businesses with a set market capitalization is called a flexi-cap fund. The prospectus for the fund will specify this kind of structure. The fund manager may have more options for investments and diversification with a flexi-cap fund.

Funds that invest in firms throughout the market capitalization range, such as large-cap, mid-cap, and small-cap equities, are known as flexi-cap funds. These funds make investments in all large-, mid-, and small-cap equities.

KEY KNOWLEDGE

Understanding Flexi-Cap Fund

Investors can reduce risk and volatility by diversifying their portfolio among firms with varying market capitalization through the use of flex-cap funds. They are also known as multi-cap funds or diversified equity funds.

Flexi-cap funds are able to invest in any firm, regardless of the market capitalization of the company, in contrast to mid-cap or small-cap funds that concentrate on equities depending on market capitalization.

Types of Market Capitalization:

One of the most popular methods used by mutual funds to choose which firms to invest in is market capitalization. The entire dollar market value of a company's outstanding shares is referred to as market capitalization. It's typical to refer to market capitalization as "market cap." A company's market capitalization is determined by multiplying its outstanding shares by the share price as of right now.

Typically, large-cap firms have a market value of at least $10 billion. These big businesses are often well-established and have been in their respective fields for a considerable amount of time. Purchasing stock in large-cap firms does not always result in rapid financial gain. On the other hand, these businesses often provide investors with a steady rise in share value and dividend payments over the long term.

The market capitalization of mid-cap corporations typically ranges from $2 billion to $10 billion. Mid-cap businesses are currently growing. Because they are less established than large-cap firms, they are inherently riskier, but their growth potential makes them appealing.

The market capitalization of small-cap firms ranges from $300 million to $2 billion. These little businesses may be very new, cater to specialized consumers, or operate in emerging sectors. Because of their size, age, and target markets, these firms are regarded as riskier investments. Economic downturns affect smaller businesses more acutely since they have less resources.

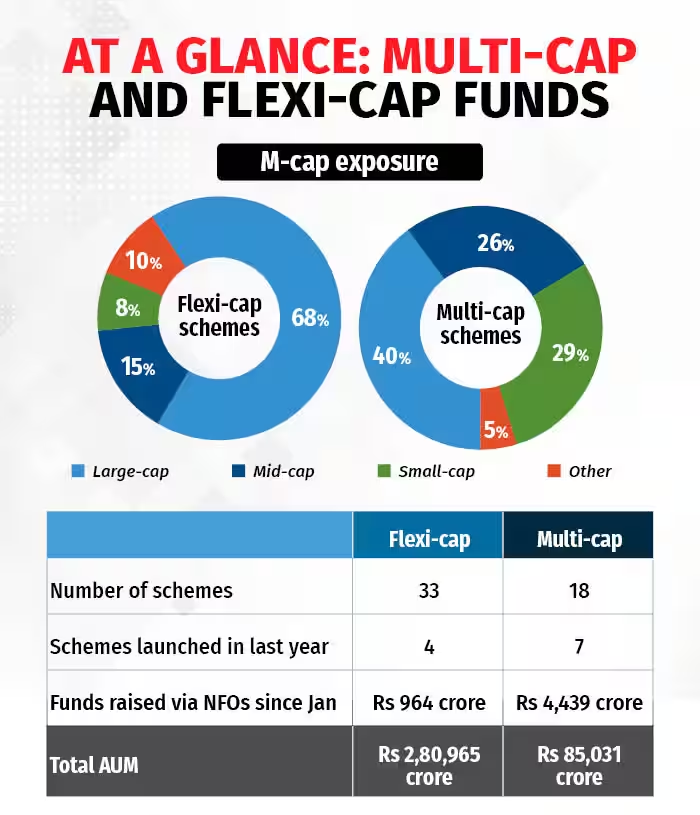

Difference Between Multi-Cap & Flexi-Cap Fund

| Multi-Cap Fund | Flexi-Cap Fund |

|---|---|

| Meaning : This equity-oriented fund, namely Multi-Cap Funds' mandate is to maintain a diversified portfolio of large, mid-cap, and small-cap corporations, as the name would imply. | Meaning : An open-ended, dynamic equity program is called a Flexi-Cap Fund. It makes investments in businesses without any market capitalization. Specifically large, mid-size, and small-cap companies. |

| Equity Exposure : Multi-Cap Funds require a minimum of 75% in Equities. This means that at least 75% of the scheme's total assets must be invested in equity and instruments that relate to equity. | Equity Exposure : Flexi-Cap Funds require a minimum of 65% in Equities. This means that at least 65% of the scheme's total assets must be allocated to investments in equity and instruments with an equity component. |

| Market Cap Allocation : Multi-Cap Funds are required to have a minimum 25% allocation of their portfolio in large-cap, mid-cap, and small-cap companies, as per SEBI. | Market Cap Allocation : Flexi-Cap Funds are free to invest in any market cap because they have no mandate. Flexi-Cap Funds invest in stocks of companies with a range of capitalizations |

| Fund Manager Discretion : In Multi-Cap Funds, the fund manager has the freedom to select stocks and market capitalization. | Fund Manager Discretion : In Flexi-Cap Funds, only the stocks with the specified market cap are available for the fund manager to select. |

| Risks : A Multi-Cap Fund, by definition, invests in the stocks of large-cap, mid-cap, and small-cap corporations. As a result, these plans are riskier than large-cap plans, which invest mainly in large corporations. | Risks : Flexi-Cap Funds offer exposure to a wide range of equity securities, covering all industries and business entities. This could result in a portfolio with a strong mix of stocks that produces moderate returns. Furthermore, if held for a long time, this fund offers a lot of flexibility in managing the risk associated with market volatility. |

Top performing Flexi-Cap Funds

Quant Flexi Cap Fund Direct-Growth is a Flexi Cap mutual fund scheme from Quant Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Quant Flexi Cap Fund Direct-Growth has ₹2,163 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.77%, which is close to what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

JM Flexicap Fund Direct Plan-Growth is a Flexi Cap mutual fund scheme from Jm Financial Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. JM Flexicap Fund Direct Plan-Growth has ₹718 Crores worth of assets under management (AUM) as on 30/09/2023 and is small fund of its category. The fund has an expense ratio of 2.34%, which is higher than what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

Parag Parikh Flexi Cap Fund Direct-Growth is a Flexi Cap mutual fund scheme from Ppfas Mutual Fund. This fund has been in existence for 10 yrs 6 m, having been launched on 13/05/2013. Parag Parikh Flexi Cap Fund Direct-Growth has ₹44,038 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.65%, which is less than what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

HDFC Flexi Cap Direct Plan-Growth is a Flexi Cap mutual fund scheme from Hdfc Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. HDFC Flexi Cap Direct Plan-Growth has ₹39,396 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.94%, which is higher than what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

Franklin India Flexi Cap Fund Direct-Growth is a Flexi Cap mutual fund scheme from Franklin Templeton Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Franklin India Flexi Cap Fund Direct-Growth has ₹11,940 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.08%, which is higher than what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

Union Flexi Cap Fund Direct-Growth is a Flexi Cap mutual fund scheme from Union Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Union Flexi Cap Fund Direct-Growth has ₹1,621 Crores worth of assets under management (AUM) as on 30/09/2023 and is small fund of its category. The fund has an expense ratio of 0.91%, which is higher than what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

PGIM India Flexi Cap Fund Direct-Growth is a Flexi Cap mutual fund scheme from Pgim India Mutual Fund. This fund has been in existence for 8 yrs 9 m, having been launched on 11/02/2015. PGIM India Flexi Cap Fund Direct-Growth has ₹5,633 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.4%, which is less than what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

Edelweiss Flexi Cap Fund Direct-Growth is a Flexi Cap mutual fund scheme from Edelweiss Mutual Fund. This fund has been in existence for 8 yrs 10 m, having been launched on 13/01/2015. Edelweiss Flexi Cap Fund Direct-Growth has ₹1,297 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.48%, which is less than what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

SBI Flexicap Fund Direct-Growth is a Flexi Cap mutual fund scheme from Sbi Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. SBI Flexicap Fund Direct-Growth has ₹17,570 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.85%, which is close to what most other Flexi Cap funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

Related Articles