INVESTMENTS

MONEY MARKET MUTUAL FUND

What Is Money Market Fund?

One type of mutual fund that makes investments in highly liquid, short-term securities is called a money market fund. These instruments consist of cash and cash equivalent assets as well as debt-based securities with short maturities and high credit ratings. The goal of money market funds is to provide investors with a high degree of liquidity at a very low risk. Another name for money market funds is money market mutual funds.

Debt funds known as money market funds make loans to businesses for a maximum of one year. Through the modification of loan length, these funds' architecture enables the fund management to limit risk and provide superior returns. Higher returns are often associated with longer loan terms.

KEY KNOWLEDGE

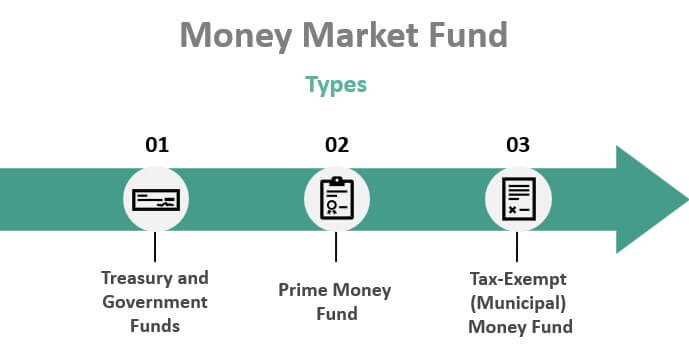

Types of Money Market Fund:

Treasury bills are a means for the Indian government to raise money for a maximum of 365 days. These are regarded as being quite safe because the government issues them. lesser risks, however, also equate to lesser rewards, and this is also true with Treasury notes. T-bill returns are not as high as those of other money market securities.

Scheduled commercial banks provide CDs, which are term deposits without the opportunity of early redemption. A CD and an FD vary primarily in that a CD is negotiable without restriction.

A repurchase agreement is made between a bank and RBI to facilitate short-term loans. It can also be made between two banks.

How Does Money Market Fund Works?

A money market fund invests in money market instruments with the objective of offering good returns (interest income) and keeping the NAV fluctuations minimal.

Factors to be considered before Investing in Money Market Funds in India:

Being debt funds, money market funds are subject to all the risks associated with debt funds, including credit risk and interest rate risk. To boost returns even further, the fund manager may choose to invest in products with a little greater risk profile. Generally speaking, money market funds provide higher returns than a standard savings account. A shift in the interest rate regime affects these funds' Net Asset Value, or NAV.

Since the returns are not very high, the expense ratio plays an important role in determining your earnings from a money market fund.

Usually, money market funds are recommended to investors with an investment horizon of 90-365 days. These schemes can help you diversify your portfolio and help invest surplus cash while maintaining liquidity. Ensure that you invest according to your investment plan.

Top Scheme of Money Market Mutual Funds

Tata Money Market Fund Direct-Growth is a Money Market mutual fund scheme from Tata Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Tata Money Market Fund Direct-Growth has ₹15,016 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.17%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

Aditya Birla Sun Life Money Manager Fund Direct-Growth is a Money Market mutual fund scheme from Aditya Birla Sun Life Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Aditya Birla Sun Life Money Manager Fund Direct-Growth has ₹16,417 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.21%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

HDFC Money Market Fund Direct Plan-Growth is a Money Market mutual fund scheme from Hdfc Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. HDFC Money Market Fund Direct Plan-Growth has ₹17,621 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.23%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

Nippon India Money Market Fund Direct-Growth is a Money Market mutual fund scheme from Nippon India Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Nippon India Money Market Fund Direct-Growth has ₹12,075 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.24%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

UTI Money Market Fund Direct-Growth is a Money Market mutual fund scheme from Uti Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. UTI Money Market Fund Direct-Growth has ₹11,578 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.2%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

SBI Savings Fund Direct-Growth is a Money Market mutual fund scheme from Sbi Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. SBI Savings Fund Direct-Growth has ₹19,714 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.23%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

ICICI Prudential Money Market Direct-Growth is a Money Market mutual fund scheme from Icici Prudential Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. ICICI Prudential Money Market Direct-Growth has ₹14,789 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.21%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

Franklin India Money Market Fund Direct-Growth is a Money Market mutual fund scheme from Franklin Templeton Mutual Fund. This fund has been in existence for 10 yrs 10 m, having been launched on 01/01/2013. Franklin India Money Market Fund Direct-Growth has ₹1,501 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.1%, which is less than what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

Sundaram Money Market Fund Direct - Growth is a Money Market mutual fund scheme from Sundaram Mutual Fund. This fund has been in existence for 5 yrs 2 m, having been launched on 12/09/2018. Sundaram Money Market Fund Direct - Growth has ₹102 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.25%, which is close to what most other Money Market funds charge.

HOLDING ANALYSIS

DEBT SECTOR ANALYSIS

Related Articles

Money market funds make the most sense for short-term goals and generally should not be used for long-term investing, such as retirement.

Usually, money market funds are recommended to investors with an investment horizon of 90-365 days. These schemes can help you diversify your portfolio and help invest surplus cash while maintaining liquidity. Ensure that you invest according to your investment plan.

Promissory Note: A promissory note is one of the earliest type of bills.

Bills of exchange or commercial bills.

Treasury Bills (T-Bills)

Call and Notice Money.

Inter-bank Term Market.

Commercial Papers (CPs)

Certificate of Deposits ( CD's )

Banker's Acceptance (BA)

Related Articles