What is Price-to-Earnings (P/E) Ratio:

The ratio used to value a firm that compares its current share price to its earnings per share (EPS) is called the price-to-earnings ratio. The price multiple or earnings multiple are other names for the price-to-earnings ratio.

Investors and analysts use price-to-earnings ratios (P/E ratios) to compare a company's shares to others in the same industry and ascertain the relative worth of those shares. Additionally, a company's past performance may be compared, as can the aggregate markets' performance over time or against one another.

KEY KNOWLEDGE

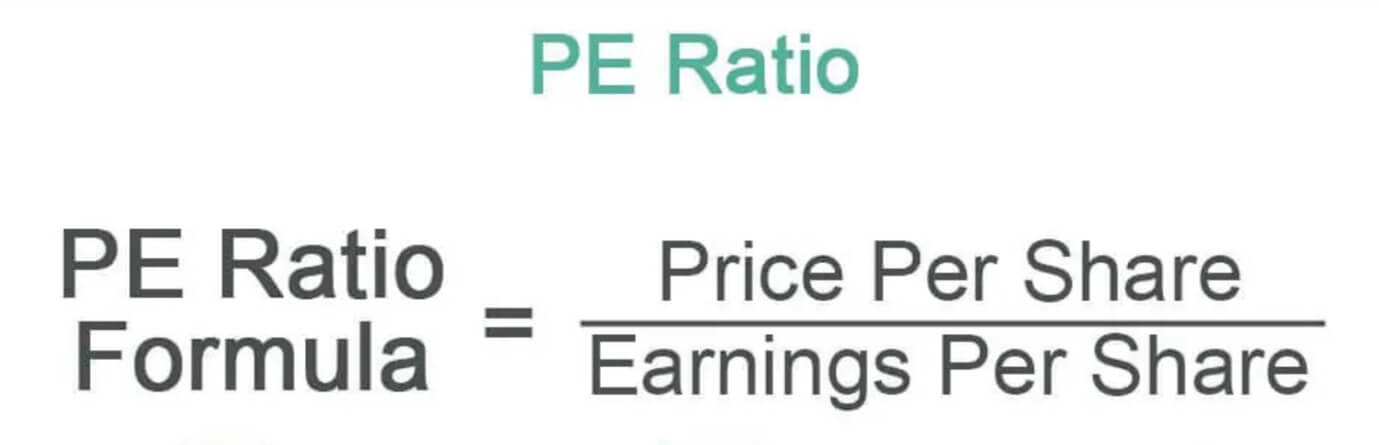

Price-to-Earnings Formula and it's Calculation:

P/E Ratio = (Current Market Price of a Share / Earnings per Share)

Cost in Relation to Earnings One of the indicators that analysts and investors use the most frequently worldwide is the ratio. It is the sum of money an investor is ready to put up for a single share of a business in exchange for ₹ 1 of its earnings. For example, investors are prepared to pay ₹ 20 for a business's stocks for ₹ 1 of its current profits if the company has a P/E ratio of 20.

Therefore, a high P/E ratio indicates that a firm is either overpriced or is headed for growth. Another way to interpret a high price-to-earnings ratio would be to say that analysts and investors are speculating that the firm will see higher revenue in the future, which has caused the stock price to soar.

Types of P/E Ratio:

It is computed by dividing the projected earnings of a firm based on its future earnings guidance by the price of a single unit of its shares. This ratio is also known as an estimated P/E ratio as it is predicated on a company's potential future profits.

Investors evaluate a company's projected growth rate and future performance using the forward price to earnings ratio.

Trailing P/E Ratio is the most commonly used metrics by investors; wherein past earnings of a company over a period is considered. It provides a more accurate and objective view of a company’s performance.

EXAMPLE

Reliance Industry Limited:

Current Market Price of a Share / Earnings per Share = ₹2394/₹101 = 23.70

What is the good P/E Ratio?

In the end, it's difficult to pinpoint an ideal P/E ratio. However, many value investors believe that lower P/E ratio is preferable overall. As previously mentioned, these ratios are frequently utilized in a comparison manner, thus what is good or poor often depends on what it is being compared against.

To give you some sense of what average for the market is, though, many value investors would refer to 20 to 25 as the average P/E ratio range. And again, like golf, the ,b>lower the P/E ratio a company has, the better an investment the metric is saying it is.

Top Performing Stocks in Future

Incorporated in 1970, Swadeshi Polytex Ltd is in the business of real estate development.

Fundamental Analysis

Incorporated in Dec 2017, Varanium Cloud Limited is a technology company focused on providing services surrounding digital audio, video, and financial blockchain (for PayFac) based streaming services

Fundamental Analysis

Life Insurance Corporation (LIC) is the largest insurance provider company in India. It has a market share of above 66.2% in new business premium. The company offers participating insurance products and non-participating products like unit-linked insurance products, saving insurance products, term insurance products, health insurance, and annuity & pension products.

Fundamental Analysis

Incorporated in 1992, Hazoor Multi Projects Limited is engaged in the business of Infrastructure and Real Estate.

Fundamental Analysis

Coal India Ltd is mainly engaged in mining and production of Coal and also operates Coal washeries. The major consumers of the company are power and steel sectors. Consumers from other sectors include cement, fertilizers, brick kilns etc.

Fundamental Analysis

Advani Hotels & Resorts (India) is engaged in the Hotel Business through its "Caravela Beach Resort", a five-star Deluxe Resort situated in Varca Beach, South Goa.

Fundamental Analysis

Consolidated Finvest & Holdings Ltd is an NBFC registered with the Reserve Bank of India, engaged in the business of investments and providing loans

Fundamental Analysis

Frequently Asked Questions

20 to 25 as the average P/E ratio range.

Once a company becomes more mature, it will grow more slowly and the P/E tends to decline.

The P/E ratio also changes as companies report earnings, typically on a quarterly basis

Related Articles