INVESTMENTS

BULLISH ENGULFING CANDLESTICK PATTERN

What is Bullish Engulfing Pattern?

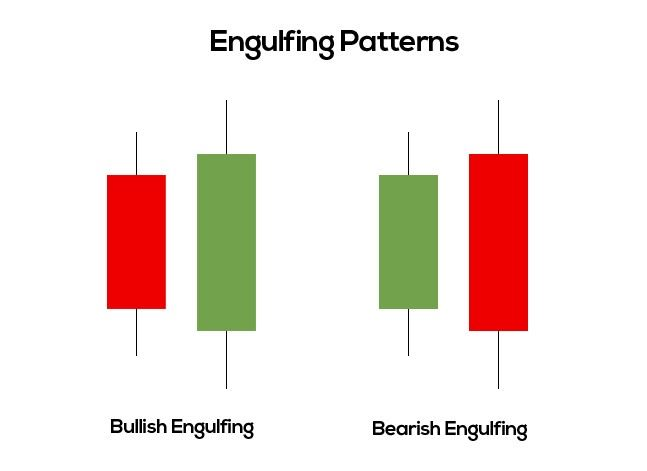

A Japanese candlestick pattern called the bullish engulfing pattern can help traders determine the beginning of a new bull trend and assess market sentiment. In the meanwhile, a bearish engulfing pattern suggests a potential trend reversal by confirming that sellers are shorting.

The bullish engulfing candlestick pattern denotes a positive trend reversal when it is preceded by a cluster of red or black candlesticks that signal a negative trend. The previous day's red or black candlestick is entirely surrounded or engulfed by the bullish green or white candle body, indicating the beginning of a new upswing.

KEY KNOWLEDGE

Understanding Bulllish Engulfing CandleStick Pattern:

A two-candle reversal pattern is the bullish engulfing pattern. Regardless of the length of the tail shadows, the second candle totally "engulfs" the first one's actual body.

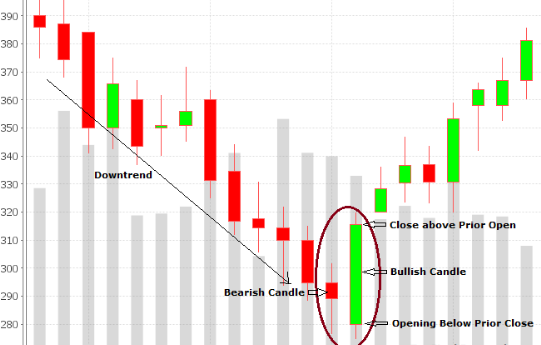

This pattern, which consists of a continous read candle followed by a bigger green candle, is seen during a decline. The price begins lower on the second day of the pattern than the previous low, but buying pressure drives it up to a greater level than the previous high, clearly indicating a win for the buyers.

How to Identify the Bullish Engulfing CandleStick pattern:

Bullish Engulfing CandleStick Pattern Reversal

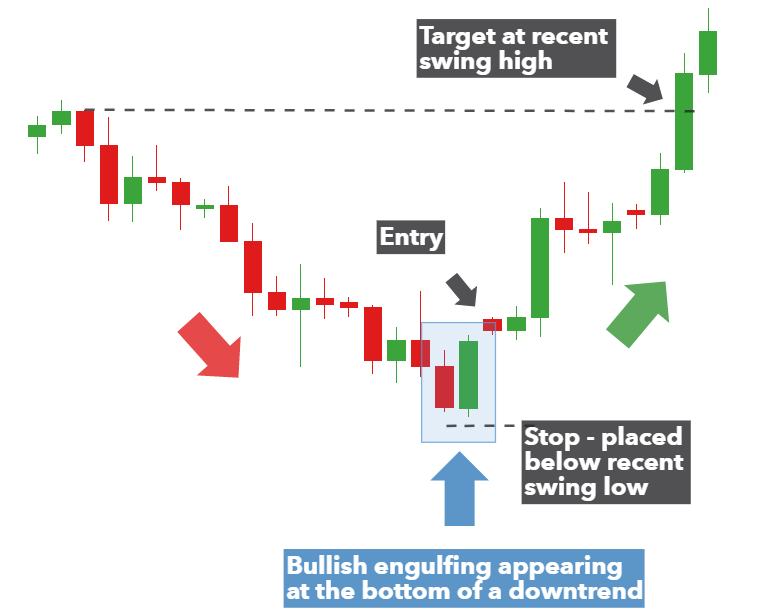

Investors should also pay attention to the candlesticks that came before the two that make up the bullish engulfing pattern. It will be easier to determine whether the bullish engulfing pattern represents a genuine trend reversal in this broader perspective.

When bullish engulfing patterns are preceded by four or more black candlesticks, they are more likely to indicate reversals. The likelihood of a trend reversal developing increases with the number of red candlesticks the bullish engulfing candle engulfs; this may be verified by a second green candlestick closing higher than the bullish engulfing candle.

Related Articles: