INVESTMENTS

CandleStick Pattern

CANDLESTICK PATTERN

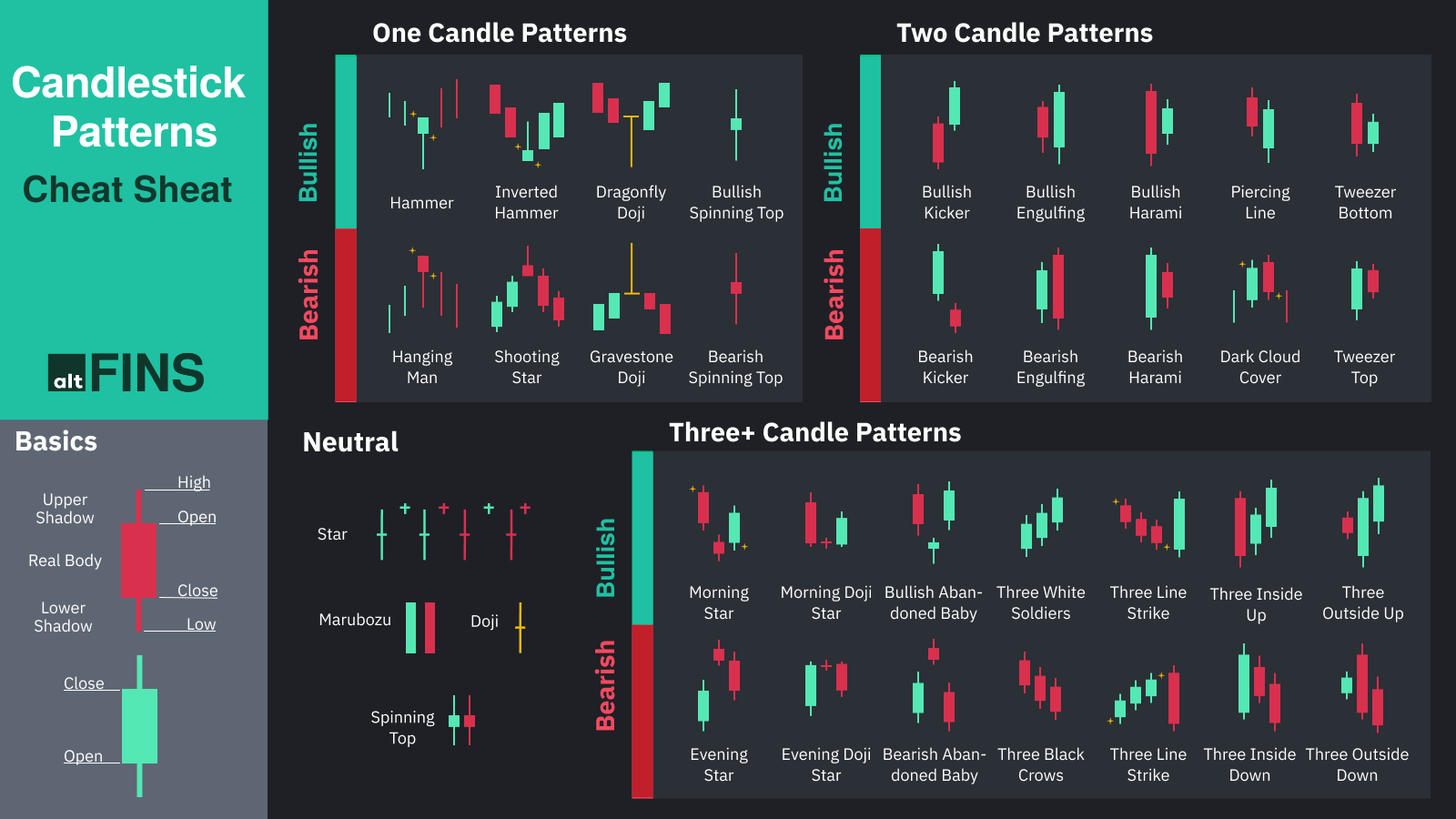

A financial technical analysis method called candlestick patterns uses a candlestick chart to graphically display daily price movement data. A financial chart known as a candlestick chart displays the price movement of currencies, equities, and derivatives as patterns.

A technical technique that condenses data from several time periods into a single price bar is the candlestick chart. Because of this, they are more beneficial than conventional OHLC bars or straightforward lines that join the closing prices. Candlesticks create patterns that, when finished, can be used to forecast price direction. This colorful technical instrument, originating from Japanese rice traders in the 18th century, gains depth through proper color coding.

KEY KNOWLEDGE

How To Read CandleStick Pattern

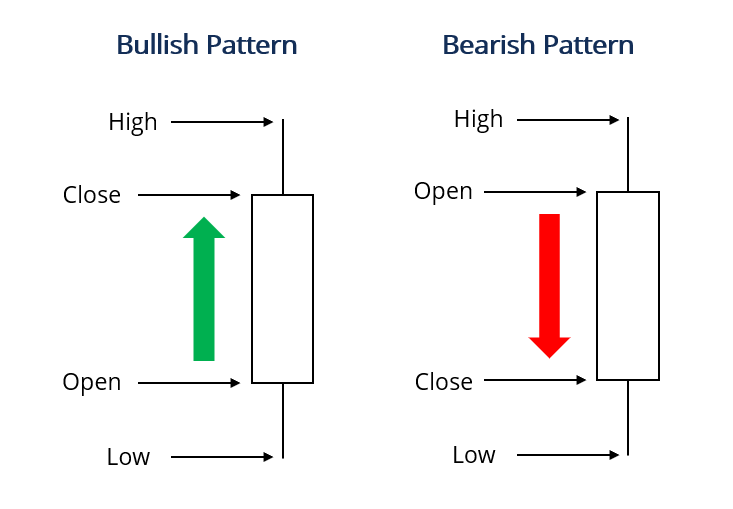

A daily candlestick chart displays the open, high, low, and closing prices of the market for the day, just like a bar chart does. The broad area on the candlestick is referred to be the "real body"

The price range between the opening and closing prices of that trading day is represented by this actual body. The genuine body indicates that the close was less than the open when it is filled in or black (also red). The genuine body was higher at close than at open if it is white (or green).

Types Of Candlestick Pattern

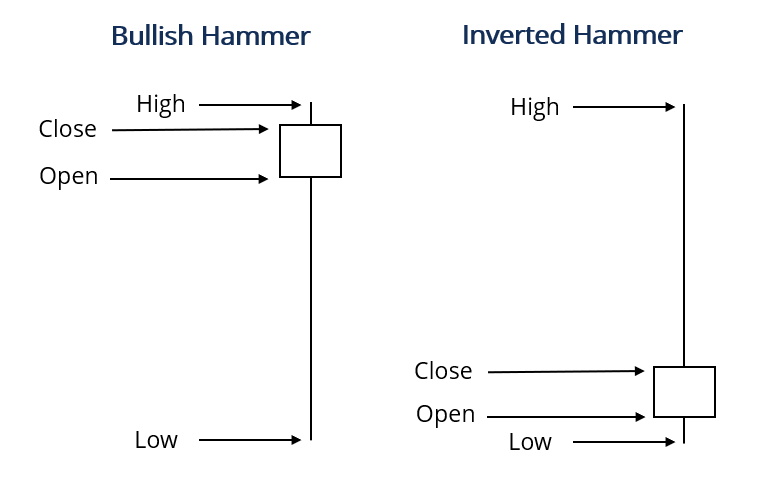

Bullish Hammer:

Inverted Hammer:

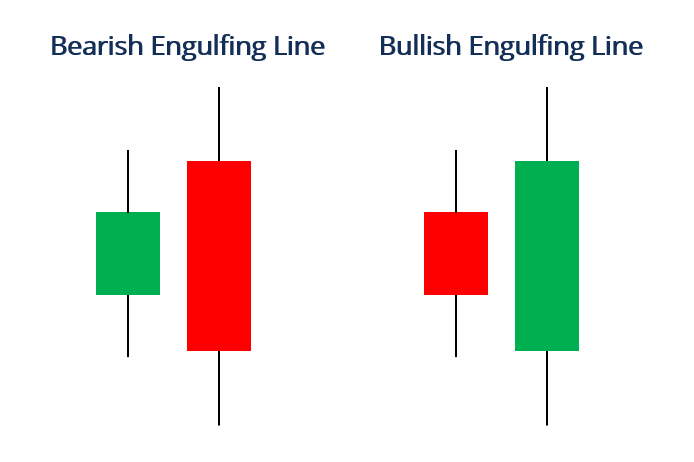

Engulfing Line:

An engulfing line (EL) is a type of candlestick pattern represented as both a bearish and bullish trend and indicates trend continuation.

A bearish engulfing line indicates a bearish trend continuation (lower prices to come), whereas a bullish engulfing line indicates a bullish trend continuation (higher prices to come) in terms of financial indications.

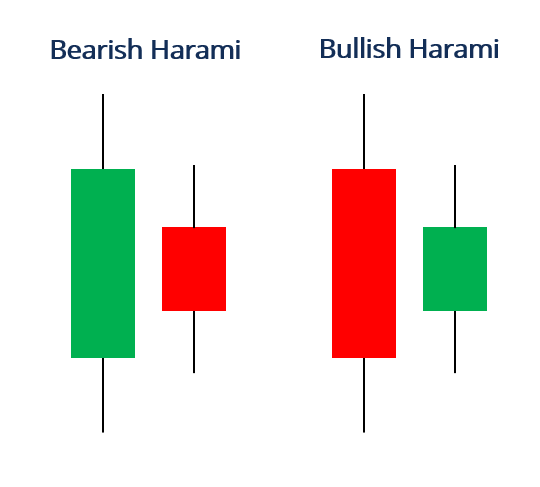

Harami Pattern:

A Japanese candlestick pattern known as the Harami (HR) pattern may indicate a possible market reversal or the continuation of a bullish or bearish trend. Harami, which translates from Japanese to mean "pregnant," is shown by the first candle, which is regarded as such.

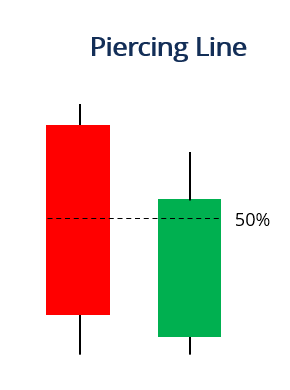

Piercing Line:

A sort of candlestick pattern that spans two days is called the piercing line (PL), and it indicates a possible bullish turnaround in the market.

The piercing line pattern is typically found near the base of a downward trend. Given that prices are declining, purchasers are prompted to influence a trend reversal in order to raise prices.

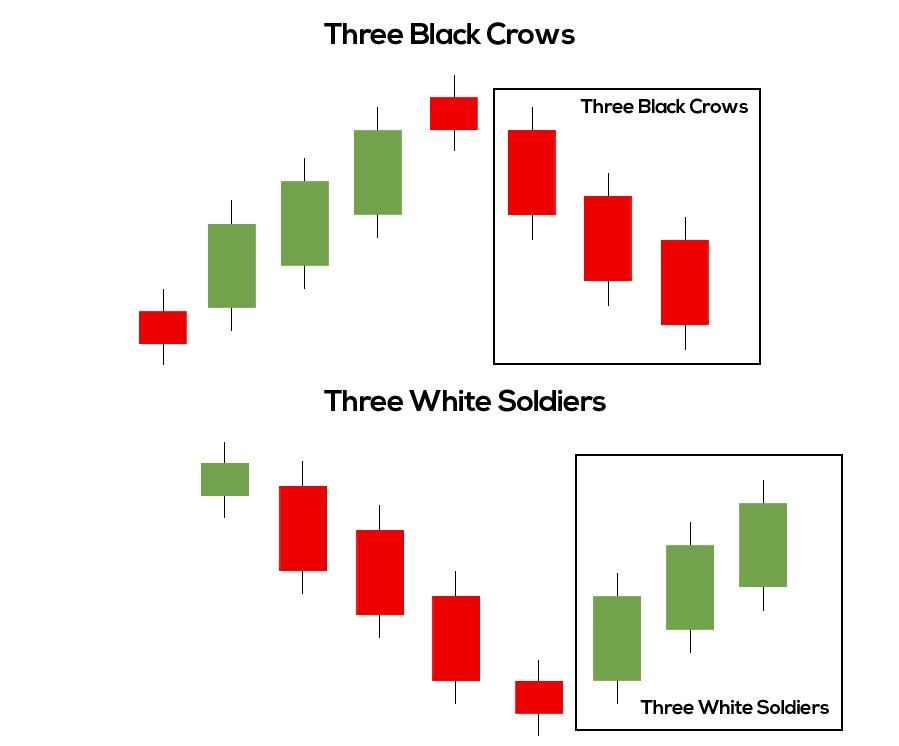

Three Black Crows pattern:

The three black crows candlestick pattern is considered a relatively reliable bearish reversal pattern. Consisting of three consecutive bearish candles at the end of a bullish trend, the three black crows signals a shift of control from the bulls to the bears.

Related Articles: