INVESTMENTS

Three White Soldier CandleStick Pattern

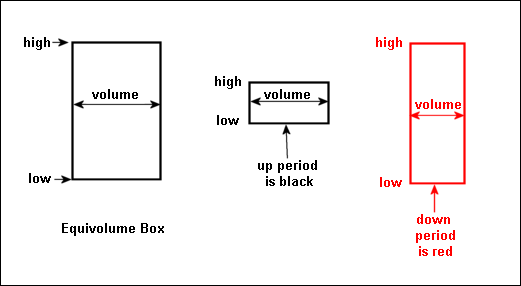

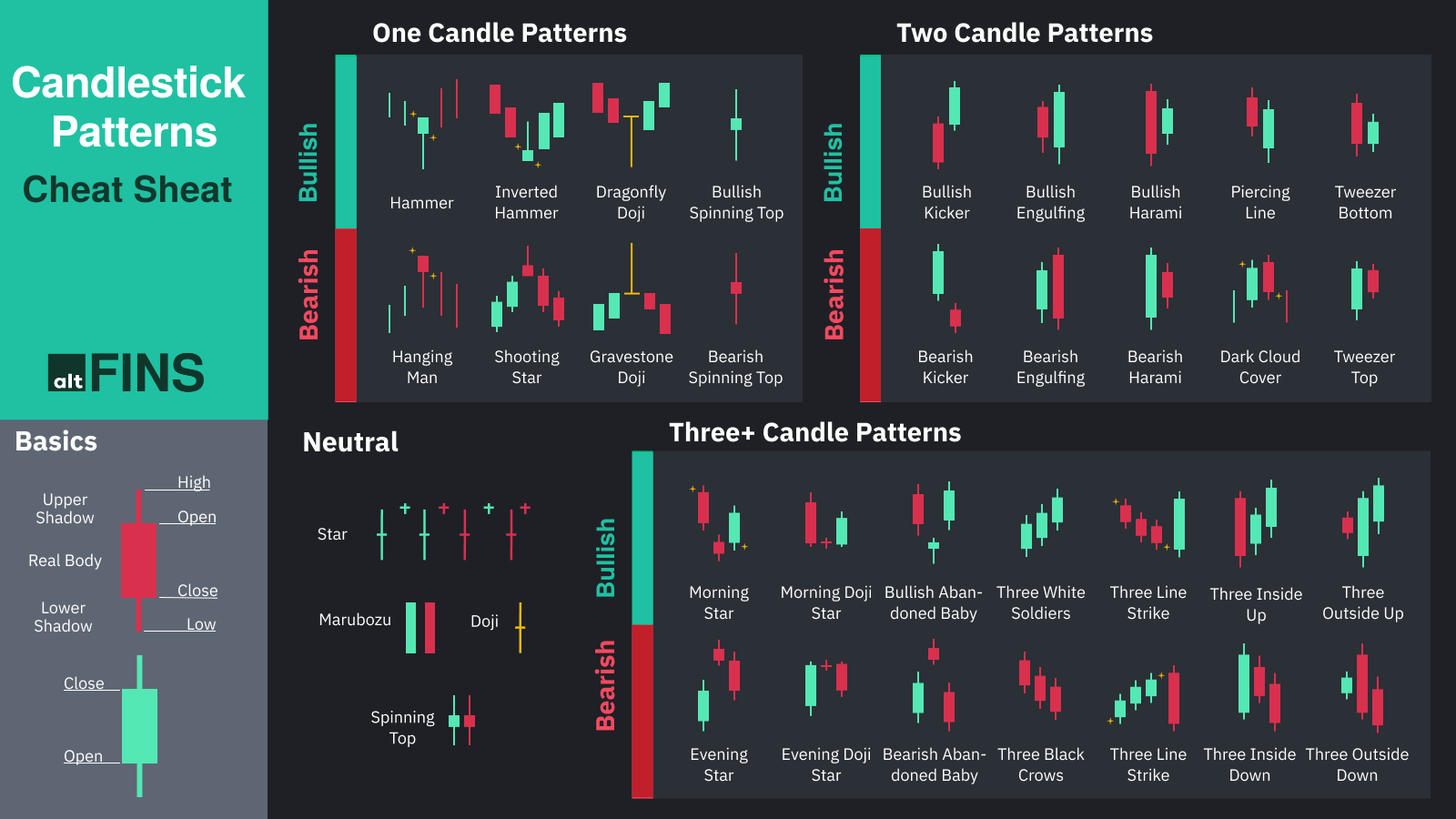

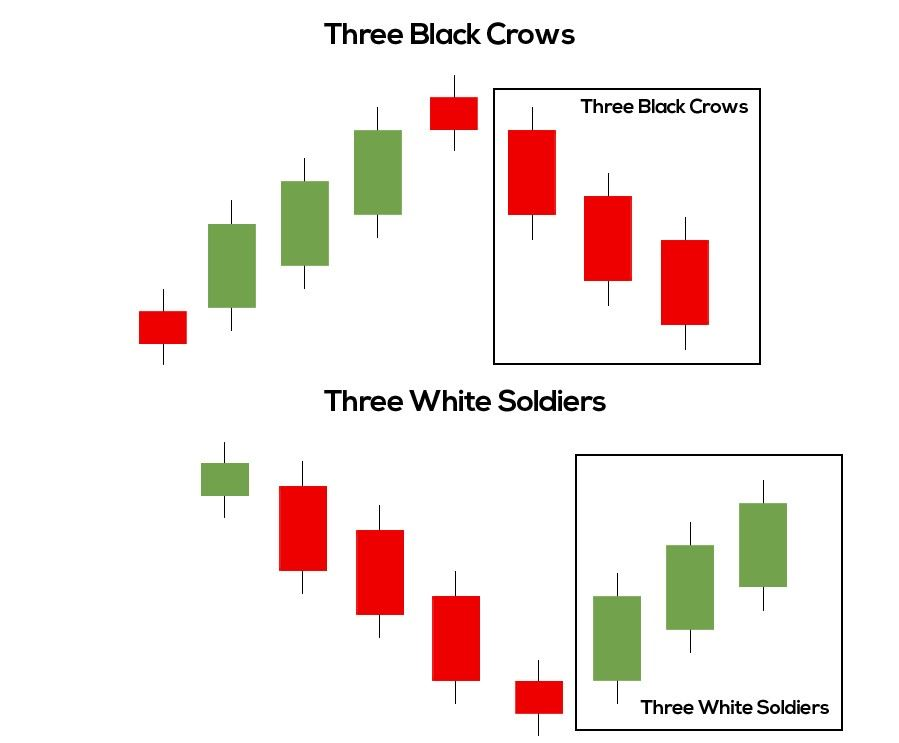

A bearish candlestick pattern known as "three black crows" may indicate the conclusion of an upward trend,. For a given asset, candlestick charts display the opening, high, low, and closing prices for the day. The candlestick is either white or green while the stocks are rising. They become crimson or black as they descend.

Three successive long-bodied candlesticks that opened inside the actual body of the preceding candle and closed lower than the preceding candle make up the black crow pattern. This indicator is frequently used by traders as confirmation of a reversal together with other technical indicators or chart patterns.

KEY KNOWLEDGE

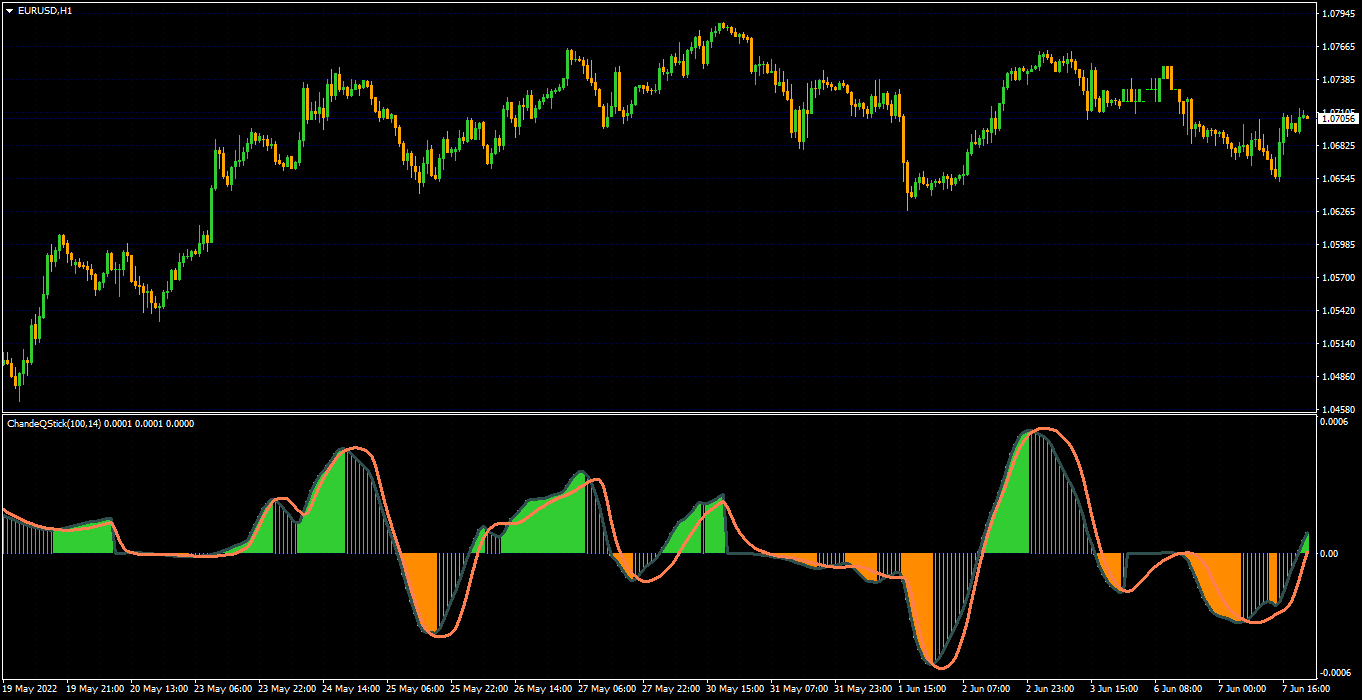

The price movement pauses to follow the same trend at one point, giving the bulls a chance to drive the price higher. As you can see, the price movement is moving upward thanks to three powerful bullish candles, which finally result in a big reversal.

This illustration shows how the three white soldiers totally overpower the bears with their strength and will. Given the significant gains that the bears were able to accomplish in a prior severe decline, a large turnaround is likewise not surprising.

How to Trade Three Black Soldier CandleStick Pattern:

By taking advantage of this window of opportunity, the bears reverse the trend direction by producing three straight bearish candles. The bulls failed to capitalize on the early positive momentum, and what comes next is a powerful push lower.

The third candle closed at the point when we entered. Since we are risking more than 200 pip in this trade, it is difficult to play this setup because the stop-loss is positioned above the most recent high.

While the wide stop loss makes it challenging, the high probability that the price action is reversing is partially offsetting the main weakness. While on the other hand we risk more, the fact that the reversal is all but confirmed makes it easier to commit to a trade.

Related Technical Indicators in Stock Market: