What is Qstick Indicator ?

Tushar Chande created the Qstick indicator, a technical analysis tool, to quantitatively pinpoint trends on a price chart. It is computed by averaging the difference between the opening and closing prices over a period of 'n'. When the Qstick value is more than zero, it indicates that purchasing pressure has been building since most of the previous 'n' days have been up.

Another name for the Qstick Indicator is Quick Stick. It is not commonly found in trading and charting programs.

KEY KNOWLEDGE

Formula for QStick Indicator:

QSI = EMA or SMA of (Close−Open)

Where:

EMA = Exponential moving average

SMA = Simple Moving Average

Close = Closing Price of Period

Open = Opening Price of Period

How to Calculate Qstick Indicator

Understanding about Qstick Indicator

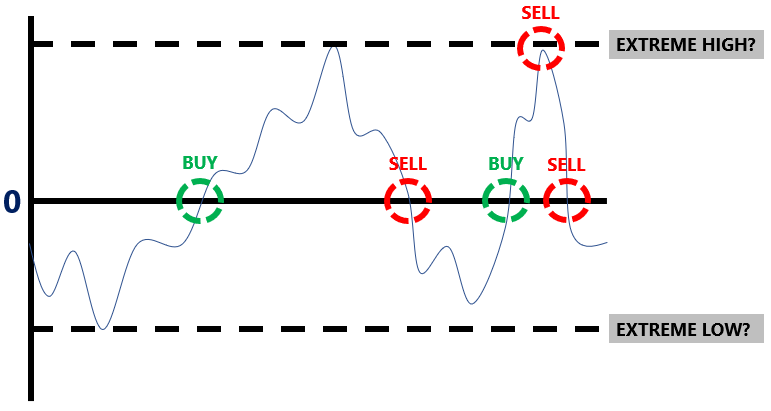

By averaging the difference between closing and starting prices, the QStick gauges the amount of buying and selling pressure>. The indicator falls down when the price closes lower on average than it opens. The indicator rises when the price closes higher than it opened on average.

The Qstick passes over the zero line to indicate a transaction. As purchasing pressure is building, crossing above zero is interpreted as a buy signal; conversely, when the indicator goes below zero, it is interpreted as a sell signal.

To serve as a signal line, a 'n' period moving average of the Qstick values can also be drawn. The Qstick value then passes across the trigger line, generating transaction signals. Signal line 'n' periods often have three.

The price may be beginning to climb when the QSticks go over the signal line, which suggests that there are more closes above the open. The market is beginning to experience more closures below the open when the Qstick crosses below the signal line. The price could be beginning to decline.

Divergence may also be emphasized by the indicator. Price increases that are accompanied by a declining QStick suggest that momentum may be flagging. Price declines indicate that purchasing momentum in the market may happen shortly when QStick rises. However, abnormalities may be produced by the indicator. Only intraday price movement is taken into consideration; gaps are ignored. Therefore, even if the price may have finished higher than the previous close, it is still considered bearish if the price gaps higher but closes below the open. May may lead to divergence, which is not always a sign of a timely price turnaround.

Example of Qstick indicator

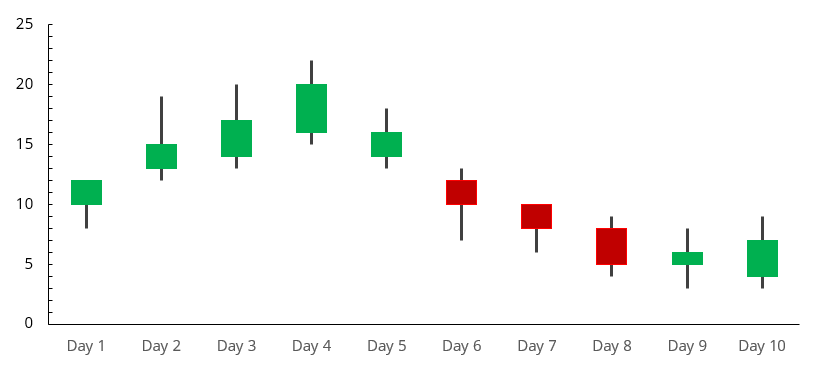

Daily Candlestick for 10 Day periods

| Date | Open | Close |

|---|---|---|

| Day 1 | 10 | 12 |

| Day 2 | 13 | 15 |

| Day 3 | 14 | 17 |

| Day 4 | 16 | 20 |

| Day 5 | 14 | 16 |

| Day 6 | 12 | 10 |

| Day 7 | 10 | 08 |

| Day 8 | 08 | 05 |

| Day 9 | 05 | 06 |

| Day 10 | 04 | 07 |

We'll figure out Stock A's two-day simple moving average below. Thus, these are the crucial variables for our Qstick indicator:

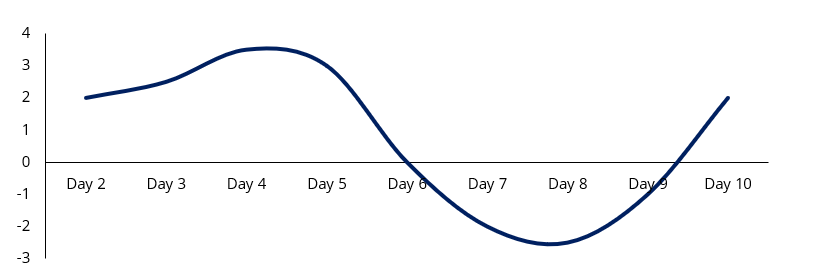

| Date | Close-Open |

|---|---|

| Day 1 | 2 |

| Day 2 | 2 |

| Day 3 | 3 |

| Day 4 | 4 |

| Day 5 | 2 |

| Day 6 | -2 |

| Day 7 | -2 |

| Day 8 | -3 |

| Day 9 | 1 |

| Day 10 | 3 |

Plotting the values of the Qstick indicator would yield the following chart, which is commonly used in technical analysis:

Interpreting the Qstick Indicator

A Qstick indication > 0 in technical analysis denotes rising buying pressure, whereas a Qstick indicator < 0 denotes rising selling pressure. Plotting the Qstick indicator allows for the identification of trends. As such:

IMPORTANT

When the Qstick indicator is reversing off of an extreme high, it is a signal to SELL, and when the Qstick indicator is reversing off an extreme low, it is a signal to BUY.

SUMMARY

Related Article: