What is Relative Strength Index (RSI)

Technical analysis uses the relative strength index (RSI) as a momentum indicator. In order to assess whether a security's price is overpriced or undervalued, RSI calculates the speed and amplitude of recent price fluctuations.

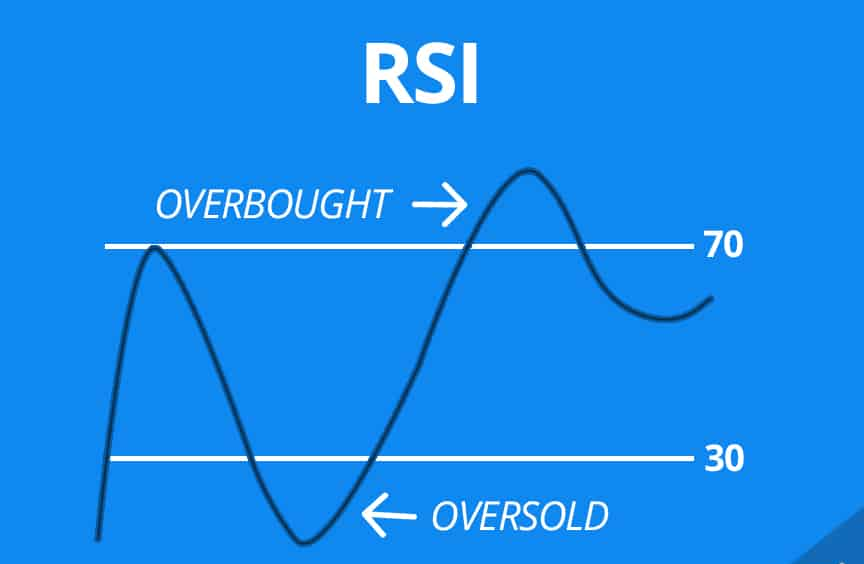

An oscillator, or line graph, representing the RSI is shown on a scale from zero to 100. J. Welles Wilder Jr. created the indicator and published it in his influential 1978 book New Concepts in Technical Trading Systems.

The RSI is not limited to identifying assets that are overbought or oversold. It can also point to stocks that might be ready for a correctional price dip or trend reversal. It may serve as a buy/sell indication. An RSI value of 70 or higher often denotes an overbought condition. An oversold situation is indicated by a rating of 30 or below.

KEY KNOWLEDGE

How does Relative Strength Index Works?

The relative strength index, as a momentum indicator, contrasts the strength of a security on days when prices rise with its strength on days when prices fall. Traders can get a sense of how a security could perform by comparing the outcome of this comparison to price movement. When used with other technical indicators, the RSI may assist traders in making more educated trading decisions.

Calculation of RSI

The average gain or loss used in this calculation is the average percentage gain or loss during a look-back period. The formula uses a positive value for the average loss.

Plotting of RSI

The RSI indicator may be plotted alongside the price chart of an item once the RSI has been calculated, as seen below. The more and larger the amount of up days, the higher the RSI will be. As the quantity and magnitude of down days rise, it will decrease.

The accompanying chart illustrates how, during an advance in the stock, the RSI indicator may remain in the overbought area for lengthy periods of time. When the stock is in a downward trend, the indicator could also be in oversold area for an extended period of time. For novice analysts, this may be unclear, but understanding how to interpret the indicator in relation to the dominant trend will make things clearer.

Why RSI is Important?

Overbought and Oversold Fit Levels

On the RSI chart, the RSI indicator typically indicates a bullish trend when it reaches 30 and a negative trend when it passes 70. Stated differently, an asset is on the averge of becoming overbought or overpriced if its RSI score is 70 or above. It could be ready for a correctional price decline or trend reversal. An oversold or undervalued situation is indicated by an RSI reading of 30 or less.

A security that trades over its real (or inherent) value is said to be overbought. That indicates that experts in technical analysis or fundamental analysis believe the price is higher than it should be. When a security shows signs of being overbought, traders may anticipate a price correction or trend reversal. As a result, they could market the security.

Example of RSI Divergences

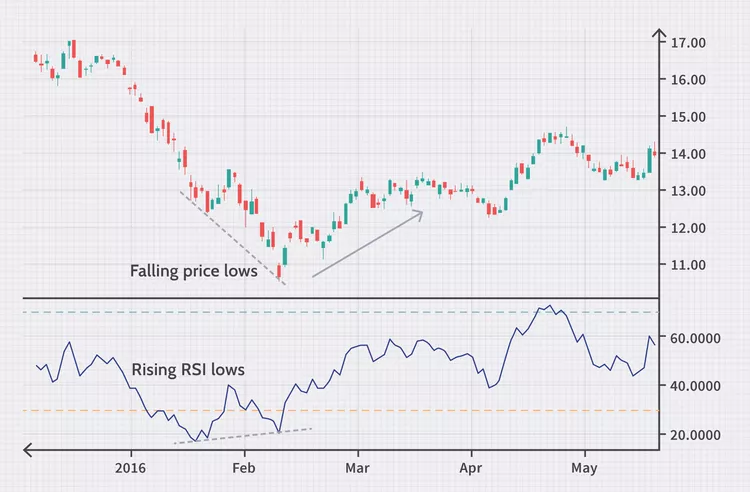

When price swings against the RSI, it is called an RSI divergence. Put differently, a chart may show a shift in momentum preceding a shift in price.

When the RSI shows an oversold reading and a higher low shows up with lower lows in the price, this is known as a bullish divergence. This would point to increasing bullish momentum, and a move above oversold area might serve as the catalyst for a fresh long position.

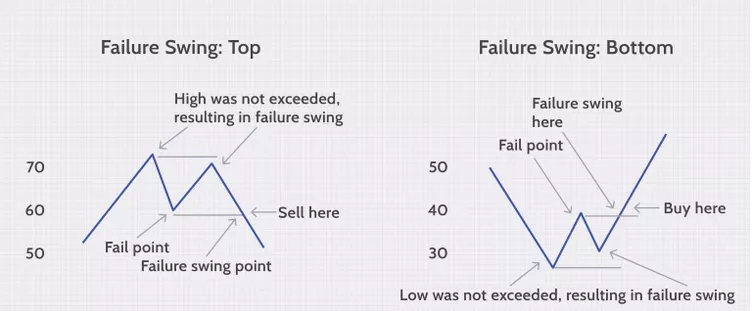

Failure Swings

Failure swings are trend indicators that point to a reversal. Both uptrends and downtrends can cause these oscillations; the former denotes selling activity while the latter denotes purchasing activity. Failure swings happen when the index oscillator doesn't track the apex of a decline or the high point of an upswing.

When the asset's price achieves a peak but the relative strength index falls below the most recent failure point, or the latest swing low, this kind of failure swing takes place. This is a warning to sell the asset when it occurs.

When the asset's price reaches its lowest point but the RSI rises above either the fail point or the most recent swing high, this is known as the failure swing bottom. This suggests that you should purchase the asset.

RSI Ranges:

During uptrends, the RSI tends to be more static than it is during downtrends. Given that the RSI compares gains to losses, this makes reasonable. More gains are made during an upswing, which maintains the RSI at higher levels. The RSI, on the other hand, tends to remain lower during a decline.

During an uptrend, the RSI tends to stay above 30 and should frequently hit 70. During a downtrend, it is rare to see the RSI exceed 70, and the indicator frequently hits 30 or drops under this threshold. These guidelines can help determine trend strength and spot potential reversals

RSI Trendline Breaks

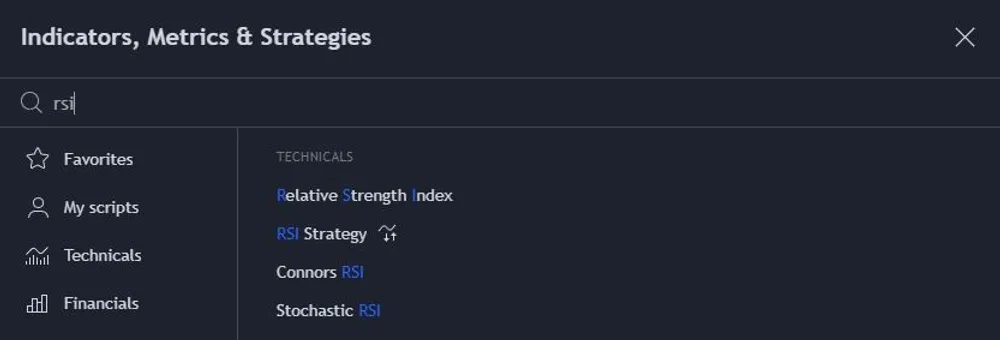

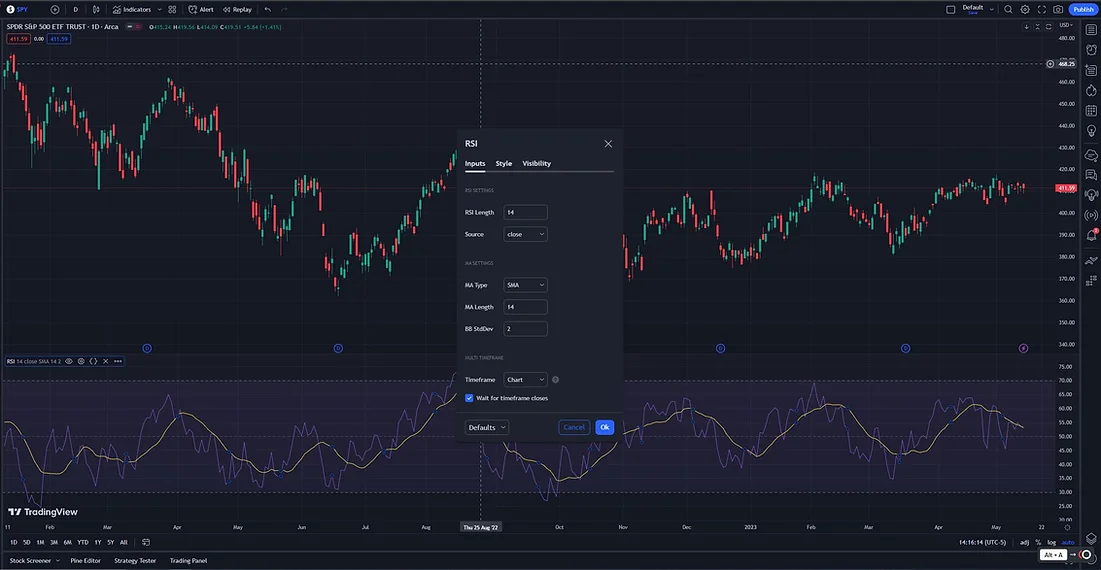

How to Add RSI Indicator to Tradingview Chart?

STEP-2

Frequently Asked Questions

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30.

Moving average crossovers can also be used to confirm RSI indications that a market is overbought or oversold. RSI is often used to obtain an early sign of possible trend changes. Therefore, adding exponential moving averages (EMAs) that respond more quickly to recent price changes can help.

Related Articles: