INVESTMENTS

Arms CandleVolume Charts

INTRODUCTION:

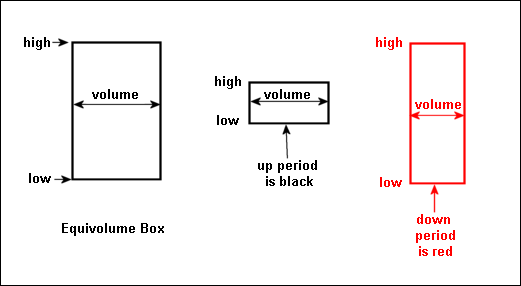

A candlestick is used inside an EquiVolume box to make Arms CandleVolume charts. The breadth is determined by the relative volume in the EquiVolume box. Let's examine each of them separately before showcasing the combined result. Three parts make up an EquiVolume box: volume, price low, and price high.

Volume determines the breadth, the price high forms the upper border, and the price low defines the lower limit. EquiVolume boxes display red when the close is below the previous close and black when the closure is above it.

CALCULATIONS:

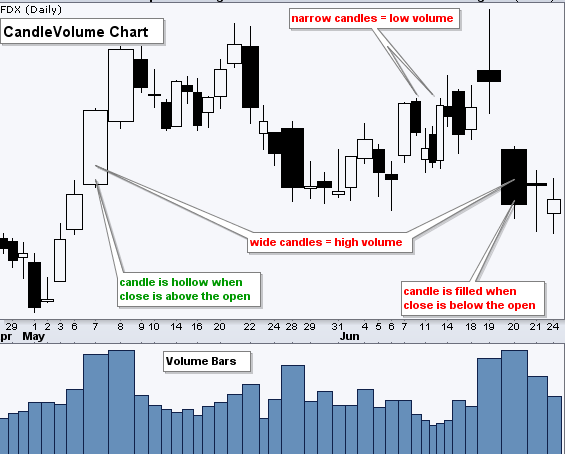

There are five parts to a CandleVolume candlestick: open, high, low, close, and volume. Similar to regular candlesticks, the body of the candlestick is formed by the open and shut, while the upper and lower shadows are formed by the high and low. The candlestick's breadth is based on volume. When the volume is large, wide candlesticks develop; when the volume is low, narrow candlesticks form. Simple black and white (full and hollow) candlesticks based on CandleVolume are displayed in the sample below. When the volume is large and the close is much above the open, wide, hollow candlesticks form. When the volume is large and the close is much below the open, wide and filled candlesticks develop. When there is very little volume, narrow candlesticks form.

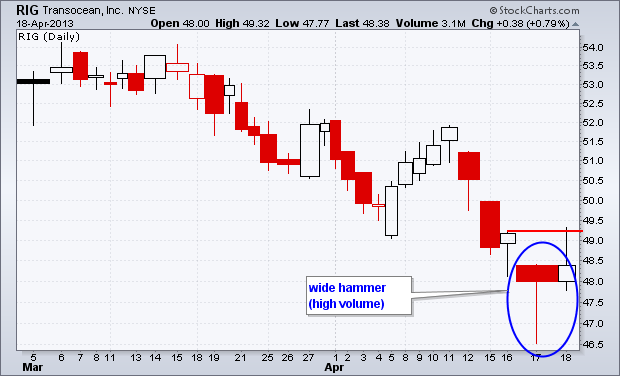

CANDLESTICK REVERSALS

Candlestick reversal patterns may be verified using CandleVolume charts. When candlesticks reverse on high volume, they are more significant than when they do so on low volume. Transocean (RIG) is creating a broad hammer in mid-April, as shown in the first chart below. In mid-May, RIG forms a broad bearish engulfing, as shown in the second chart. Following these patterns, the third chart displays the price activity.

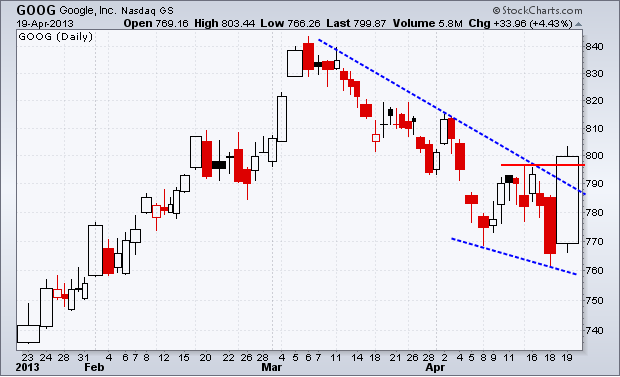

BREAKOUT VALIDATION

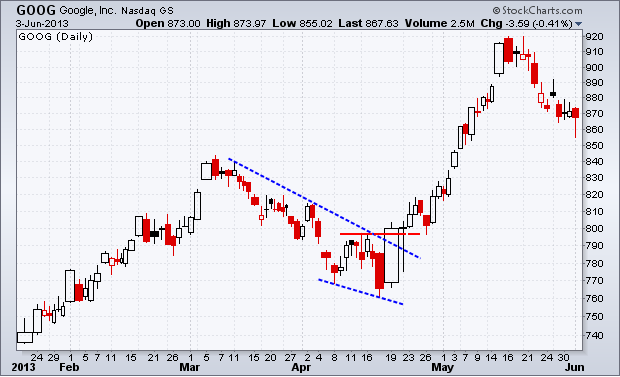

Volume is a crucial component of chart analysis, particularly when confirming breaches in support and resistance. Volume is fuel, thus an upside breakout on high volume is more optimistic than an upside breakout on low volume. A breakthrough to the upside on large volume indicates robust demand that is unlikely to diminish. Google (GOOG) is seen in the chart below with a CandleVolume pattern that ends on April 19. Take note of the broad, hollow candlestick that indicates the stock's break above resistance. This indicates a significant demand (high volume) during the breakout.

Bearish Breakout Validation

Bullish Breakout Validation

Interpretation

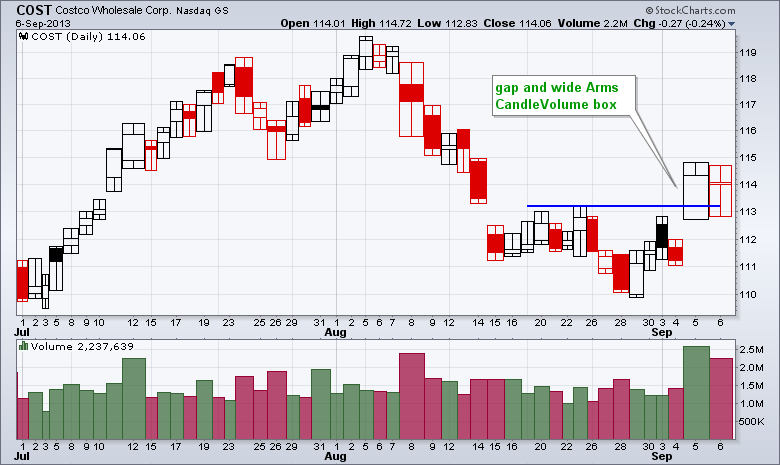

Candlestick reversal patterns may be found and volume flows can be analyzed to support these patterns by chartists using Arms CandleVolume charts. In the example below, on October 9, Costco (COST) displayed a bullish engulfing pattern with heavy volume. This candlestick is broad in addition to being lengthy since the volume increased to an amount not seen in more than two months. With the biggest box on the chart, Arms CandleVolume effectively depicts this volume rise. Volume supports the late August bottom and verifies the bullish engulfing pattern. Take note of how the purchasing pressure persisted over the next three days, driving the stock upward. After that, the stock rose to 126 and set a number of new highs in November.

Gap & Wide Arms Candle Volume

There are two other elements on this chart that are particularly noteworthy. On September 5th, COST first appeared with a gap and large Arms CandleVolume box. Second, the stock broke support with a close on the low after a bearish engulfing on strong volume signaled the mid-September top. But take note that when the chart concludes on that specific day, the real width of the Arms CandleVolume boxes is displayed.

Related Articles: