INVESTMENTS

MARUBOZU CANDLESTICK PATTERN

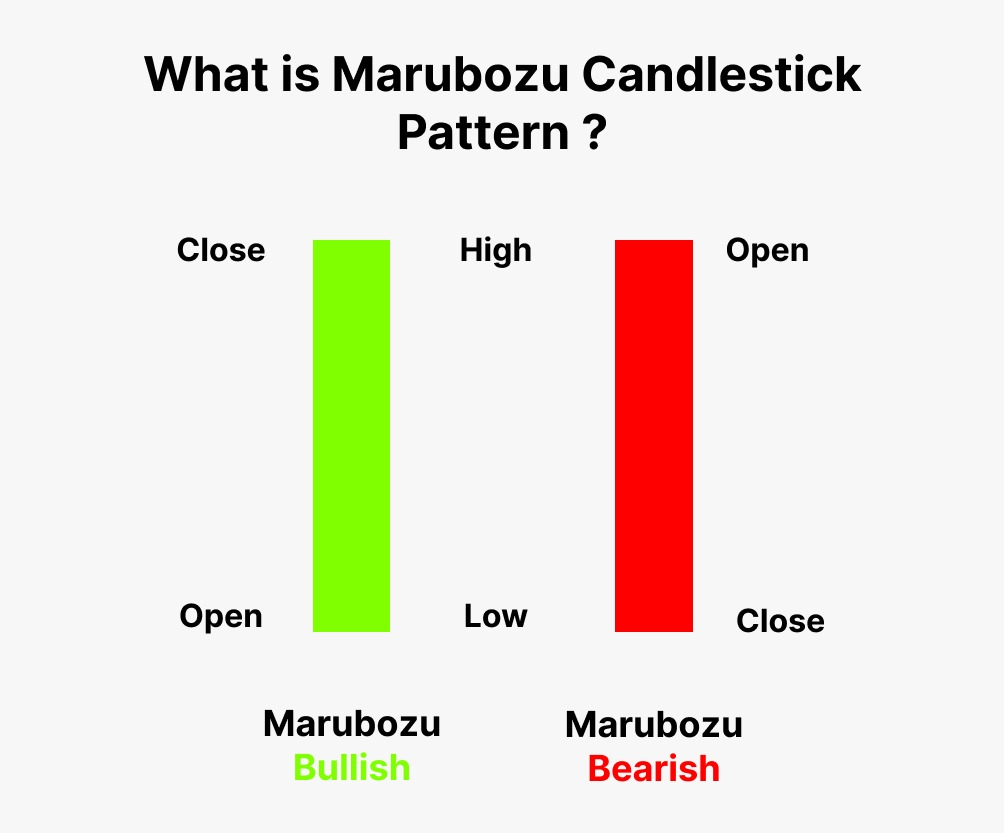

What is Marubozu Candlestick Pattern?

A Marubozo candlestick charting configuration signifies that the price of an asset did not move beyond of the range of its opening and closing prices. It's an unshadowed candlestick design.

When a bullish (green/white) Marubozu candlestick forms, it indicates that the price rose steadily from the time it opened until it closed, trying to rise even higher. A Marubozu candlestick means that there is a powerful movement, either upward or downward, indicated by its large, lengthy body and almost nonexistent shadows.

KEY KNOWLEDGE

Understanding Marubozu Candlestick Pattern

The term "close-cropped" in Japanese, which denotes a candle without a shadow, is where the name Marubozo originates. On a chart, the Marubozo is identified by the lack of upper or lower shadows, which indicates that the chart stays within the opening day price range. When the day opens at the same price as the low and closes at the same price as the high, it is said to be an up day. A bull market is indicated by days when the stock has gained, while a /bear market is shown by days when it has lost.

Gaining days, also known as up days, are a clear sign that there is a higher demand than supply for the asset. or, at the very least, more interest in the stock than there is in selling it. On days when you're losing or feeling low, the reverse is true.

Since the time of the Japanese rice traders and merchants, candlestick charting has gained popularity. They would utilize the broad portion of the candlestick, which they referred to as the "real body," to assess if the closing price had increased or decreased from the starting price.

Location Of Marubozu Candlestick Pattern

When a White/Green Marubozu appears at the conclusion of an upward trend in the price of a stock that you have been tracking, it might be a reliable sign that the trend will continue. This is due to the fact that the White/Green Marubozu often denotes a bullish attitude that will probably push the price higher.

A White/Green Marubozu toward the conclusion of a downtrend in a stock's price might be a reliable sign that the downtrend is about to reverse if you have been tracking its movement. This is due to the fact that the White/Green Marubozu often denotes a bullish attitude that will probably start pushing the price higher.

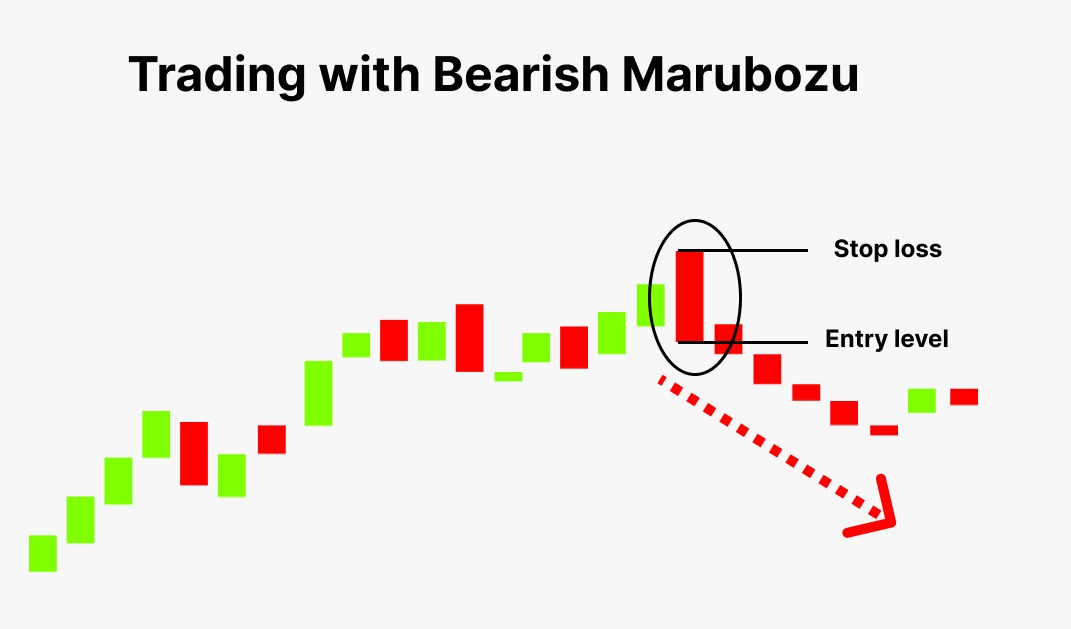

When a Red/Black Marubozu appears at the conclusion of a downturn in the price of a stock that you have been tracking, it might be a reliable sign that the decline will continue. The rationale behind this is because the Red/Black Marubozu often denotes a pessimistic outlook that might potentially drive the price lower.

A Red/Black Marubozu near the conclusion of an upward trend in a stock's price might be a reliable sign that the trend is about to reverse if you have been tracking it. This is due to the fact that the Red/Black Marubozu often denotes a bearish attitude that will probably start to drive the price lower.

Related Articles: