INVESTMENTS

SECTORAL BANKING MUTUAL FUND

What is Sectoral Banking Mutual Fund?

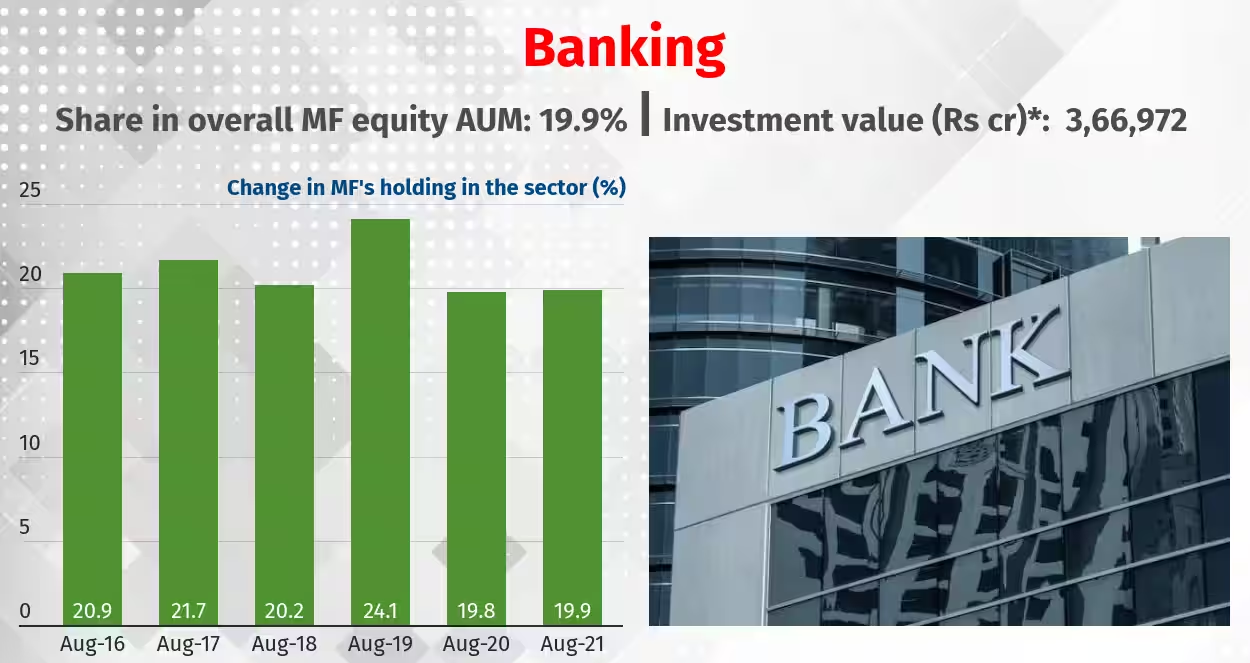

Sectoral mutual funds are equity funds that put the entire money in one sector. For instance, an IT sector fund invests only in IT companies, a banking sector fund only in banks and so on. This one sector only exposure make them one of the riskiest mutual funds.

Sectoral banking mutual funds are those sector funds whose asset allocation is made mostly towards the equities of Indian banks. These funds are expected to do well and beat the benchmark when the banking sector is doing well. By investing in these funds, you gain exposure to a well-constituted portfolio of banking securities.

Advantages of Sectoral Banking Fund

Who Should Invest in Sectoral Banking Mutual Funds?

Top Performing Sectoral Banking Mutual Fund

Sundaram Financial Services Opportunities Fund Direct-Growth is a Sectoral-Banking mutual fund scheme from Sundaram Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. Sundaram Financial Services Opportunities Fund Direct-Growth has ₹876 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.87%, which is close to what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Nippon India Banking & Financial Services Fund Direct-Growth is a Sectoral-Banking mutual fund scheme from Nippon India Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. Nippon India Banking & Financial Services Fund Direct-Growth has ₹4,846 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.14%, which is higher than what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Invesco India Financial Services Fund Direct-Growth is a Sectoral-Banking mutual fund scheme from Invesco Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. Invesco India Financial Services Fund Direct-Growth has ₹575 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.08%, which is higher than what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Tata Banking and Financial Services Fund Direct-Growth is a Sectoral-Banking mutual fund scheme from Tata Mutual Fund. This fund has been in existence for 8 yrs, having been launched on 04/12/2015. Tata Banking and Financial Services Fund Direct-Growth has ₹1,672 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.54%, which is less than what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Aditya Birla Sun Life Banking & Financial Services Fund Direct-Growth is a Sectoral-Banking mutual fund scheme from Aditya Birla Sun Life Mutual Fund. This fund has been in existence for 10 yrs, having been launched on 25/11/2013. Aditya Birla Sun Life Banking & Financial Services Fund Direct-Growth has ₹2,787 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.04%, which is higher than what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

ICICI Prudential Banking and Financial Services Direct Plan-Growth is a Sectoral-Banking mutual fund scheme from Icici Prudential Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. ICICI Prudential Banking and Financial Services Direct Plan-Growth has ₹6,740 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.03%, which is higher than what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

SBI Banking & Financial Services Fund Direct-Growth is a Sectoral-Banking mutual fund scheme from Sbi Mutual Fund. This fund has been in existence for 8 yrs 9 m, having been launched on 11/02/2015. SBI Banking & Financial Services Fund Direct-Growth has ₹4,245 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 0.79%, which is close to what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

UTI Banking and Financial Services Fund Direct Plan-Growth is a Sectoral-Banking mutual fund scheme from Uti Mutual Fund. This fund has been in existence for 10 yrs 11 m, having been launched on 01/01/2013. UTI Banking and Financial Services Fund Direct Plan-Growth has ₹898 Crores worth of assets under management (AUM) as on 30/09/2023 and is medium-sized fund of its category. The fund has an expense ratio of 1.19%, which is higher than what most other Sectoral-banking funds charge.

HOLDING ANALYSIS

EQUITY SECTOR ALLOCATION

TOP STOCK HOLDINGS

ALLOCATION BY MARKET CAPITALIZATION

Related Articles: