What is Goods and Service Tax(GST) :

The Goods and Services Tax is abbreviated as GST. In India, it is an ,indirect tax that has taken the place of several other indirect taxes, including services tax, VAT, and excise duty. On March 29, 2017, the Parliament enacted the Goods and Service Tax Act, which became operative on July 1st, 2017.

Put otherwise, the provision of goods and services is subject to the Goods and Service Tax (GST). Every value addition is subject to the comprehensive, multi-stage, destination-based Goods and Services Tax Law in India. For the whole nation, there is just one domestic indirect tax legislation, or GST.

The tax is imposed under the GST framework at each point of sale. Both state and central taxes are applied to sales within the same state. The Integrated GST is applicable to all interstate sales.

KEY KNOWLEDGE

Knowledge of Goods and Service Tax(GST)

An indirect federal sales tax that is added to the price of some products and services is known as the goods and services tax, or GST. Customers that purchase the product pay the sales price, which includes the GST, as the firm includes the GST in the product's price. The seller or firm collects the GST component and sends it to the government. In certain nations, it is also known as value-added tax, or VAT.

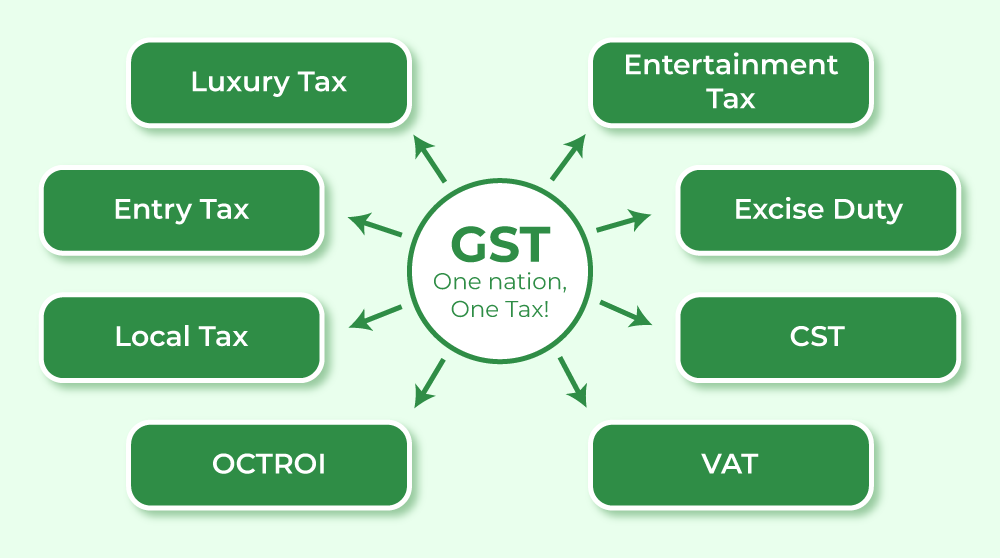

The majority of GST-implementing nations have a single, unified GST system, meaning that a single tax rate is used nationwide. In a nation with a single GST platform, state-level taxes such as entertainment taxes, entrance taxes, transfer taxes, sin taxes, and luxury taxes are combined with central taxes such as sales taxes, excise duty taxes, and service taxes, and they are collected as a single tax. Almost everything is taxed at the same rate in these nations.

IMPORTANT

Since France became the first nation to impose the Goods and Services Tax (GST) in 1954, an estimated 140 other nations have done the same. Canada, Vietnam, Australia, Singapore, United Kingdom, Spain, Italy, Nigeria, Brazil, and India are a few of the nations that have a Goods and Services Tax (GST).

Multi-Stage of GST

Value Addition

A biscuit producer purchases flour, sugar, and other ingredients. After the flour and sugar are combined and cooked into biscuits, the inputs' value rises.

The warehouse agency purchases the biscuits from the producer, who packages and labels vast numbers of biscuits in cartons. This adds even more value to the biscuits. The storage agent then sells it to the store.

By investing in the biscuits' marketing and packaging them in lesser numbers, the shop raises the biscuits' worth. The monetary value added at each stage to reach the ultimate sale to the end client is known as value adds, and it is subject to GST.

Objectives of Goods and Service Tax :

1. To fulfill the "One Nation, One Tax" philosophy

Several indirect levies that were in force under the former tax system have been replaced by the GST. The benefit of a single tax is that each state charges the same amount for a given good or service. The Central Government sets the tax rates and policies, making tax administration simpler. Common legislation, such e-way bills for the transportation of goods and e-invoicing for transaction reporting, may be introduced. Additionally, since taxpayers are not burdened by numerous return forms and deadlines, tax compliance is improved. All things considered, it's a single indirect tax compliance system.

2. To absorb the vast majority of India's indirect taxes

Value Added Tax (VAT), Central Excise, service tax, and other former indirect taxes were previously imposed in India at various levels of the supply chain. The federal government oversaw certain taxes while the states oversaw others. A single, centralized tax on products and services did not exist. Thus, the GST was implemented. The main indirect taxes were combined into one under the GST. It has made tax administration easier for the government and significantly lessened the cost of compliance for taxpayers.

3. To stop taxes from having a cascade impact

Eliminating the cascading impact of taxes was one of the main goals of the GST. Taxpayers were previously unable to offset the tax credits from one tax against the other because of disparate indirect tax legislation. For instance, the VAT due at the time of sale could not be offset by the excise taxes paid during production. Taxes cascaded as a result of this. Only the net value contributed at each level of the supply chain is subject to taxation under the GST. As a result, the cascading impact of taxes has been lessened, and input tax credits for both products and services are now flowing smoothly.

4. To increase the taxpayer base

The GST has aided in expanding India's tax base. There used to be distinct registration thresholds based on turnover for each tax code. The Goods and Services Tax (GST) has resulted in a rise in the number of enterprises that are registered with the government. Furthermore, certain unorganized industries have been brought into the tax net because to the tougher regulations governing input tax credits. Take the Indian construction sector, for instance.

Components of Goods and Service Tax

GST Tax Rates in India

0% Rated Goods and Service Tax

| Product | Tax Rates |

|---|---|

| Milk | 0% |

| Curd | 0% |

| Egg | 0% |

| Lassi | 0% |

| Kajal | 0% |

| Educational Service | 0% |

| Health Service | 0% |

| Children's Drawing & Coloring Books | 0% |

| Unpacked Foodgrains | 0% |

| Unpacked Paneer | 0% |

| Gur | 0% |

| Unbranded Natural Honey | 0% |

| Fresh Vegetable | 0% |

| Unbranded Atta | 0% |

| Unbranded Maida | 0% |

| Unbranded Maida | 0% |

| Besan | 0% |

5% Rated Goods and Service Tax

| Product | Tax Rates |

|---|---|

| Sugar | 5% |

| Tea | 5% |

| Packed Paneer | 5% |

| Coal | 5% |

| Edible Oil | 5% |

| Raisin | 5% |

| Domestic LPG | 5% |

| Roasted Coffee Beans | 5% |

| PDS Kerosene | 5% |

| Skimmed Milk Powder | 5% |

| Cashew Nuts | 5% |

| Footwear (<500) | 5% |

| Milk Food for Babies | 5% |

| Apparels | 5% |

| Fabric | 5% |

| Coir Mats, Matting & Floor Covering | 5% |

| Spices | 5% |

| Agarbatti | 5% |

12% Rated Goods and Service Tax

| Products | Tax rates |

|---|---|

| Butter | 12% |

| Ghee | 12% |

| Computer | 12% |

| Processed Foods | 12% |

| Almonds | 12% |

| Fruit juice | 12% |

| Mobiles | 12% |

| Preparations of Vegetables, Nuts Fruits, or other parts | 12% |

| Packed Coconut Water | 12% |

| Umbrella | 12% |

18% Rated Goods and Service Tax

| Products | Tax Rates |

|---|---|

| Hair Oil | 18% |

| Capital Goods | 18% |

| Toothpaste | 18% |

| Soap | 18% |

| Ice-Cream | 18% |

| Pasta | 18% |

| Printer | 18% |

| Computer | 18% |

28% Rated Goods and Service Tax

| Products | Tax Rate |

|---|---|

| Small cars (+1% or 3% cess) | 28% |

| High-end motorcycles (+15% cess) | 28% |

| Consumer durables such as AC and fridge | 28% |

| Beedis are NOT included here | 28% |

| Luxury & sin items like BMWs, cigarettes | 28% |

| aerated drinks (+15% cess) | 28% |

Example of Goods and Service Tax (GST)

For instance, a laptop maker pays, say, Rs. 10 for the raw materials, which also includes a 10% tax. This indicates that they pay Rs. 1 in taxes on supplies valued at Rs. 9. The producer adds value to the Rs. 5 original materials throughout the notebook's production process, making the overall worth of Rs. 10 + Rs. 5 = Rs. 15. On the completed commodity, a 10% tax of Rs. 1.50 would be payable. In a GST system, the effective tax rate would be Rs. 1.50 - Rs. 1.00 = Rs. 0.50 after deducting the already paid tax from this new tax.

Related Articles