INVESTMENTS

INTRODUCTION TO INSURANCE

What is Insurance?

An insurance policy is a legal agreement between a policyholder and an insurance

company that provides the policyholder with financial protection or compensation against losses.

In order to reduce the insured's payment costs, the firm combines the risks of its clients.

Most individuals have some kind of insurance, whether it is for their life, their property,

their automobile, or their health.

Policies that provide insurance protect against monetary losses brought on by mishaps, injuries, or property damage. Insurance also contributes to the financial burden of bearing legal responsibility for harm or damage done to a third party.

KEY KNOWLEDGE

How Insurance Works

Insurance Policy Components

The premium for a policy is its cost, usually paid on a monthly basis. When setting a premium, an insurer frequently considers a number of different criteria. Here are few instances:

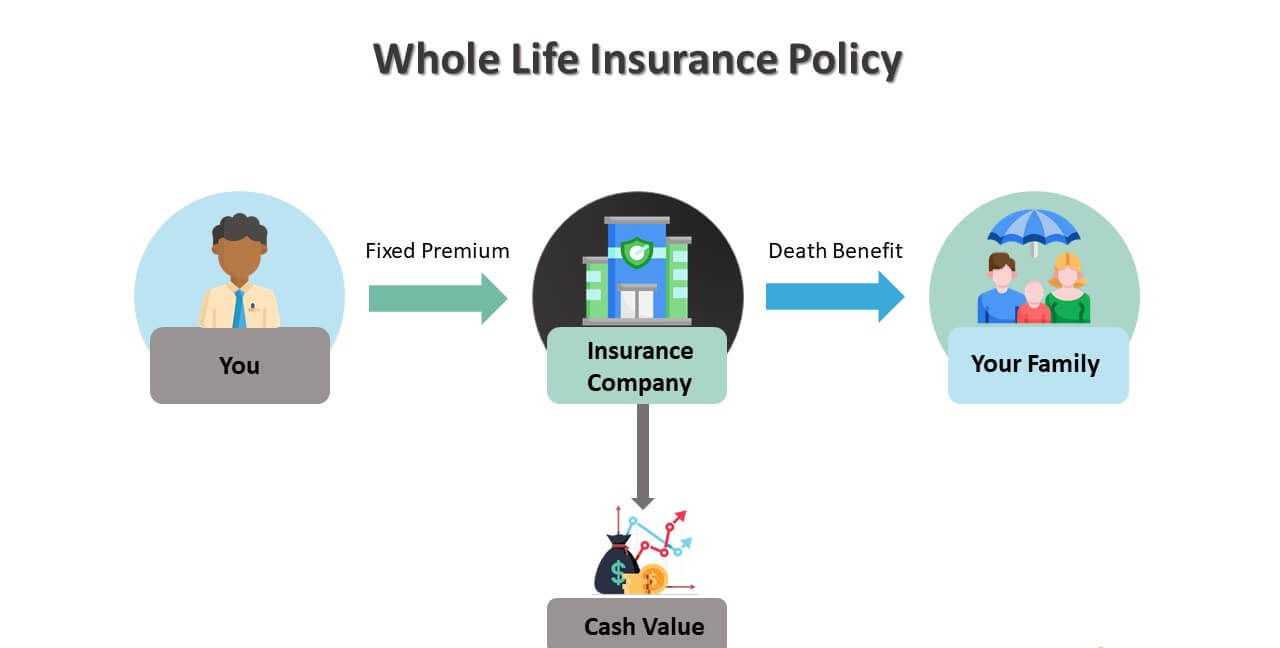

Policy Limit

The most that an insurer will pay for a covered loss under a policy is known as the policy limit. The maximum can be established for each loss or damage, each period (annual, policy term, etc.), or for the duration of the policy, which is also referred to as the lifetime maximum.

Higher limitations usually result in higher rates. The face value of a general life insurance policy is the highest sum that the insurer will pay. This is the sum that is given to your beneficiary after you pass away.

Types Of Insurance

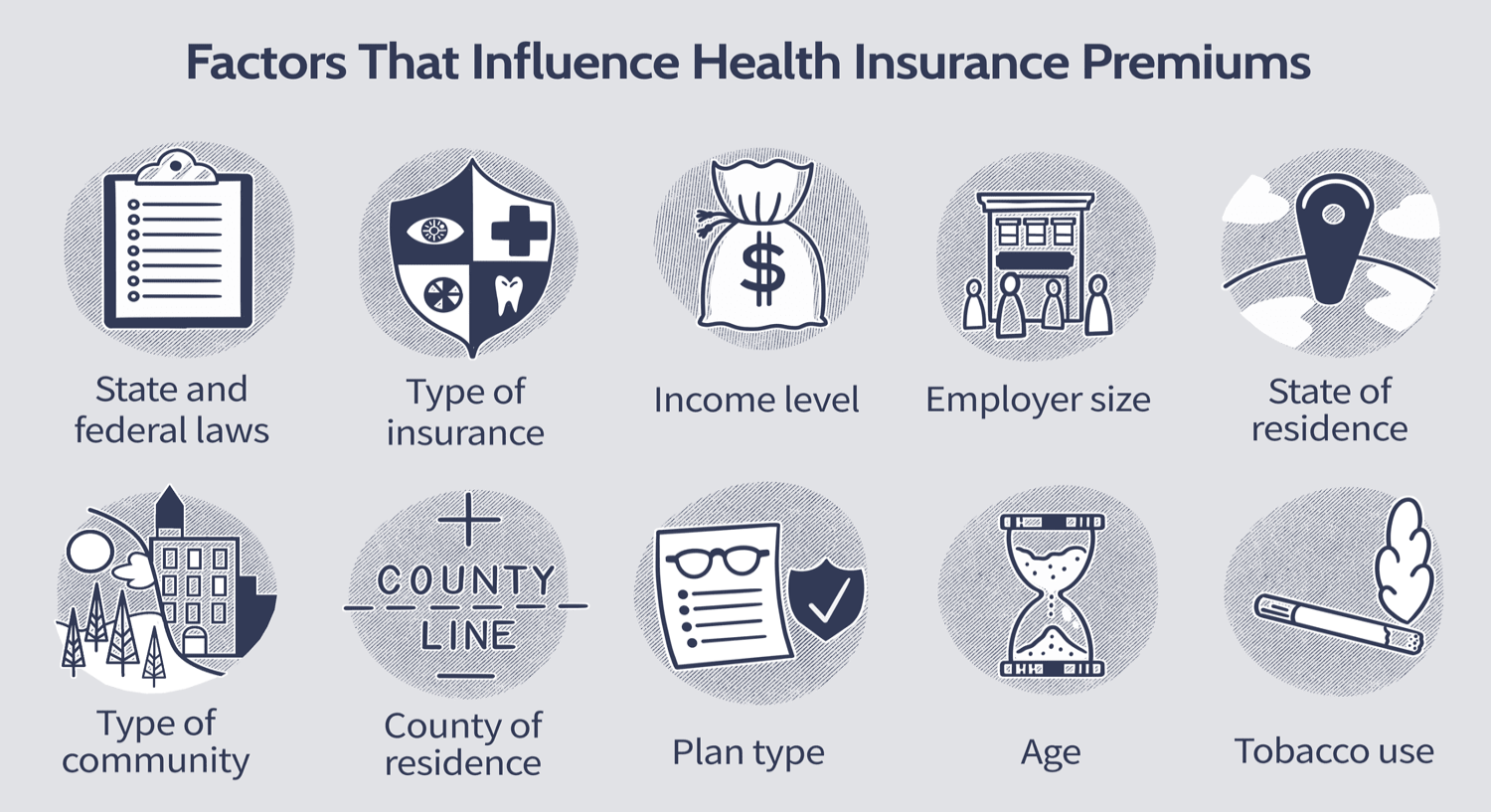

HEALTH INSURANCE PREMIUMS

Regular and emergency medical expenses are covered by health insurance, with the option to add dental and eye care at an additional fee. You may also be required to pay copays and coinsurance, which are one-time fees or a portion of a covered medical benefit that you must pay after reaching the yearly deductible.

Health insurance may be purchased from an insurance company, an insurance agent, the federal Health Insurance Marketplace, provided by an employer, or federal Medicare and Medicaid coverage.

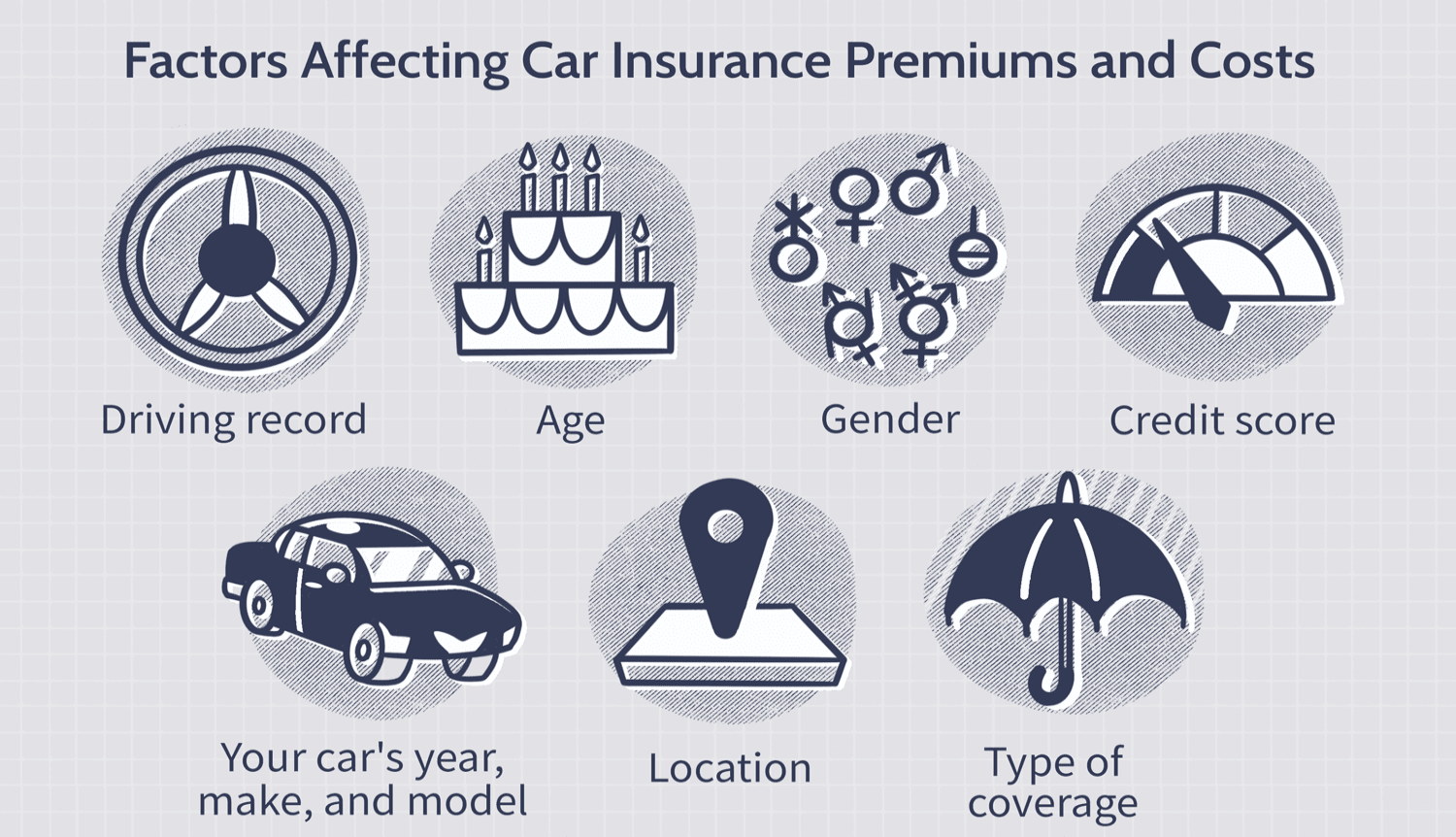

AUTO INSURANCE PREMIUMS

In the event of a car accident, auto insurance can assist in covering claims for injuries or property damage to third parties, assist in covering the cost of repairs necessary for the vehicle, and replace or repair the vehicle in the event that it is stolen, vandalized, or destroyed by a natural disaster.

People pay annual payments to an auto insurance provider instead of paying out-of-pocket for motor accidents and damage. The business then covers all or the majority of the expenses related to a car accident or other damage to the vehicle.

Related Articles