INVESTMENTS

PREFERRED STOCK

What is Preferred Stock?

Preference Share is considered as suitable for investor with low risk-taking capacity

"Stock" denotes equity or ownership in a company. Preferred stock and ordinary stock are the two categories of equity. Compared to common shareholders, preferred stockholders are entitled to a larger portion of dividends and asset distributions. Each preferred stock's specifics vary depending on the offering.

Reliance Industries Limited is issuing a 7% preferred share at 80,000 Rs par value. As a result, the investor would receive a Rs. 5600 annual dividend. Typically, this preferred share will revolve around its par value behaving much more similar to a bond.

KEY KNOWLEDGE

Features of Preferred Stock

Liquidation:

Dividend Payouts:

Prefence in Dividend:

Non-Voting:

Convertability to Common Stock:

Convertible Preference Share

Non-Convertible Preference Share

Redeemable Preference Share

Non-Redeemable Preference Share

Participating Preference Share

Non-Participating Preference Share

Cumulative Preference Share

Non-Cumulative Preference Share

Market Cap : 27,213Cr

P/E Ratio : 24.0

Industry P/E : 15.0

Debt to Equity : 0.01

EPS : 23.1

Dividend Yield : 0.00%

Book Value : 43.2

Face Value : 1.00

ROE : 90.5%

ROCE :82%

Market Cap : 41,817Cr

P/E Ratio : 81.9

Industry P/E : 41.7

Debt to Equity : 0.12

EPS : 458

Dividend Yield : 0.67%

Book Value : 1372.0

Face Value : 10.00

ROE : 46.4%

ROCE :53.8%

Market Cap : 21,460Cr

P/E Ratio : 27.4

Industry P/E : 38.4

Debt to Equity : 0.17

EPS : 205

Dividend Yield : 0.71%

Book Value : 644

Face Value : 10.00

ROE : 32.3%

ROCE :51.1%

Market Cap : 111,863Cr

P/E Ratio : 50.2

Industry P/E : 56.6

Debt to Equity : 0.98

EPS : 105

Dividend Yield : 1.55%

Book Value : 118

Face Value : 1.00

ROE : 66.6%

ROCE :48.6%

Market Cap : 51,905Cr

P/E Ratio : 66.1

Industry P/E : 38.7

Debt to Equity : 0.11

EPS : 126

Dividend Yield : 0.73%

Book Value : 337

Face Value : 10.00

ROE : 41.1%

ROCE :47.7%

Market Cap : 51,097Cr

P/E Ratio : 47.2

Industry P/E : 39.0

Debt to Equity : 0.03

EPS : 509

Dividend Yield : 0.75%

Book Value : 1463

Face Value : 10.00

ROE : 31.6%

ROCE :41.1%

The shares provide their holders with priority over common stock holders to claim the company’s assets upon liquidation.

Dividend payments to shareholders are made by the shares. The payments may be variable or fixed, determined by reference to a benchmark interest rate like LIBOR.

Preferred shareholders have a priority in dividend payments over the holders of the common stock.

In general, the holders of the shares are not granted the ability to vote. On the other hand, certain preferred shares provide their owners the ability to vote on unusual occasions.

A fixed number of ordinary shares may be obtained by converting preferred shares. While some preferred shares have a conversion date specified, others need board of directors permission before they may be converted.

Types of Preferred Shares:

| Types of Preference Share | Description |

|---|---|

| Convertible | These Shares can be readily converted into Equity Shars |

| Non-Convertible | Though these type of preference share cannot be converted into common stock, they are still prioritised over them |

| Redeemable | Typically, these shares come with a maturity date. On maturity, the company repurchase its shares from investors at a fixed date and ceases their dividends |

| Non-Redeemable | These shares cannot be redeemed in the life-time of the company. Notably they come with the fixed rate of dividend |

| Participating | Besides extending dividends, participating preference shareholders are also entitled to surplus profits of the company |

| Non-Participating | These shares do not entitle to shareholders to any surplus profit but offered them a promised Dividend |

| Cumulative | In the event of loss, the company is liable to pay shareholder's outstanding dividend |

| Non-Cumulative | The Non-Cumulative shareholder's are not entitled to receive dividends in arrears |

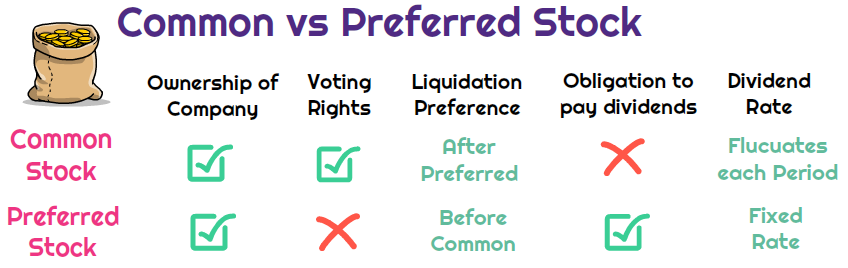

Difference Between Preference Share and Equity Share

| Parameter | Preference Share | Equity Share |

|---|---|---|

| Definition | It offers preferential rights in the terms of receving dividends or capital amounts | It represents shareholder's ownership of the Company |

| Dividend | Dividend Payout's rate is fixed | Dividene payout's rate fluctuates with more earnings |

| Bonus Share | Shareholders may receive bonus share against current shareholdings | Shareholders may receive bonus shares against their shareholdings |

| Capital Repayment | Capital Repayment is made before equity share | Capital is Repaid at end |

| Voting Rights | Shareholders do not enjoy voting rights | Shareholders avail voting rights |

| Convertability | Preference Stock can be converted | Equity Stock cannot be converted |

| Arrears of Dividend | Shareholders may receive a cumulated dividends | Shareholders are not entitled to avail cumulative dividends |

| Types | Preference shares and its types includes convertible, non-convertible, cumulative, non-cumulative, participating, and non-participating | There are simply classified as ordinary and common stock of a company |

| Suitability | It is considered as suitable for investor with low risk-taking capacity | It is considered for investor who can take risk |

Top 10 Preference Shares

Fundamental Analysis

Lloyds Metals & Energy is into the business of manufacturing of Sponge Iron, Power generation and mining activities

Fundamental Analysis

Incorporated in 1995, Page Industries Limited is the exclusive licensee of JOCKEY International Inc. for manufacturing, distribution and marketing of the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal and the UAE. Page Industries is also the exclusive licensee of Speedo International Ltd. for the manufacturing, marketing and distribution of the Speedo brand in India.

Fundamental Analysis

Apar, founded by Mr. Dharmsinh D. Desai in 1958, is a market leader in India with a global presence. Contributing to India’s process of electrification it started from manufacturing power transmission cables to having three broad business segments, which are Conductors, Transformer and specialty oils (TSO), and Power/telecom Cables.

Fundamental Analysis

Britannia Industries is one of Indias leading food companies with a 100 year legacy and annual revenues in excess of Rs. 9000 Cr. Britannia is among the most trusted food brands, and manufactures Indias favorite brands like Good Day, Tiger, NutriChoice, Milk Bikis and Marie Gold which are household names in India. Britannias product portfolio includes Biscuits, Bread, Cakes, Rusk, and Dairy products including Cheese, Beverages, Milk and Yoghurt.

Fundamental Analysis

Tata Elxsi is amongst the world’s leading providers of design and technology services across industries including Automotive, Media, Communications and Healthcare. Tata Elxsi provides integrated services from research and strategy, to electronics and mechanical design, software development, validation and deployment, and is supported by a network of design studios, global development centers and offices worldwide.

Fundamental Analysis

Abbott India Ltd is one of the leading multinational pharmaceutical companies in India and sells its products through independent distributors primarily within India. It was established in 1944

Related Articles