NET WORTH : $493 Billion Dollars

JPMorgan Chase & Co. is a Delaware-incorporated American global financial services company with its headquarters located in New York City. As of 2023, it is the biggest bank in the US and the largest bank globally based on market value. The Financial Stability Board views the company as systemically significant because it is the biggest of the Big Four banks. Larger organizations have frequently maintained an internal "Fortress Balance Sheet" of capital reserves in addition to improved regulatory scrutiny because of their size and scope. The company will relocate to the JPMorgan Chase Building, which is now under construction at 270 Park Avenue, in 2025 from its current location at 383 Madison Avenue in Midtown Manhattan.

The Chase Manhattan Company was established in 1799, marking the beginning of the company's existence. J. P. Morgan established J.P. Morgan & Co. in 1871 after opening the House of Morgan on 23 Wall Street and becoming a nationwide provider of investment, commercial, and private banking services. Following the 2000 merger of the two previous companies, a diversified holding entity was created, which gave rise to the current corporation. It is a significant supplier of investment banking services, including corporate advising, sales and trading, mergers and acquisitions, and initial public offerings. In terms of overall assets, their asset management business and private banking franchise rank among the largest in the world. In the US and the UK, its retail banking and credit card services are delivered under the Chase name.

With total assets of US $3.9 trillion, In terms of assets, JPMorgan Chase is the fifth-biggest bank globally. In terms of revenue, the company runs the biggest investment bank globally. According to revenue, it is ranked 24th out of the biggest U.S. firms on the Fortune 500 list. Across all of its business lines, it generates institutional research on economics, geopolitics, financial markets, and personal finance. The corporation has a significant market share in banking and a high degree of brand loyalty because to its balance sheet, regional reach, and thought leadership. On the other hand, it is frequently criticized for its extensive financing activities, risk management, and significant lawsuit settlements.

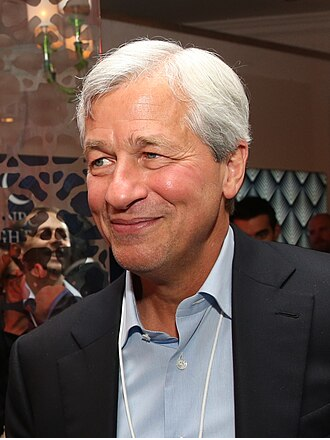

Jamie Dimon

James Dimon, an American billionaire businessman and banker, was born on March 13, 1956. He has served as JPMorgan Chase's chairman and CEO since 2005. Additionally, he served on the Federal Reserve Bank of New York's board of directors. .Dimon was listed among the 100 most important individuals in the world in Time magazine's selections from 2006, 2008, 2009, and 2011. As of June 2023, Forbes assessed his net worth at $1.6 billion. He is a member of the boards of directors of many non-profit organizations, such as the Harvard Business School, the Bank Policy Institute, and the Business Roundtable. He currently chairs the Bank Policy Institute and was previously the chairman of the Business Roundtable.

EARLY LIFE & EDUCATION

The birthplace of Jamie Dimon is New York City. He is one of the three sons of Greek-born Theodore and Themis (née Kalos) Dimon . His paternal grandfather, a Greek immigrant who worked as a banker in Izmir and Athens, changed the family name from Papademetriou to Dimon. It is said that he did this either because he fell in love with a French girl and wanted his name to sound French, or because he realized that hiring Greeks would be difficult. Ted, Dimon's fraternal twin brother, and Peter, his elder brother, are also present. At Shearson, his grandparents and father were stockbrokers.

He graduated summa cum laude from Tufts University, where he studied in psychology and economics after attending the Browning School. After writing an article about Shearson's mergers while attending Tufts, Dimon's mother emailed the piece to Sandy Weill, who then employed Dimon to work as a budget analyst at Shearson during a summer break.

Before enrolling at Harvard Business School, he spent two years working as a management consultant at Boston Consulting Group after receiving his degree. He was a summer employee at Goldman Sachs while attending Harvard. As a Baker Scholar, he received an MBA upon graduation in 1982.

COMPANIES OWNED BY JP MORGAN CHASE

JP Morgan Chase Bank

The consumer and commercial banking division of the American multinational banking and financial services holding corporation JPMorgan Chase is JPMorgan Chase Bank, N.A., doing business as Chase. It is a national bank with its headquarters located in New York City. Chase Manhattan Bank was the name of the bank prior to its 2000 merger with J.P. Morgan & Co. In 1955, the Manhattan Company and Chase National Bank merged to establish Chase Manhattan Bank. In 1996, the bank amalgamated with Chemical Bank New York. Subsequently, in 2004, it merged with Bank One Corporation. In 2008, the bank procured the majority of Washington Mutual's assets and deposits.

Incorporation Year : 2000

Revenue : $30.9 Billion Dollars

Bank One Corporation

Founded in 1968, Bank One Corporation was the sixth-largest bank in the United States during its height of operations. Under the ticker symbol ONE, it was traded on the New York ticker Exchange. On July 1, 2004, the corporation amalgamated with JPMorgan Chase & Co., and Jamie Dimon became leadership of the united enterprise. The Chase Tower, formerly known as Bank One Plaza, is currently home to Chase's retail banking business. The corporation was founded in Chicago, Illinois, and its headquarters were located in the Chicago Loop.

Incorporation Year : 2004

Revenue : $58 Billion Dollars

The Bear Stearns Companies Inc.

Amidst the global financial crisis and recession in 2008, the American investment bank, securities trading, and brokerage business Bear Stearns Companies, Inc. folded. It was later sold to JPMorgan Chase when it closed. Prior to its demise, the company's primary lines of business included worldwide clearing services, investment banking, wealth management, and capital markets. It also had a significant role in the subprime mortgage crisis.

Incorporation Year : 2008

Revenue : $1.4 Billion Dollars

Washington Mutual Bank

Originally called the Washington National Building Loan and Investment Association, Washington Mutual was founded in Seattle in 1889. In 1917, the savings and loan bank changed its name to Washington Mutual Savings Bank and began providing residential mortgages, checking and savings accounts, and other loans. Through the acquisition of other financial organizations, it grew during the 20th century, and by 2008, it was the biggest savings and loan bank in the country.

Incorporation Year : 2008

Revenue : $1.8 Billion Dollars

Cazenove Group

Philip Cazenove established the British brokerage and financial business Cazenove in 1823. It was among the final independent investment banks in the UK and among the last to continue operating as a private partnership. In 2004, the investment banking division formed a joint venture with JPMorgan Chase, and in 2005, Cazenove Capital Management, a fund management company, separated. 2009 saw JPMorgan Chase purchase the remaining investment banking company. Schroders purchased Cazenove Capital Management in 2013.

Incorporation Year : 2009

Revenue : $1.7 Billion Dollars

InstaMed

InstaMed was founded in 2004 in an effort to streamline the healthcare payments system. The company expanded quickly, adding Visa and Mastercard certification in 2007 and Apple Pay capabilities in 2015. In the year prior to its acquisition by JPMorgan, InstaMed processed roughly $94 billion in transactions>.

Incorporation Year : 2019

Revenue : $600 Million Dollars

WePay

WePay was JPMorgan's first significant fintech purchase, making the bank's 2017 acquisition of the company a significant turning point. When WePay first started in 2008, it was a test platform for an interface that any organization in need of a payments infrastructure, including well-known crowdfunding websites like GoFundMe, could utilize.

Incorporation Year : 2017

Revenue : $400 Million Dollars

Related Articles: