WHAT IS PESTLE ANALYSIS

One strategic framework that is frequently used to assess the business environment in which a company works is the PESTLE study. PEST analysis, which stands for Political, Economic, Social, and Technological aspects, was the term used historically to describe the framework. More recently, environmental and legal considerations were added to the framework. It is basically all the elements of the macro environment of a business.

PESTLE analysis is a versatile instrument for business. Thus, the outcomes are imprecise and unclear if the study is not issue-focused but rather is diluted.

POLITICAL FACTORS

This aspect becomes crucial if the government meddles in the economy in any way.

These political elements include laws and policies of the government, budgets, taxes, trade restrictions, international trade rules, and even existing environmental regulations. Thus, any modifications to current laws or the enactment of new ones will have an impact on business.

EXAMPLE

A multinational corporation moves its activities to a place with lower tax rates, more state financing and grant possibilities, or both in order to close several sites in a jurisdiction with higher tax rates.

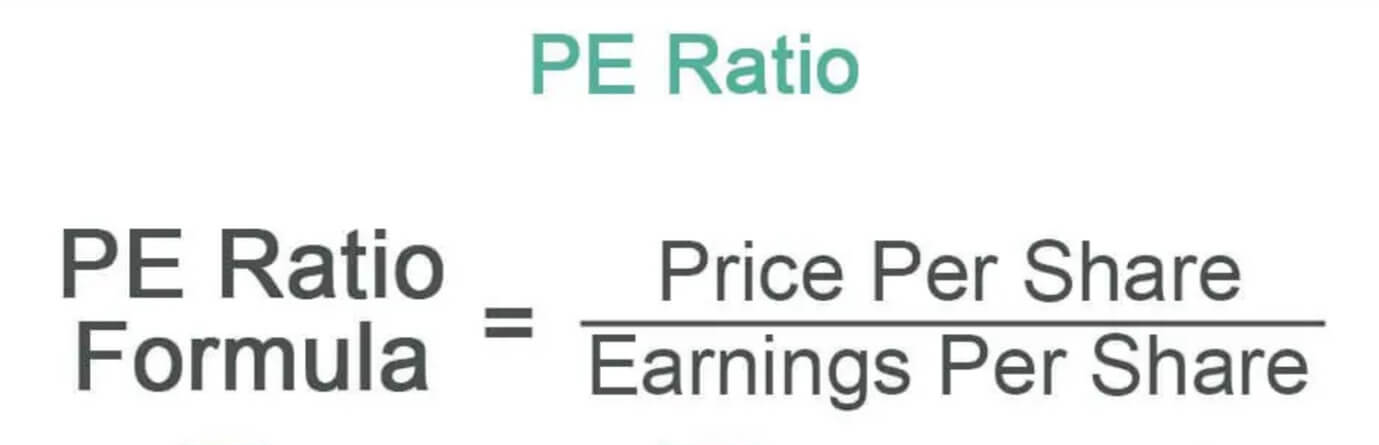

ECONOMIC FACTORS

Nearly every shift in a country's economy has a big effect on businesses. The profit margin of a corporation is directly impacted by economic parameters like the GDP, average national income, inflation rate, economic growth rate, and market interest rates.

These economic factors are inclusive of both micro and macroeconomic factors. Macroeconomic factors like the market demand, interest rate, taxation policies, total expenditure, etc relate to the economy as a whole. Microeconomics focus on single households – disposable income, customer choices, and preferences, etc.

EXAMPLE

An equities research analyst may change the discount rate in their model assumptions based on the state of the economy and Treasury yield movements; this can have a significant effect on the prices of the firms they cover.

SOCIAL FACTORS

Social factors that impact a specific population's age, gender ratio, population growth, employment rates, health statistics, preferences, etc. also have an impact on a business's ability to make a profit from the sale of its goods or services. These are a demographic's social and cultural components.

EXAMPLE

Following the epidemic, a technology company's management was forced to reassess recruiting, onboarding, and training procedures due to a significant majority of employees expressing a desire for a hybrid work-from-home (WFH) model.

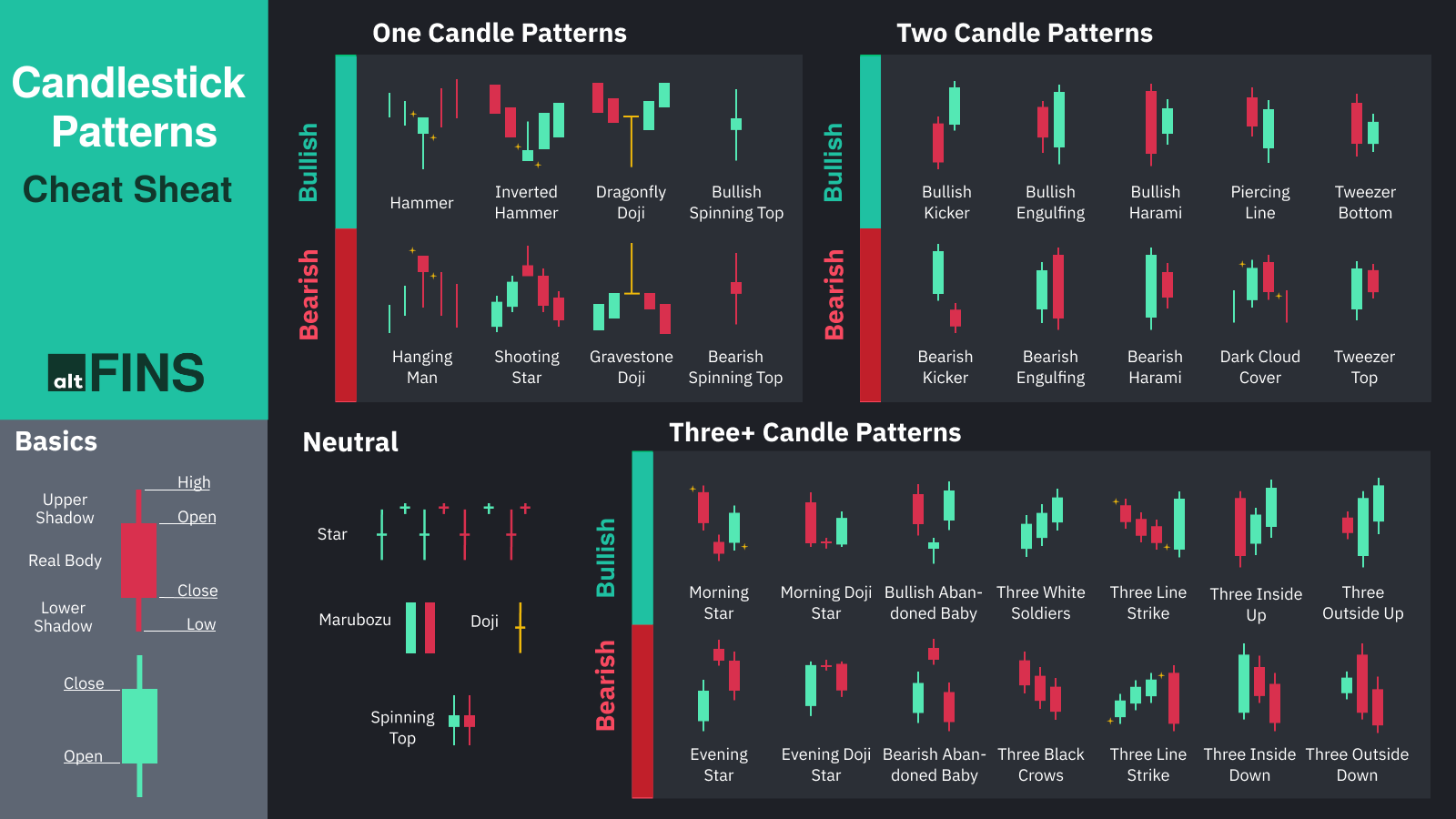

TECHNOLOGICAL FACTORS

This advancement of technology can apply in three basic ways – improvement or the advent of technology in producing the goods, distributing the goods, or in marketing the goods. So the business must keep up with the evolving technology to stay with the times.

Automation

How research and development (R&D) may impact both costs and competitive advantage

Technology infrastructure

Cyber security

EXAMPLE

A management team must assess the financial and practical effects of switching from physical servers located on site to a cloud-based data storage solution.

ENVIRONMENTAL FACTORS

During the past twenty years or more, the significance of these environmental influences has increased, companies are more aware of their carbon footprint and the potential for contamination.

They want expansion, but it has to be sustainable and not come at the expense of the ecosystem. Thus, new environmental regulations, eco-friendly behaviors, pollution control technologies, etc.

EXAMPLE

A publicly traded company's management must review its internal record-keeping and reporting systems in order to monitor greenhouse gas emissions after the stock exchange's announcement that all listed businesses must provide required climate and ESG disclosure.

LEGAL FACTORS

These variables include modifications to laws and regulations, recommendations for women's safety and equality, health and safety regulations, consumer rights, ethical standards for advertising, etc.

EXAMPLE

A rating agency is assessing the creditworthiness of a technology firm that has considerable growth prospects in emerging markets. The analyst must weigh this growth trajectory against the inherent risk of IP theft in some jurisdictions where legal infrastructure is weak. IP theft can severely undermine a firm’s competitive advantage.

HOW PESTLE IS USED IN FINANCIAL ANALYSIS

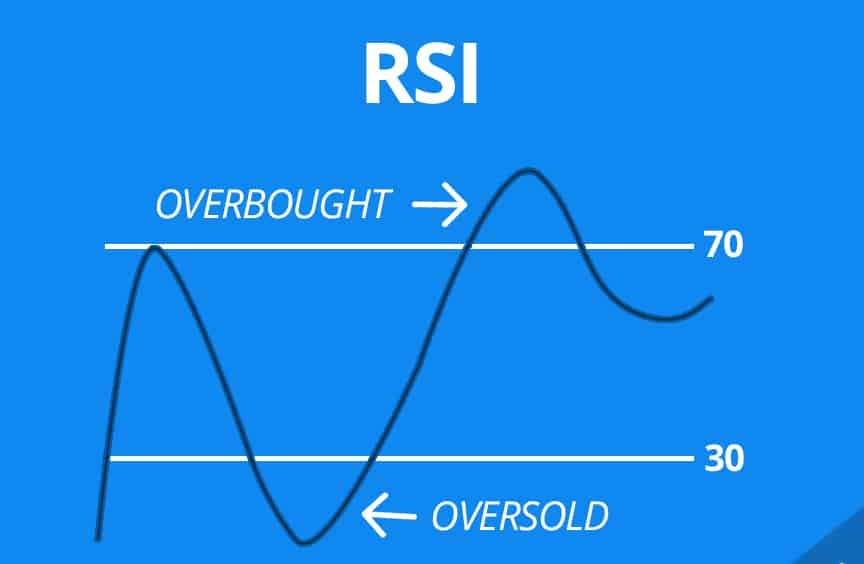

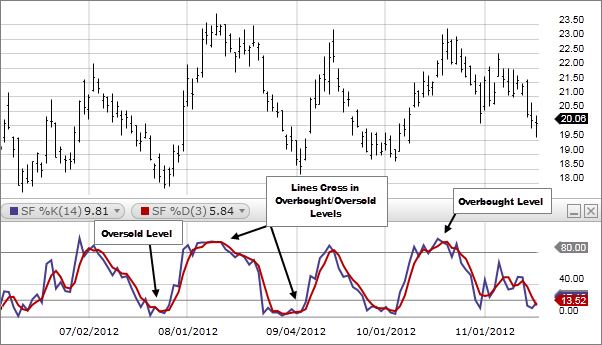

Based on anticipated inflation, financial analysts may modify model assumptions such as gross margins and rates of revenue growth.

Analysts may want to anticipate a cash reserve in accordance with the possibility of future fines or carbon tax levies for a company that has not managed its carbon footprint well.

When determining a firm's debt payment coverage ratio, credit rating agency analysts may need to factor in a greater interest rate buffer for sensitivity analysis due to shifting macroeconomic conditions.

Significant labor cost reductions in a given industry are predicted to occur at a rate of X%, which would significantly alter free cash flow calculations in a financial model.

RELATED ARTICLES