INVESTMENTS

SYSTEMATIC INVESTMENT PLAN

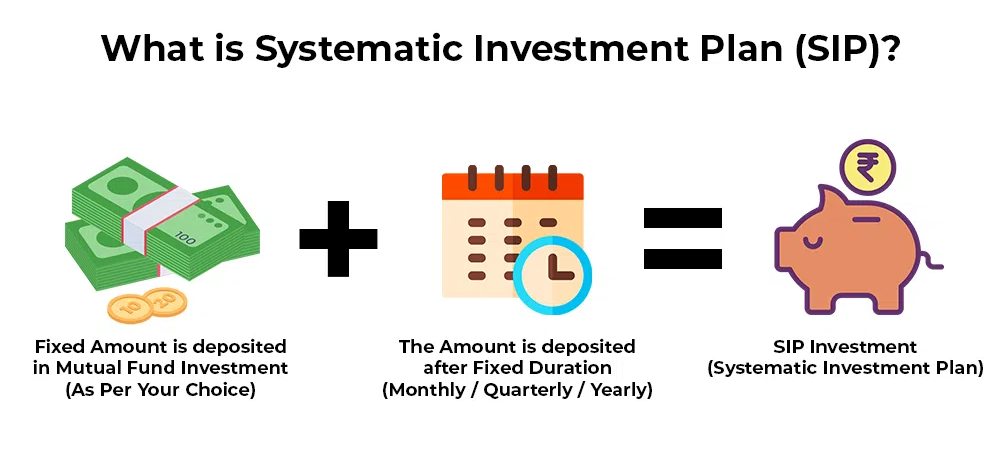

What is Systematic Investment Plan?

SIP stands for Systematic Investment Plan in stocks is a type of investment strategy where an investor invests a fixed amount of money at regular intervals in the stock market. This is done through a Systematic Investment Plan (SIP) in shares, which is similar to a SIP in mutual funds. It allows you to invest small amounts of money regularly in the SIP in stock market, instead of investing a lump sum at once.

An investor who follows a systematic investment plan (SIP) will regularly and equitably contribute to a mutual fund, trading account, or retirement account like a 401(k). With SIPs, investors may take advantage of the long-term benefits of dollar-cost averaging (DCA) while saving consistently with a lower amount of money. Using a DCA approach, an investor purchases an investment with equal monthly transfers of monies in order to gradually increase wealth or a portfolio over time.

KEY KNOWLEDGE

POPULAR STOCKS IN SYSTEMATIC INVESTMENT PLAN(SIP)

RELIANCE INDUSTRIES

Reliance Group was founded by Dhirubhai Ambani, who went into business in the 1950s. The company expanded into textiles in the 1960s and entered the petrochemical sector in the 1980s, amassing a fortune for Ambani. After Ambani died in 2002, his sons Mukesh, the eldest, and Anil had a row over corporate policy.

HDFC BANK

The bank commenced operations as a Scheduled Commercial Bank in January 1995. On April 4, 2022 the merger of India's largest Housing Finance Company, HDFC Limited and the largest private sector bank in India

TATA CONSULTANCY SERVICES

TCS is one of the largest private-sector employers in India, and the fourth-largest employer among listed Indian companies (after Indian Railways, Indian Army, and India Post). TCS has crossed more than 600,000 employees as of 8 July 2022. The number of non-Indian nationals was 21,282 as of 31 March 2013 (7.7%).

HINDUSTAN UNILEVER

Hindustan Unilever Limited is India's largest Fast Moving Consumer Goods (FMCG) Company with a 90-year heritage in the country. We are a Company of brands and people driven by our purpose of making sustainable living commonplace.

INFOSYS

Established in 1981, Infosys is a NYSE listed global consulting and IT services company with more than 328k employees. From a capital of US$250, we have grown to become a US$ 18.55 billion (LTM Q2 FY24 revenues) company with a market capitalization of US$ 71.01 billion.

WHY SHOULD IN STOCKS THROUGH SIP?

Long-term gains may arise from investing in the SIP share market through SIP setup. Historically, returns from stocks have outpaced those from other investment alternatives like bonds and fixed deposits. Nevertheless, it is challenging to forecast short-term market fluctuations, and stock market investments are vulnerable to market volatility. You may benefit from compounding and possibly achieve larger profits in the long run by investing in the SIP stock market.

Investing in stocks using a disciplined strategy is known as SIP. You may form the habit of saving and investing on a regular basis by setting aside a certain amount of money to invest each time. This promotes a disciplined attitude to investing, which over time may result in more wise financial choices.

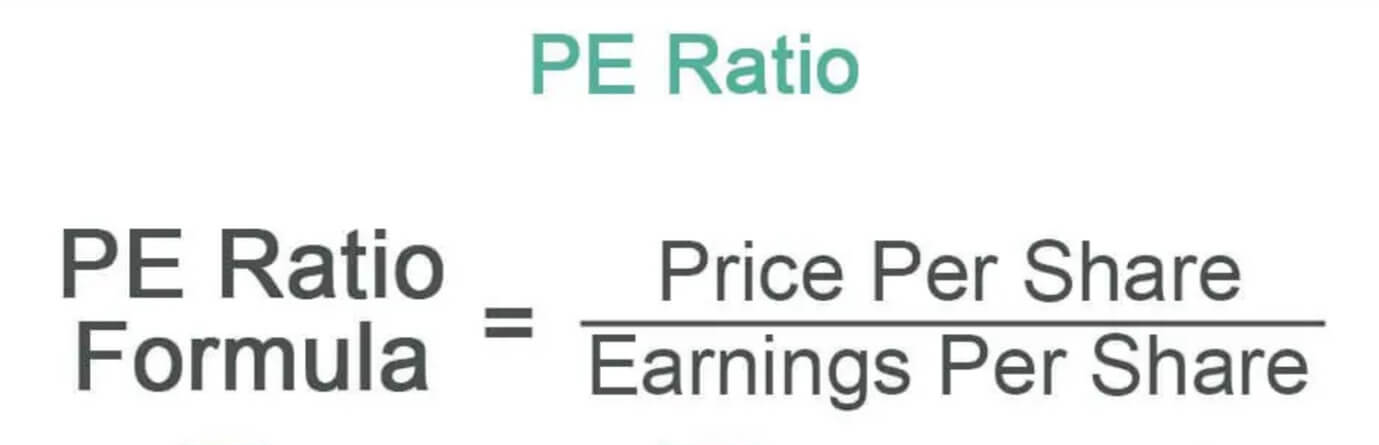

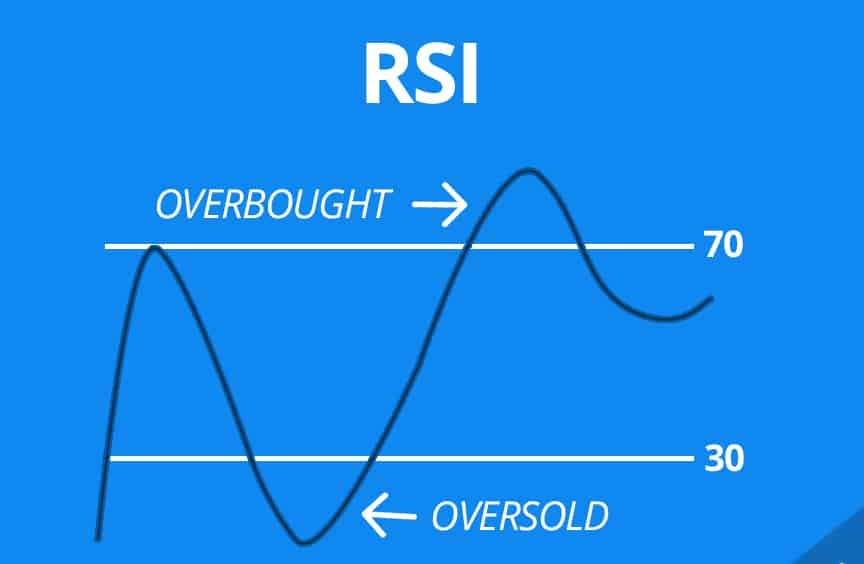

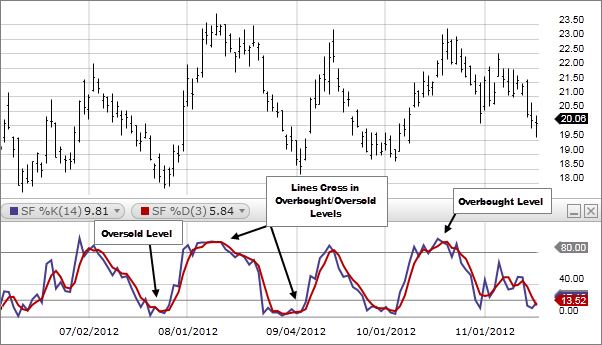

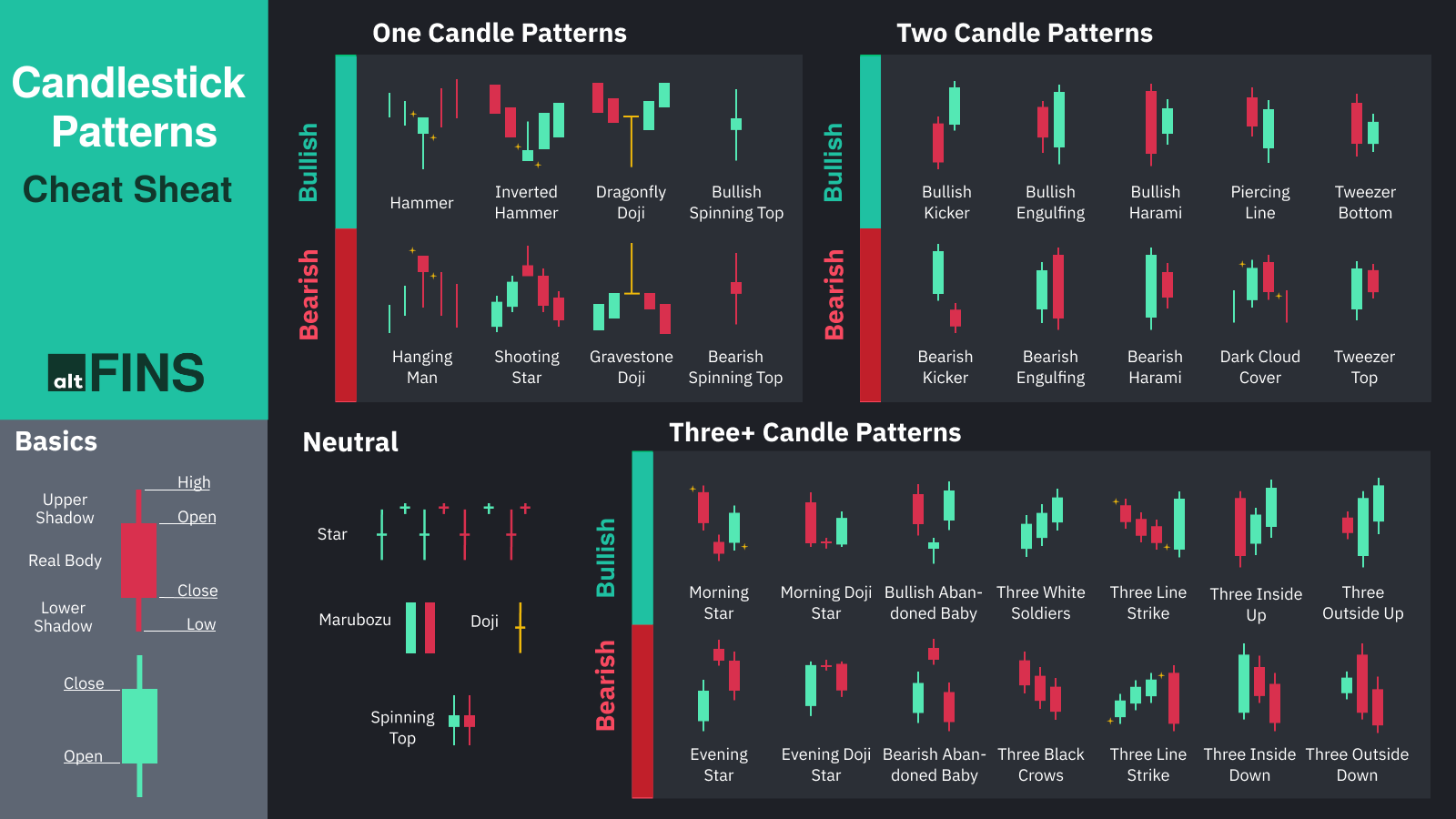

HOW TO ANALYSE STOCKS FOR SIP

Companies with a solid business plan, a competitive edge, and a track record of steady development are the ones you should seek out. Additionally, it is crucial to diversify the portfolio by purchasing equities from a range of industries and firms.

Once the stocks have been chosen, you must choose the right SIP plan. On the basis of variables such fees and charges, past performance, and the investment portfolio, you should compare the different plans.

DIFFERENCE BETWEEN MUTUAL FUND SIPs AND STOCK SIPs

| Criteria | SIP in Mutual Funds | SIP in Stocks |

|---|---|---|

| Purpose | Useful for basket investing in mutual funds. | Useful for investing in stocks. |

| Target Audience | Suitable for retail investors or first-time investors in the equity market. | Suitable for seasoned stock equity investors, enabling active management. |

| Diversification | Provides the benefit of diversification. | Offers limited diversification to your portfolio. |

| Risk Level | Involves moderately less risk. | Involves moderately higher risk. |

| Management | Investment is managed by experienced fund managers. | Requires making investment decisions and determining entry/exit points for each stock. |

| Rupee Cost Averaging | Realizes the benefit of rupee cost averaging. | Realizes the benefit only if you invest at the right time. |

RELATED ARTICLES