INVESTMENTS

McClellan Oscillator

What is McClellan Oscillator?

Based on the difference between the number of rising and declining issues on a stock exchange, the McClellan Oscillator is a market breadth indicator.

To take advantage of the market, every trader and analyst looks to, or examines, several technical indicators. Indicators are frequently classified into various groups based on the ways in which they assess various entities. The McClellan Oscillator is an example of a momentum indicator, which is a class of indicators used to show the strength or weakness of price movement instead of its direction.

KEY KNOWLEDGE

Calculations:

You deduct a 39-day exponential moving average (EMA) from a 19-day EMA in order to get the McClellan Oscillator. As previously noted, the difference between advancing and decreasing problems is used to construct the EMA.

(19-Day EMA of Advances – Declines) – (39-Day EMA of Advances – Declines)

Using the McClellan Oscillator

Given their similar methodologies, the McClellan Oscillator and the moving average convergence-divergence (MACD) indicator can be compared in a variety of ways. To put it simply, traders and analysts know that when the oscillator is positive, it means that advancing stocks are outperforming falling ones since the 19-day EMA is higher than the 39-day EMA. The exact reverse is true if the oscillator goes negative; decreasing securities are viewed as having the upper hand.

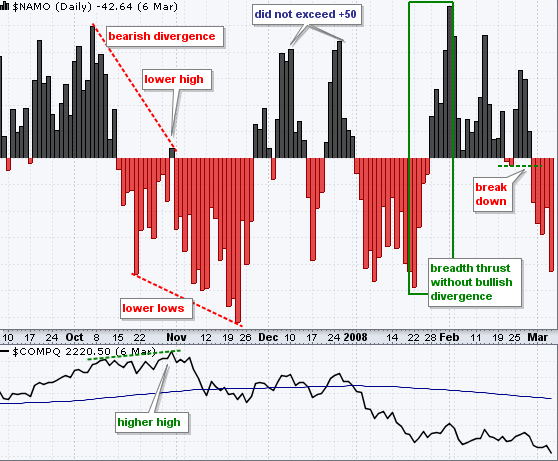

The chart above shows a thrust in the McClellan Oscillator near the far right-hand side of the chart, a possible indication of an upcoming and substantial bullish movement. If you look back, you can see that another, smaller thrust in the indicator around the first of August correctly predicted a significant bullish move in the market.

Positive vs. Negative

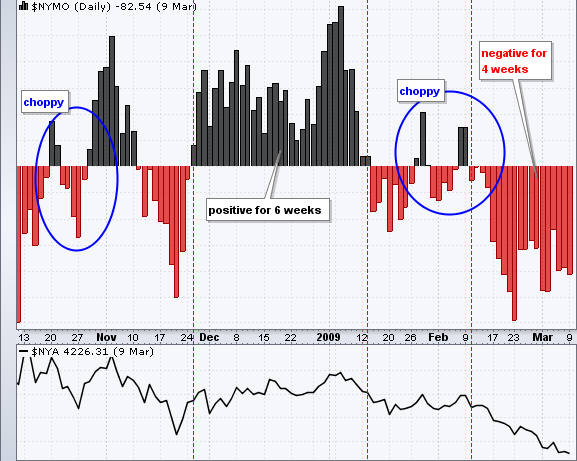

The McClellan Oscillator may be quite volatile, but it can also be positive or negative for long stretches of time when there is a significant upswing or decline. The NY Composite is used as the basis index for comparison in the following example since the NYSE McClellan Oscillator ($NYMO) is based on NYSE equities.

An upward trend in the NY Composite was consistent with this run of good numbers. When the McClellan Oscillator became negative in the second week of January, the rise came to a halt. Two brief spikes into positive territory were followed by a four-week stretch of negative numbers in February. Since none of these little blips lasted more than two days or topped +50, they were actually rather weak. Midway through February, selling pressure increased as the McClellan Oscillator dropped below its lows from January.

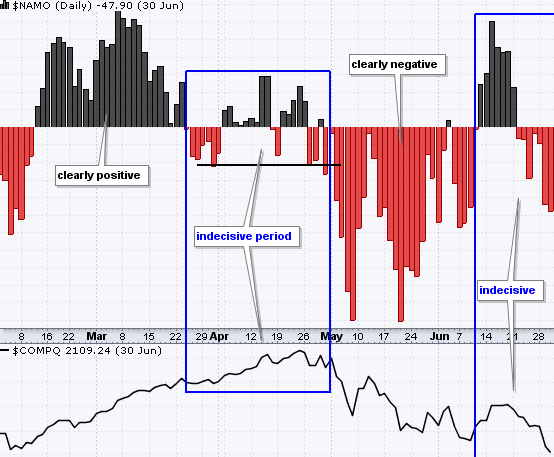

Throughout the first period, from the second week of February to the fourth week of March, the McClellan Oscillator was unquestionably positive. Observe how, in late February, it jumped beyond +50 and continued to rise until late March. Between the second week of May and the fourth week of March in the second phase, the indicator became erratic. Multiple crossings were seen above and below the zero line. It is noteworthy that the indicator did not rise over +30 or fall below -30. In any case, there wasn't much conviction.

Breadth Thrusts:

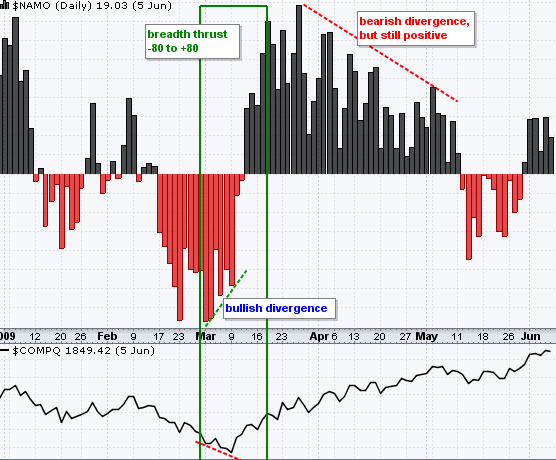

When the McClellan Oscillator jumps from strong negative readings to deep negative values, it is known as a breadth thrust. For a +100 point push, the indicator usually moves from below -50 to above +50. A push in breadth indicates a positive rise in breadth that may result in a longer rally. While not all thrusts in breadth portend long-term gains, the majority of significant lows are distinguished by a sudden increase in breadth. A bullish divergence ahead of a bullish breadth surge strengthens it.

Moreover, take note of the fact that the Nasdaq rose throughout the lengthy negative divergence that the McClellan Oscillator produced in late March and early May. Following a breadth spike, lower highs are typical. After such a broad jump, it is not possible to anticipate the oscillator to be very strong (above +50) and to keep forming higher highs. To keep the bulls running, the McClellan Oscillator only needs to be positive.

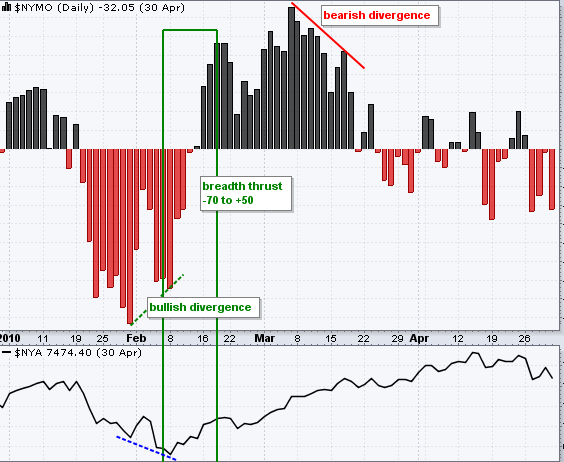

The McClellan Oscillator indicates a bottom in February on the following chart. Although the NY Composite fell to a new low in early February, the McClellan Oscillator reached its lowest point in late January. Ahead of the breadth drive, a bullish divergence developed when the McClellan Oscillator established a higher low. A potential trend reversal was signaled by the bullish divergence and verified by the breadth surge from -70 to +50 (+120). Despite a negative divergence produced by the McClellan Oscillator's top in early March, the NY Composite continued to rise until mid-April.

Divergences

Divergences in the McClellan Oscillator that are bullish or bearish might indicate that the underlying index is about to reverse. Chartists shouldn't search too deeply for these kinds of divergences, though. There will be plenty of divergences, most of which won't lead to long movements or reversals.

There are also some other signals and non-signals worth reviewing on this chart. Even though the McClellan Oscillator surged from positive to negative territory in November-December, the positive surge did not exceed +50. In other words, it was not strong enough to qualify as a bullish breadth thrust. There was a bullish breadth thrust in January-February, but this thrust was not preceded by a bullish divergence.

Related Articles: